Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

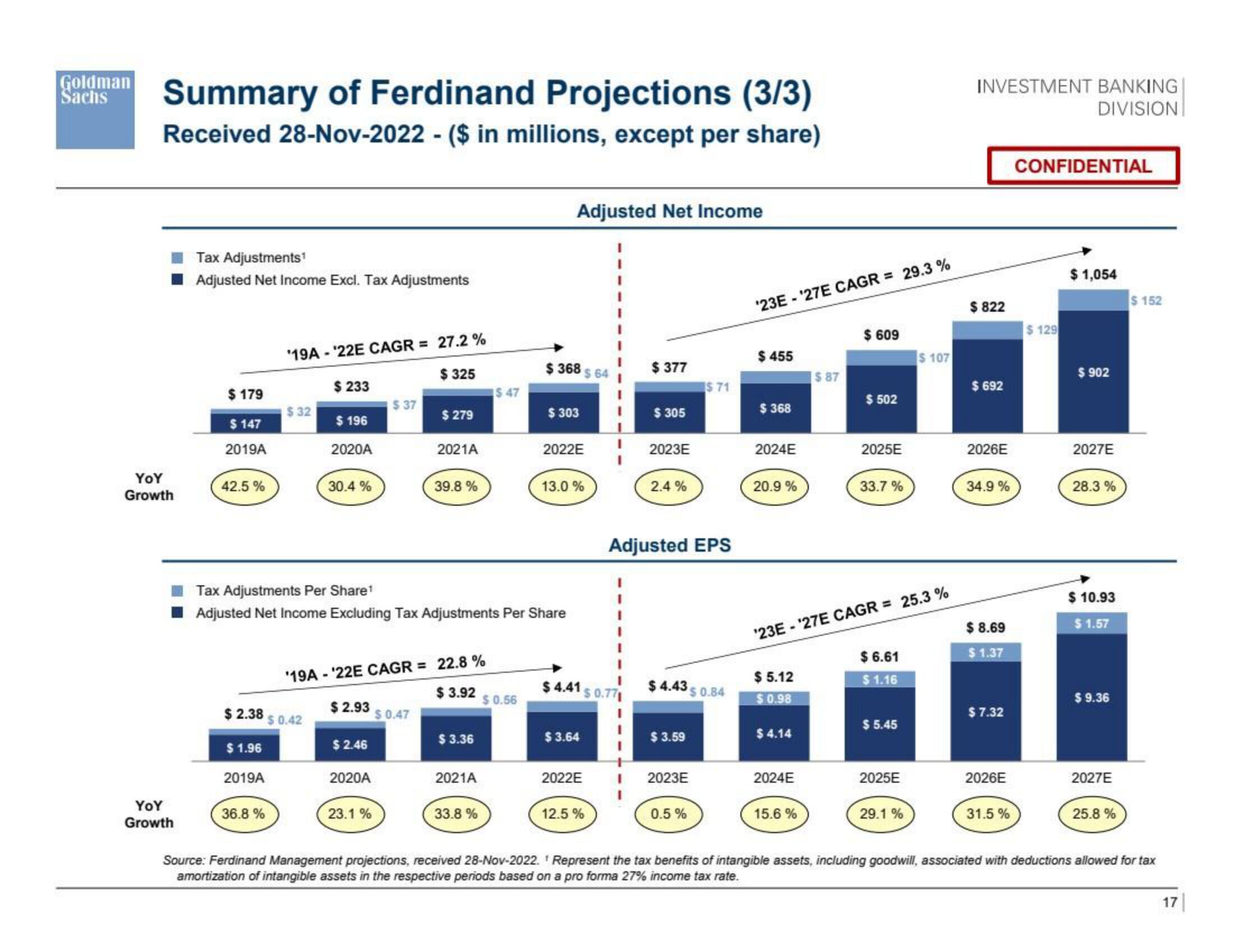

Summary of Ferdinand Projections (3/3)

Received 28-Nov-2022 - ($ in millions, except per share)

YoY

Growth

YoY

Growth

Tax Adjustments¹

Adjusted Net Income Excl. Tax Adjustments

$ 179

$147

2019A

42.5%

$ 2.38

'19A-'22E CAGR = 27.2 %

$325

$ 233

$ 1.96

2019A

36.8 %

$32

$ 196

2020A

30.4 %

$ 0.42

$ 37

$2.93

$2.46

2020A

23.1%

$ 279

'19A - '22E CAGR = 22.8%

$ 3.92

2021A

$ 0.47

39.8 %

Tax Adjustments Per Share¹

Adjusted Net Income Excluding Tax Adjustments Per Share

$ 3.36

2021A

$ 47

33.8 %

$ 0.56

Adjusted Net Income

$368 $ 64

$ 303

2022E

13.0 %

$4.41 $0.771

$3.64

2022E

12.5%

$ 377

$ 305

2023E

2.4%

Adjusted EPS

$ 4.43

$3.59

2023E

$71

0.5%

$ 0.84

'23E-¹27E CAGR = 29.3 %

$455

$368

2024E

20.9%

$ 5.12

$0.98

$4.14

$ 87

2024E

15.6 %

$ 609

$ 502

2025E

'23E-¹27E CAGR = 25.3 %

33.7%

$6.61

$1.16

$ 5.45

$ 107

2025E

29.1 %

INVESTMENT BANKING

DIVISION

$ 822

$ 692

2026E

34.9%

$8.69

$ 1.37

$7.32

2026E

31.5%

CONFIDENTIAL

$ 129

$ 1,054

$ 902

2027E

28.3 %

$ 10.93

$1.57

$ 9.36

2027E

25.8%

$ 152

Source: Ferdinand Management projections, received 28-Nov-2022. Represent the tax benefits of intangible assets, including goodwill, associated with deductions allowed for tax

amortization of intangible assets in the respective periods based on a pro forma 27% income tax rate.

17View entire presentation