Evercore Investment Banking Pitch Book

Executive Summary

Introduction

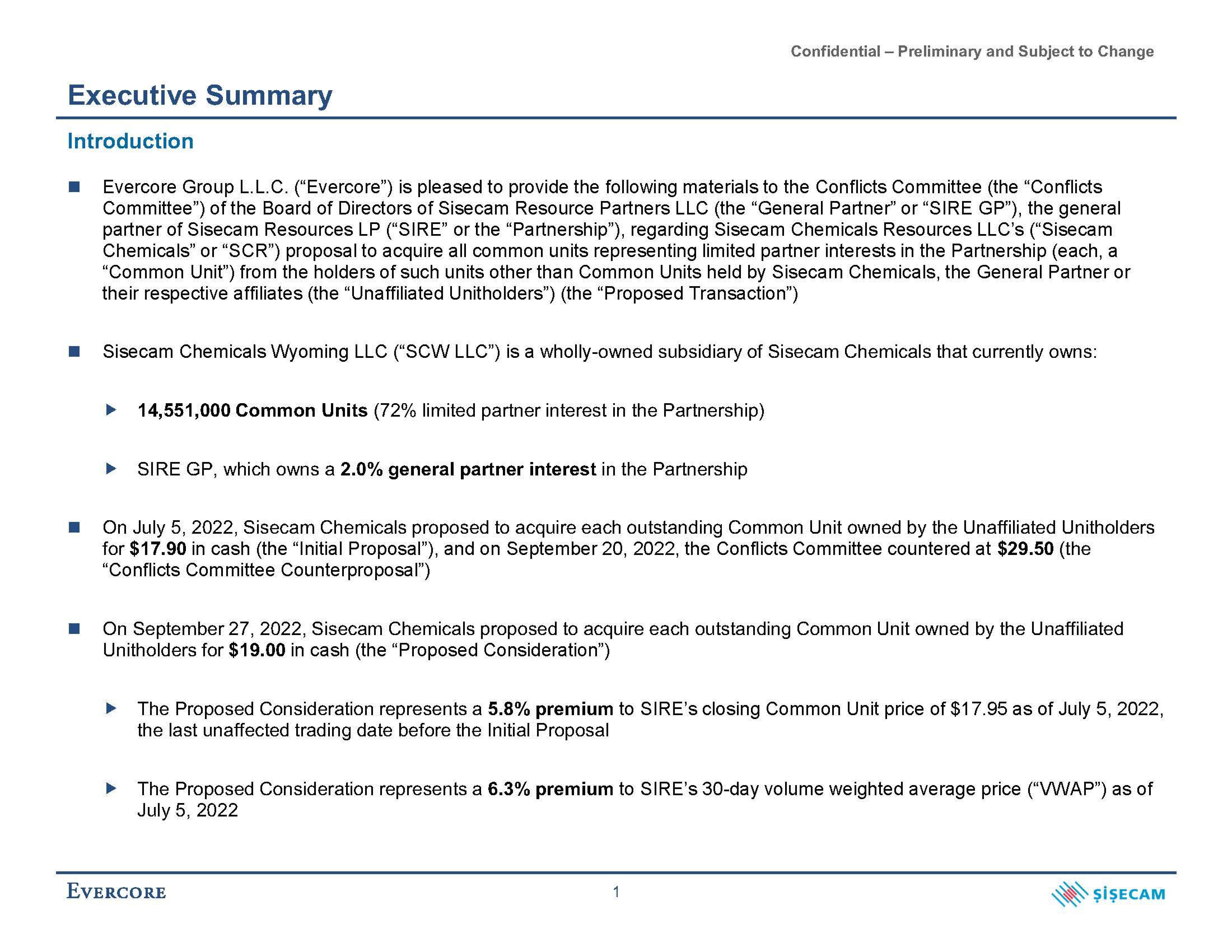

Evercore Group L.L.C. ("Evercore") is pleased to provide the following materials to the Conflicts Committee (the "Conflicts

Committee") of the Board of Directors of Sisecam Resource Partners LLC (the "General Partner" or "SIRE GP"), the general

partner of Sisecam Resources LP ("SIRE" or the "Partnership"), regarding Sisecam Chemicals Resources LLC's ("Sisecam

Chemicals" or "SCR") proposal to acquire all common units representing limited partner interests in the Partnership (each, a

"Common Unit") from the holders of such units other than Common Units held by Sisecam Chemicals, the General Partner or

their respective affiliates (the "Unaffiliated Unitholders") (the "Proposed Transaction")

Sisecam Chemicals Wyoming LLC ("SCW LLC") is a wholly-owned subsidiary of Sisecam Chemicals that currently owns:

14,551,000 Common Units (72% limited partner interest in the Partnership)

SIRE GP, which owns a 2.0% general partner interest in the Partnership

Confidential - Preliminary and Subject to Change

On July 5, 2022, Sisecam Chemicals proposed to acquire each outstanding Common Unit owned by the Unaffiliated Unitholders

for $17.90 in cash (the "Initial Proposal"), and on September 20, 2022, the Conflicts Committee countered at $29.50 (the

"Conflicts Committee Counterproposal")

On September 27, 2022, Sisecam Chemicals proposed to acquire each outstanding Common Unit owned by the Unaffiliated

Unitholders for $19.00 in cash (the "Proposed Consideration")

The Proposed Consideration represents a 5.8% premium to SIRE's closing Common Unit price of $17.95 as of July 5, 2022,

the last unaffected trading date before the Initial Proposal

The Proposed Consideration represents a 6.3% premium to SIRE's 30-day volume weighted average price ("WWAP") as of

July 5, 2022

EVERCORE

1

ŞİŞECAMView entire presentation