Bank of America Results Presentation Deck

Global Wealth & Investment Management Digital Update¹

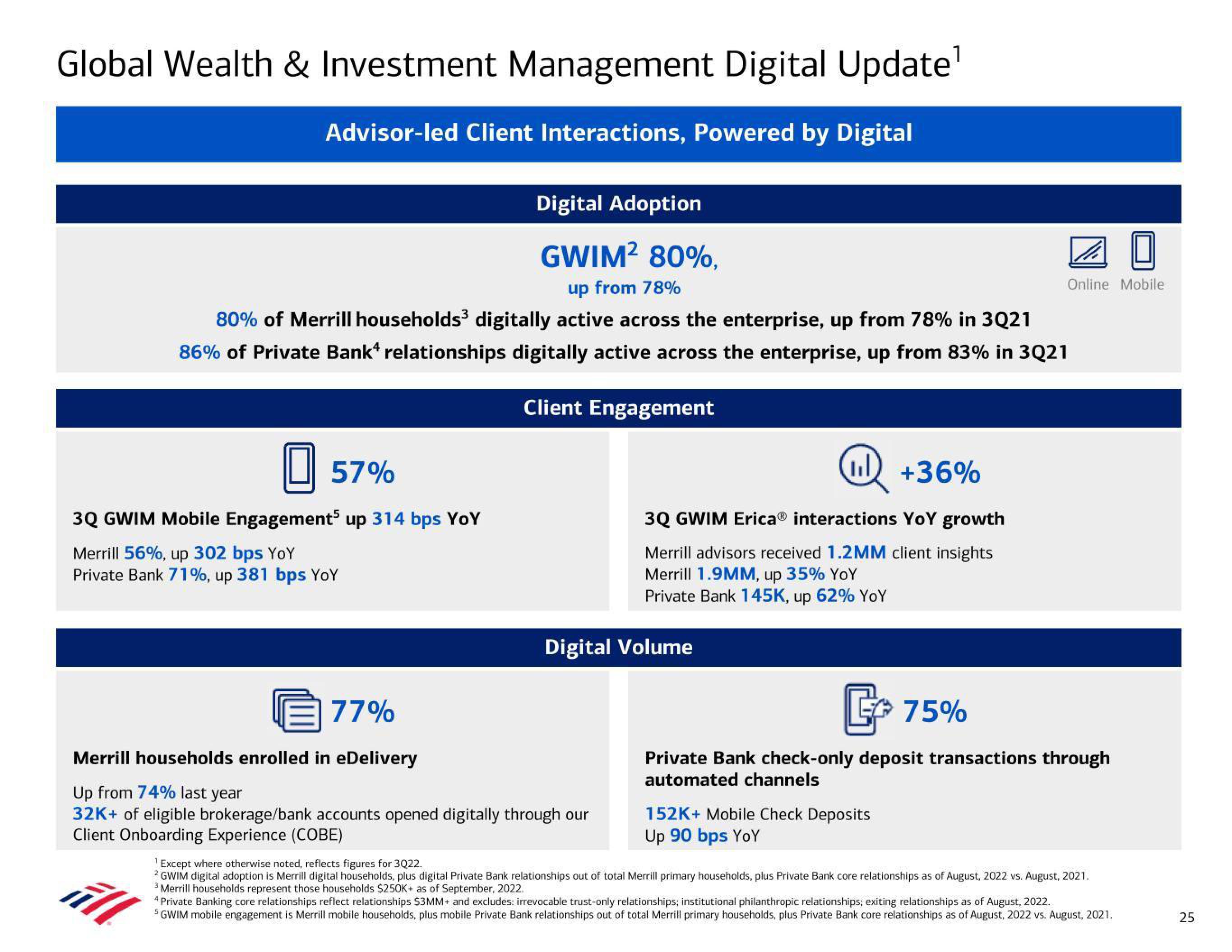

Advisor-led Client Interactions, Powered by Digital

Digital Adoption

GWIM² 80%,

up from 78%

80% of Merrill households³ digitally active across the enterprise, up from 78% in 3Q21

86% of Private Bank* relationships digitally active across the enterprise, up from 83% in 3Q21

Client Engagement

57%

3Q GWIM Mobile Engagement5 up 314 bps YoY

Merrill 56%, up 302 bps YoY

Private Bank 71%, up 381 bps YoY

ul +36%

3Q GWIM Erica® interactions YoY growth

Merrill advisors received 1.2MM client insights

Merrill 1.9MM, up 35% YoY

Private Bank 145K, up 62% YoY

Digital Volume

77%

Merrill households enrolled in eDelivery

Up from 74% last year

32K+ of eligible brokerage/bank accounts opened digitally through our

Client Onboarding Experience (COBE)

G

Private Bank check-only deposit transactions through

automated channels

152K+ Mobile Check Deposits

Up 90 bps YoY

Online Mobile

75%

Except where otherwise noted, reflects figures for 3Q22.

2 GWIM digital adoption is Merrill digital households, plus digital Private Bank relationships out of total Merrill primary households, plus Private Bank core relationships as of August, 2022 vs. August, 2021.

3 Merrill households represent those households $250K+ as of September, 2022.

4 Private Banking core relationships reflect relationships $3MM+ and excludes: irrevocable trust-only relationships; institutional philanthropic relationships; exiting relationships as of August, 2022.

5 GWIM mobile engagement is Merrill mobile households, plus mobile Private Bank relationships out of total Merrill primary households, plus Private Bank core relationships as of August, 2022 vs. August, 2021.

25View entire presentation