Avantor Results Presentation Deck

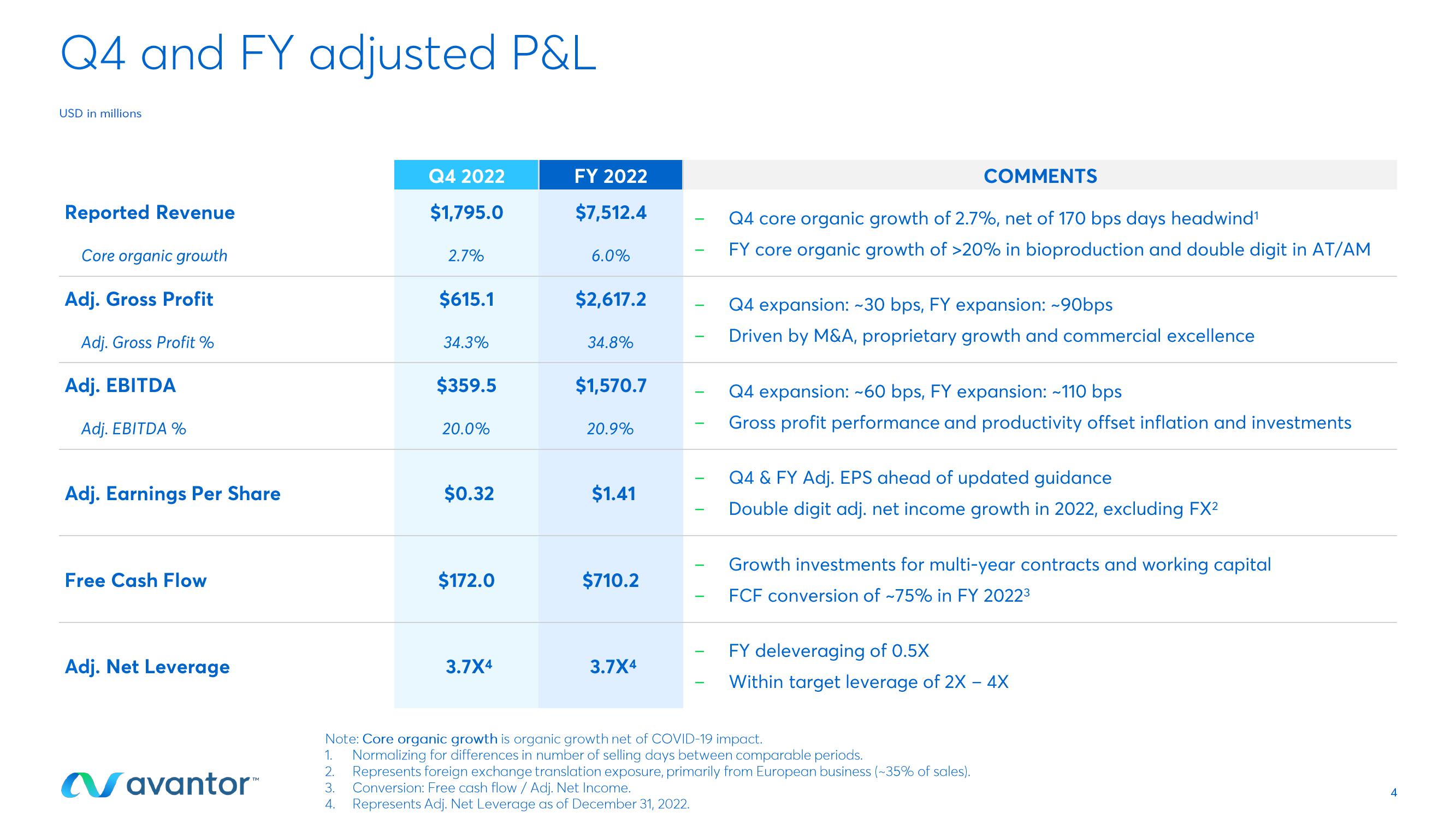

Q4 and FY adjusted P&L

USD in millions

Reported Revenue

Core organic growth

Adj. Gross Profit

Adj. Gross Profit %

Adj. EBITDA

Adj. EBITDA %

Adj. Earnings Per Share

Free Cash Flow

Adj. Net Leverage

Navantor™

Q4 2022

$1,795.0

2.7%

$615.1

34.3%

$359.5

20.0%

$0.32

$172.0

3.7X4

FY 2022

$7,512.4

6.0%

$2,617.2

34.8%

$1,570.7

20.9%

$1.41

$710.2

3.7X4

COMMENTS

Q4 core organic growth of 2.7%, net of 170 bps days headwind¹

FY core organic growth of >20% in bioproduction and double digit in AT/AM

1.

2.

3. Conversion: Free cash flow / Adj. Net Income.

4. Represents Adj. Net Leverage as of December 31, 2022.

Q4 expansion: ~30 bps, FY expansion: ~90bps

Driven by M&A, proprietary growth and commercial excellence

Q4 expansion: ~60 bps, FY expansion: ~110 bps

Gross profit performance and productivity offset inflation and investments

Q4 & FY Adj. EPS ahead of updated guidance

Double digit adj. net income growth in 2022, excluding FX²

Growth investments for multi-year contracts and working capital

FCF conversion of -75% in FY 2022³

FY deleveraging of 0.5X

Within target leverage of 2X - 4X

Note: Core organic growth is organic growth net of COVID-19 impact.

Normalizing for differences in number of selling days between comparable periods.

Represents foreign exchange translation exposure, primarily from European business (~35% of sales).

4View entire presentation