Repay SPAC

Attractive and Diverse Client Base

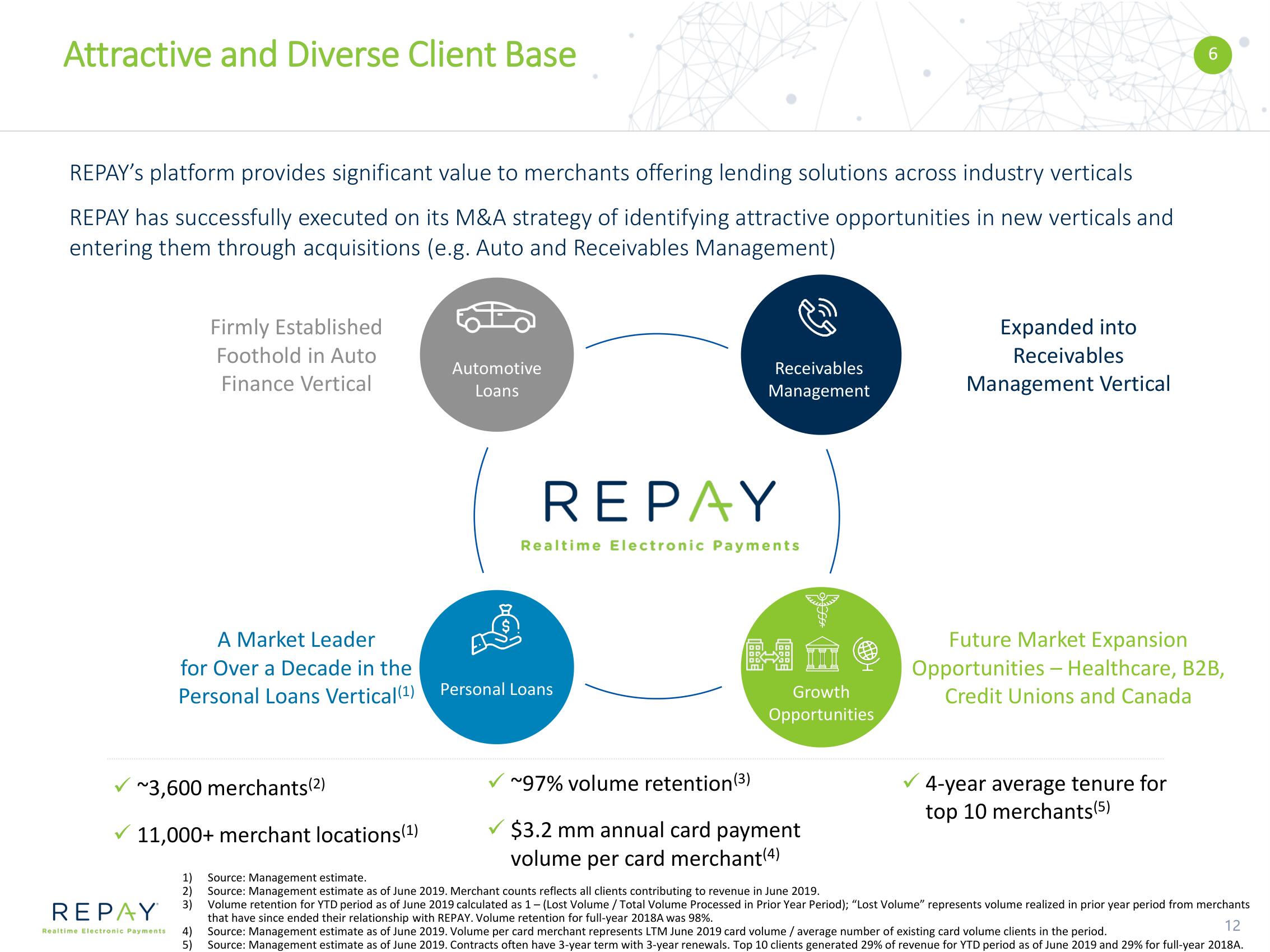

REPAY's platform provides significant value to merchants offering lending solutions across industry verticals

REPAY has successfully executed on its M&A strategy of identifying attractive opportunities in new verticals and

entering them through acquisitions (e.g. Auto and Receivables Management)

REPAY

Realtime Electronic Payments

A Market Leader

for Over a Decade in the

Personal Loans Vertical (¹)

~3,600 merchants (2)

11,000+ merchant locations (¹)

Firmly Established

Foothold in Auto

Finance Vertical

2)

3)

4)

5)

Automotive

Loans

Receivables

Management

REPAY

Realtime Electronic Payments

Personal Loans

& M

Growth

Opportunities

~97% volume retention (³)

$3.2 mm annual card payment

volume per card merchant(4)

Expanded into

Receivables

Management Vertical

SO

Future Market Expansion

Opportunities - Healthcare, B2B,

Credit Unions and Canada

4-year average tenure for

top 10 merchants(5)

1) Source: Management estimate.

Source: Management estimate as of June 2019. Merchant counts reflects all clients contributing to revenue in June 2019.

Volume retention for YTD period as of June 2019 calculated as 1 - (Lost Volume/Total Volume Processed in Prior Year Period); "Lost Volume" represents volume realized in prior year period from merchants

that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%.

12

Source: Management estimate as of June 2019. Volume per card merchant represents LTM June 2019 card volume / average number of existing card volume clients in the period.

Source: Management estimate as of June 2019. Contracts often have 3-year term with 3-year renewals. Top 10 clients generated 29% of revenue for YTD period as of June 2019 and 29% for full-year 2018A.View entire presentation