SoftBank Investor Presentation Deck

SVF1

DRIVING FUTURE SUCCESS

KEY

METRICS

SVF2

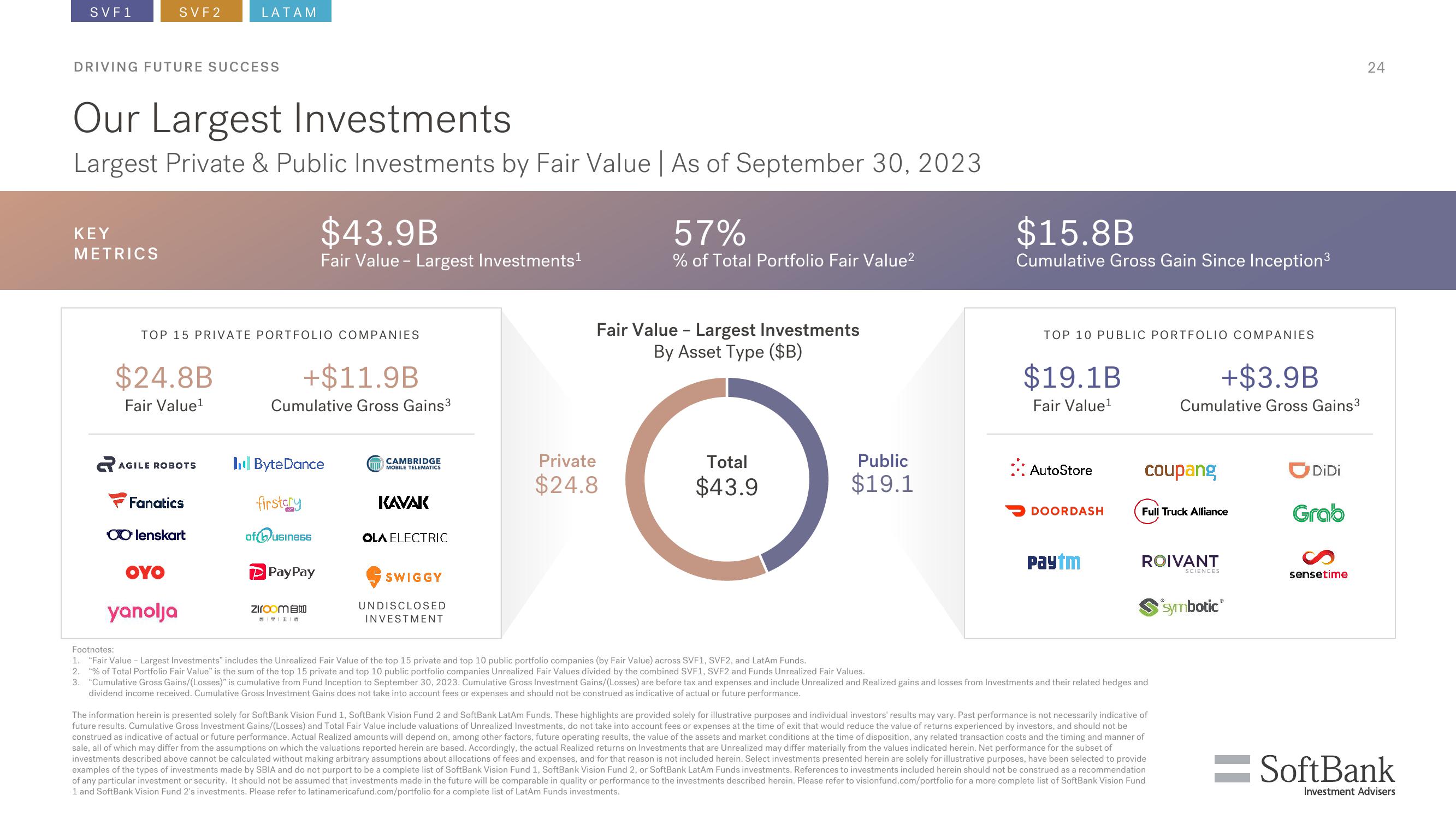

Our Largest Investments

Largest Private & Public Investments by Fair Value | As of September 30, 2023

$24.8B

Fair Value¹

TOP 15 PRIVATE PORTFOLIO COMPANIES

AGILE ROBOTS

Fanatics

LATAM

∞ lenskart

OYO

yanolja

+$11.9B

Cumulative Gross Gains³

Byte Dance

firstcry

of bus

$43.9B

Fair Value - Largest Investments ¹

Jusiness

PayPay

Zıroom

自学|主|週

CAMBRIDGE

MOBILE TELEMATICS

KAVAK

OLA ELECTRIC

SWIGGY

UNDISCLOSED

INVESTMENT

57%

% of Total Portfolio Fair Value²

Fair Value - Largest Investments

By Asset Type ($B)

Private

$24.8

Total

$43.9

Public

$19.1

$15.8B

Cumulative Gross Gain Since Inception³

TOP 10 PUBLIC PORTFOLIO COMPANIES

$19.1B

Fair Value¹

:: AutoStore

DOORDASH

Paytm

coupang

+$3.9B

Cumulative Gross Gains³

Full Truck Alliance

ROIVANT

Footnotes:

1. "Fair Value - Largest Investments" includes the Unrealized Fair Value of the top 15 private and top 10 public portfolio companies (by Fair Value) across SVF1, SVF2, and LatAm Funds.

2. "% of Total Portfolio Fair Value" is the sum of the top 15 private and top 10 public portfolio companies Unrealized Fair Values divided by the combined SVF1, SVF2 and Funds Unrealized Fair Values.

3. "Cumulative Gross Gains/(Losses)" is cumulative from Fund Inception to September 30, 2023. Cumulative Gross Investment Gains/(Losses) are before tax and expenses and include Unrealized and Realized gains and losses from Investments and their related hedges and

dividend income received. Cumulative Gross Investment Gains does not take into account fees or expenses and should not be construed as indicative of actual or future performance.

The information herein is presented solely for SoftBank Vision Fund 1, SoftBank Vision Fund 2 and SoftBank LatAm Funds. These highlights are provided solely for illustrative purposes and individual investors' results may vary. Past performance is not necessarily indicative of

future results. Cumulative Gross Investment Gains/(Losses) and Total Fair Value include valuations of Unrealized Investments, do not take into account fees or expenses at the time of exit that would reduce the value of returns experienced by investors, and should not be

construed as indicative of actual or future performance. Actual Realized amounts will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of

sale, all of which may differ from the assumptions on which the valuations reported herein are based. Accordingly, the actual Realized returns on Investments that are Unrealized may differ materially from the values indicated herein. Net performance for the subset of

investments described above cannot be calculated without making arbitrary assumptions about allocations of fees and expenses, and for that reason is not included herein. Select investments presented herein are solely for illustrative purposes, have been selected to provide

examples of the types of investments made by SBIA and do not purport to be a complete list of SoftBank Vision Fund 1, SoftBank Vision Fund 2, or SoftBank LatAm Funds investments. References to investments included herein should not be construed as a recommendation

of any particular investment or security. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. Please refer to visionfund.com/portfolio for a more complete list of SoftBank Vision Fund

1 and SoftBank Vision Fund 2's investments. Please refer to latinamericafund.com/portfolio for a complete list of LatAm Funds investments.

SCIENCES

symbotic

DiDi

Grab

sensetime

24

=SoftBank

Investment AdvisersView entire presentation