J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

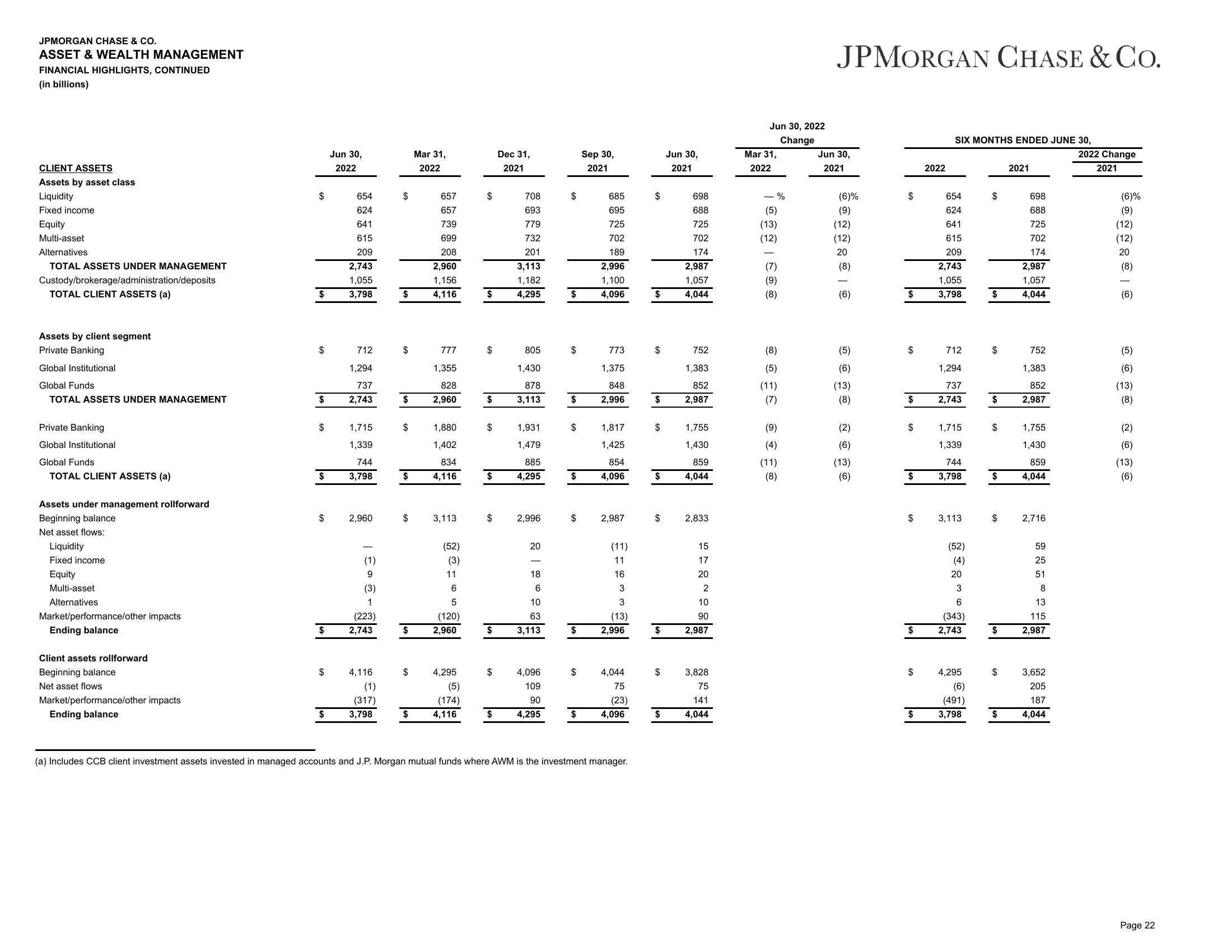

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS, CONTINUED

(in billions)

CLIENT ASSETS

Assets by asset class

Liquidity

Fixed income

Equity

Multi-asset

Alternatives

TOTAL ASSETS UNDER MANAGEMENT

Custody/brokerage/administration/deposits

TOTAL CLIENT ASSETS (a)

Assets by client segment

Private Banking

Global Institutional

Global Funds

TOTAL ASSETS UNDER MANAGEMENT

Private Banking

Global Institutional

Global Funds

TOTAL CLIENT ASSETS (a)

Assets under management rollforward

Beginning balance

Net asset flows:

Liquidity

Fixed income

Equity

Multi-asset

Alternatives

Market/performance/other impacts

Ending balance

Client assets rollforward

Beginning balance

Net asset flows

Market/performance/other impacts

Ending balance

$

$

$

$

712

1,294

737

$ 2,743

$

$

Jun 30,

2022

$

654

624

641

615

209

2,743

1,055

3,798

$

1,715

1,339

744

3,798

2,960

(223)

$ 2,743

(1)

9

(3)

1

4,116

(1)

(317)

3,798

$

$

$

$

$

$

$

$

$

$

Mar 31,

2022

657

657

739

699

208

2,960

1,156

4,116

777

1,355

828

2,960

1,880

1,402

834

4,116

3,113

(52)

(3)

11

6

5

(120)

2,960

4,295

(5)

(174)

4,116

$

$

$

$

$

$

$

$

Dec 31,

2021

$

708

693

779

732

201

3,113

1,182

4,295

805

1,430

878

3,113

1,931

1,479

885

4,295

2,996

20

18

6

10

63

3,113

4,096

109

90

$ 4,295

$

$

$

$

$

$

$

$

$

$

Sep 30,

2021

685

695

725

702

189

2,996

1,100

4,096

773

1,375

848

2,996

1,817

1,425

854

4,096

2,987

(11)

11

16

3

3

(13)

2,996

4,044

75

(23)

4,096

(a) Includes CCB client investment assets invested in managed accounts and J.P. Morgan mutual funds where AWM is the investment manager.

$

$

$

$

$

$

$

$

$

$

Jun 30,

2021

698

688

725

702

174

2,987

1,057

4,044

752

1,383

852

2,987

1,755

1,430

859

4,044

2,833

15

17

20

2

10

90

2,987

3,828

75

141

4,044

Jun 30, 2022

Change

Mar 31,

2022

%

(5)

(13)

(12)

(9)

(8)

(8)

(5)

(11)

(7)

(9)

(4)

(11)

(8)

JPMORGAN CHASE & CO.

Jun 30,

2021

(6)%

(9)

(12)

(12)

20

(8)

(6)

(5)

(6)

(13)

(8)

(2)

(6)

(13)

(6)

$

$

$

$

$

$

$

$

$

2022

SIX MONTHS ENDED JUNE 30,

654

624

641

615

209

2,743

1,055

3,798

712

1,294

737

2,743

1,715

1,339

744

3,798

3,113

(52)

(4)

20

3

6

(343)

2,743

4,295

(6)

(491)

3,798

$

$

$

$

$

$

$

$

$

$

2021

698

688

725

702

174

2,987

1,057

4,044

752

1,383

852

2,987

1,755

1,430

859

4,044

2,716

59

25

51

8

13

115

2,987

3,652

205

187

4,044

2022 Change

2021

(6)%

(9)

(12)

(12)

20

(8)

(6)

(5)

(6)

(13)

(8)

(2)

(6)

(13)

(6)

Page 22View entire presentation