OpenText Investor Presentation Deck

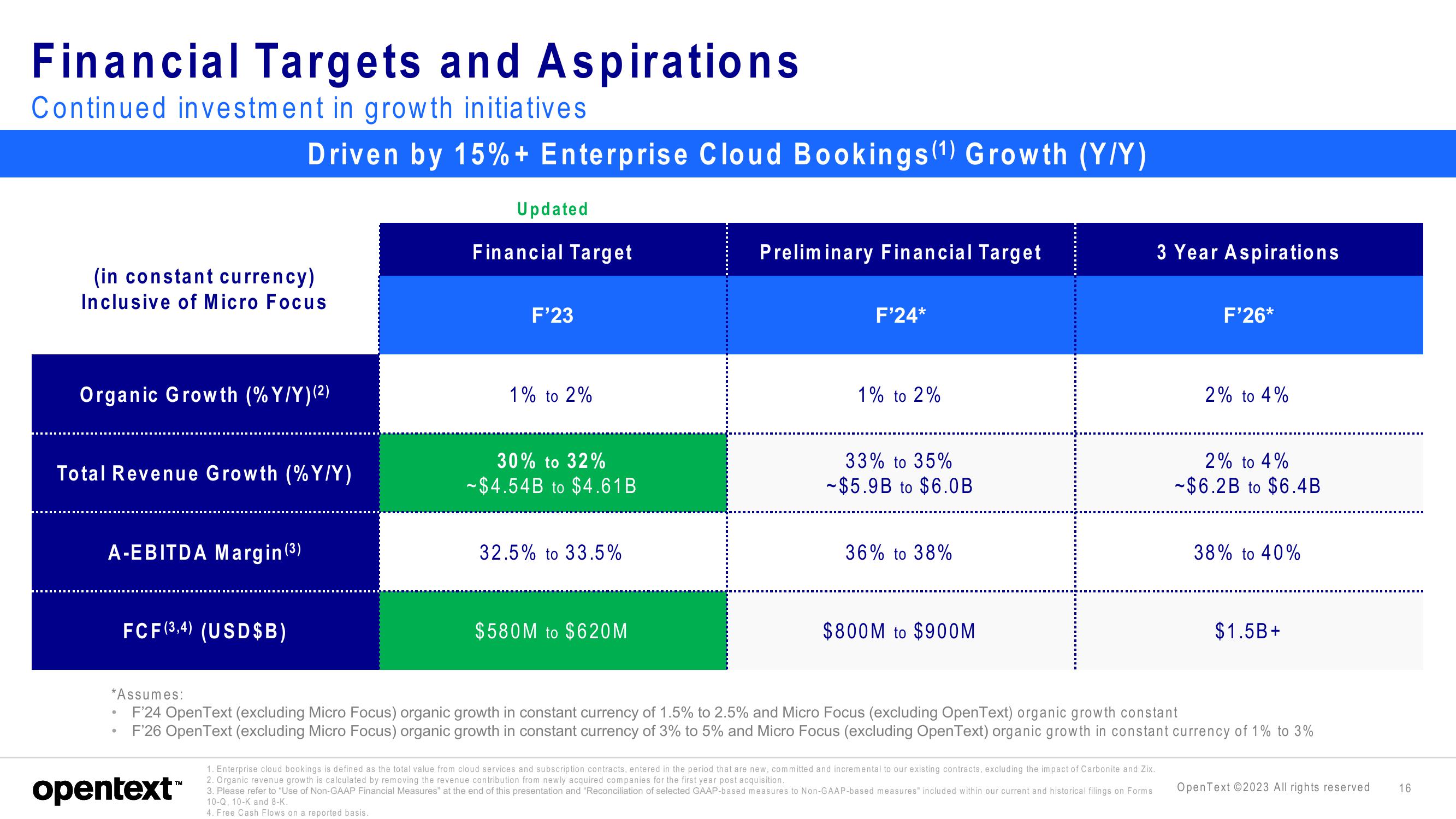

Financial Targets and Aspirations

Continued investment in growth initiatives

(in constant currency)

Inclusive of Micro Focus

Organic Growth (% Y/Y) (²)

Total Revenue Growth (%Y/Y)

A-EBITDA Margin (3)

Driven by 15%+ Enterprise Cloud Bookings (1) Growth (Y/Y)

FCF (3,4) (USD$B)

●

opentext™

Updated

Financial Target

F'23

1% to 2%

30% to 32%

-$4.54B to $4.61B

32.5% to 33.5%

$580M to $620M

Preliminary Financial Target

F'24*

1% to 2%

33% to 35%

-$5.9B to $6.0B

36% to 38%

$800M to $900M

3 Year Aspirations

1. Enterprise cloud bookings is defined as the total value from cloud services and subscription contracts, entered in the period that are new, committed and incremental to our existing contracts, excluding the impact of Carbonite and Zix.

2. Organic revenue growth is calculated by removing the revenue contribution from newly acquired companies for the first year post acquisition..

3. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms

10-Q, 10-K and 8-K.

4. Free Cash Flows on a reported basis.

F'26*

2% to 4%

2% to 4%

-$6.2B to $6.4B

*Assumes:

F'24 OpenText (excluding Micro Focus) organic growth in constant currency of 1.5% to 2.5% and Micro Focus (excluding Open Text) organic growth constant

F'26 OpenText (excluding Micro Focus) organic growth in constant currency of 3% to 5% and Micro Focus (excluding OpenText) organic growth in constant currency of 1% to 3%

38% to 40%

$1.5B+

OpenText ©2023 All rights reserved

16View entire presentation