Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

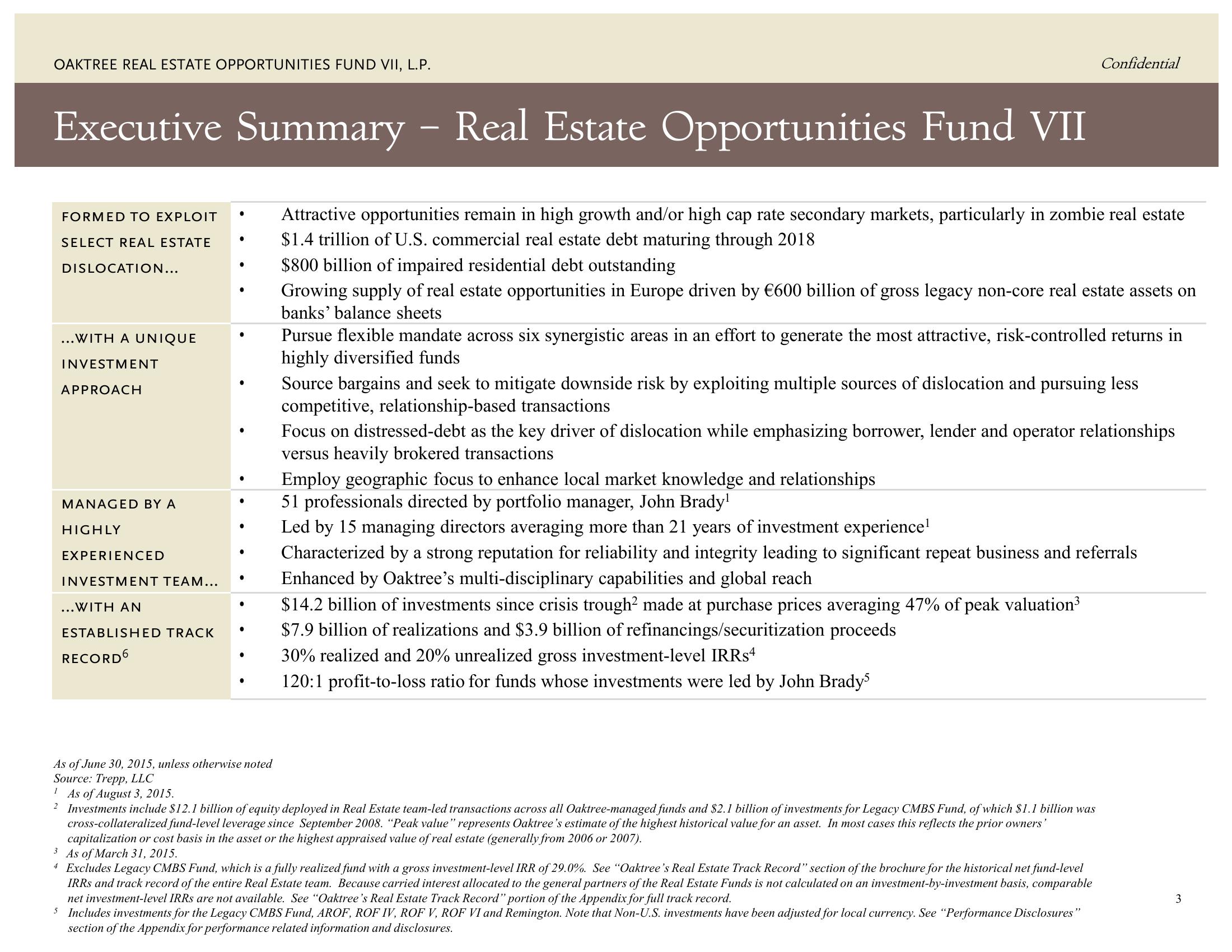

Executive Summary - Real Estate Opportunities Fund VII

FORMED TO EXPLOIT

SELECT REAL ESTATE

DISLOCATION...

...WITH A UNIQUE

INVESTMENT

APPROACH

MANAGED BY A

HIGHLY

EXPERIENCED

INVESTMENT TEAM...

...WITH AN

ESTABLISHED TRACK

RECORD6

●

●

●

As of June 30, 2015, unless otherwise noted

Source: Trepp, LLC

1 As of August 3, 2015.

Attractive opportunities remain in high growth and/or high cap rate secondary markets, particularly in zombie real estate

$1.4 trillion of U.S. commercial real estate debt maturing through 2018

$800 billion of impaired residential debt outstanding

Growing supply of real estate opportunities in Europe driven by €600 billion of gross legacy non-core real estate assets on

banks' balance sheets

Confidential

Pursue flexible mandate across six synergistic areas in an effort to generate the most attractive, risk-controlled returns in

highly diversified funds

Source bargains and seek to mitigate downside risk by exploiting multiple sources of dislocation and pursuing less

competitive, relationship-based transactions

Focus on distressed-debt as the key driver of dislocation while emphasizing borrower, lender and operator relationships

versus heavily brokered transactions

Employ geographic focus to enhance local market knowledge and relationships

51 professionals directed by portfolio manager, John Brady¹

Led by 15 managing directors averaging more than 21 years of investment experience¹

Characterized by a strong reputation for reliability and integrity leading to significant repeat business and referrals

Enhanced by Oaktree's multi-disciplinary capabilities and global reach

$14.2 billion of investments since crisis trough² made at purchase prices averaging 47% of peak valuation³

$7.9 billion of realizations and $3.9 billion of refinancings/securitization proceeds

30% realized and 20% unrealized gross investment-level IRRs4

120:1 profit-to-loss ratio for funds whose investments were led by John Brady5

2 Investments include $12.1 billion of equity deployed in Real Estate team-led transactions across all Oaktree-managed funds and $2.1 billion of investments for Legacy CMBS Fund, of which $1.1 billion was

cross-collateralized fund-level leverage since September 2008. "Peak value" represents Oaktree's estimate of the highest historical value for an asset. In most cases this reflects the prior owners

capitalization or cost basis in the asset or the highest appraised value of real estate (generally from 2006 or 2007).

3 As of March 31, 2015.

"

4 Excludes Legacy CMBS Fund, which is a fully realized fund with a gross investment-level IRR of 29.0%. See "Oaktree's Real Estate Track Record" section of the brochure for the historical net fund-level

IRRS and track record of the entire Real Estate team. Because carried interest allocated to the general partners of the Real Estate Funds is not calculated on an investment-by-investment basis, comparable

net investment-level IRRS are not available. See "Oaktree's Real Estate Track Record" portion of the Appendix for full track record.

5 Includes investments for the Legacy CMBS Fund, AROF, ROF IV, ROF V, ROF VI and Remington. Note that Non-U.S. investments have been adjusted for local currency. See "Performance Disclosures"

section of the Appendix for performance related information and disclosures.

3View entire presentation