Coppersmith Presentation to Alere Inc Stockholders

PAGE 9 |

COPPERSMITH

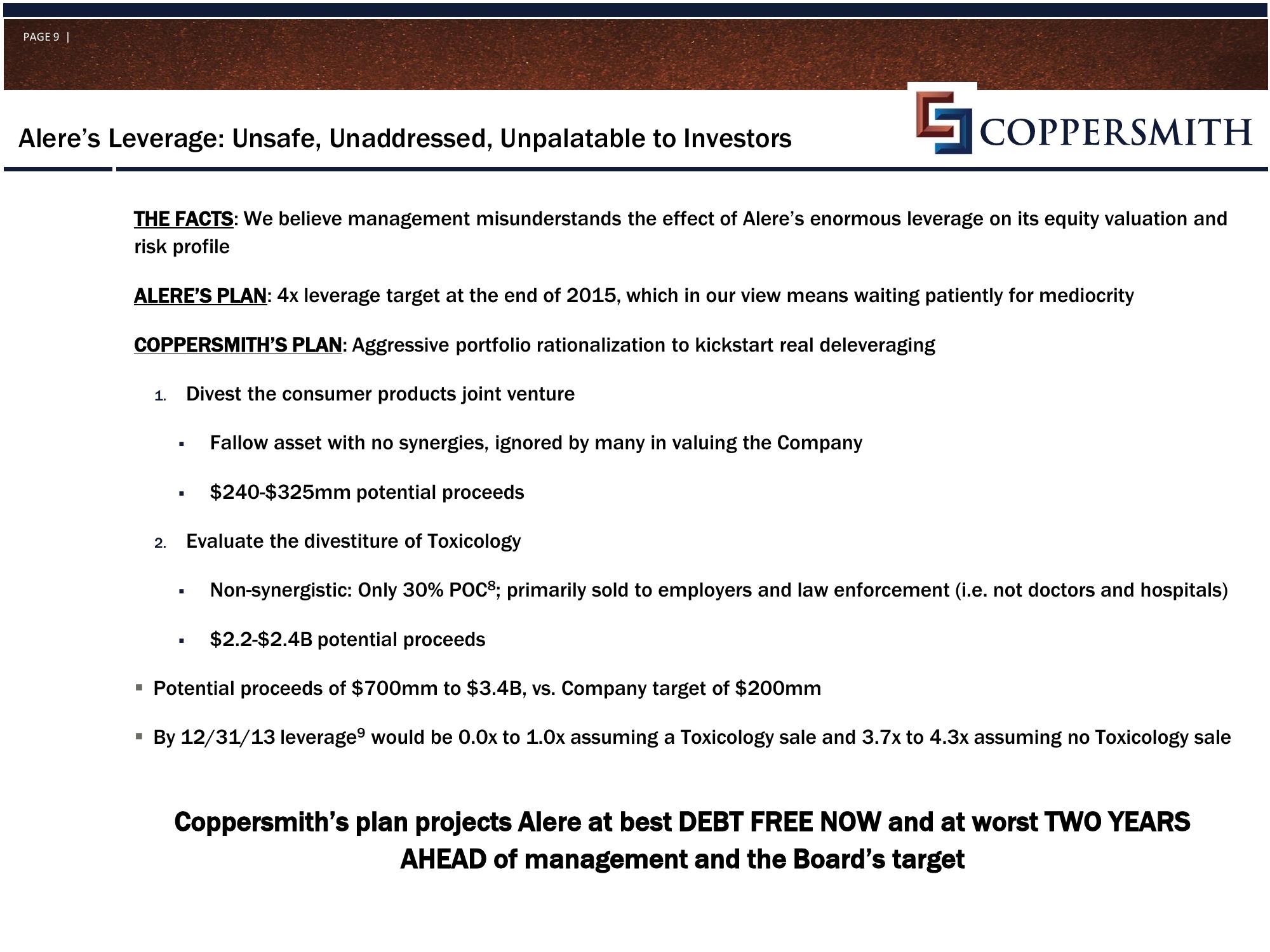

THE FACTS: We believe management misunderstands the effect of Alere's enormous leverage on its equity valuation and

risk profile

Alere's Leverage: Unsafe, Unaddressed, Unpalatable to Investors

ALERE'S PLAN: 4x leverage target at the end of 2015, which in our view means waiting patiently for mediocrity

COPPERSMITH'S PLAN: Aggressive portfolio rationalization to kickstart real deleveraging

Divest the consumer products joint venture

Fallow asset with no synergies, ignored by many in valuing the Company

$240-$325mm potential proceeds

Evaluate the divestiture of Toxicology

Non-synergistic: Only 30% POC8; primarily sold to employers and law enforcement (i.e. not doctors and hospitals)

1.

I

2.

■

■

$2.2-$2.4B potential proceeds

▪ Potential proceeds of $700mm to $3.4B, vs. Company target of $200mm

By 12/31/13 leverage would be 0.0x to 1.0x assuming a Toxicology sale and 3.7x to 4.3x assuming no Toxicology sale

■

Coppersmith's plan projects Alere at best DEBT FREE NOW and at worst TWO YEARS

AHEAD of management and the Board's targetView entire presentation