Q2 Quarter 2023

Q2 23 Highlights

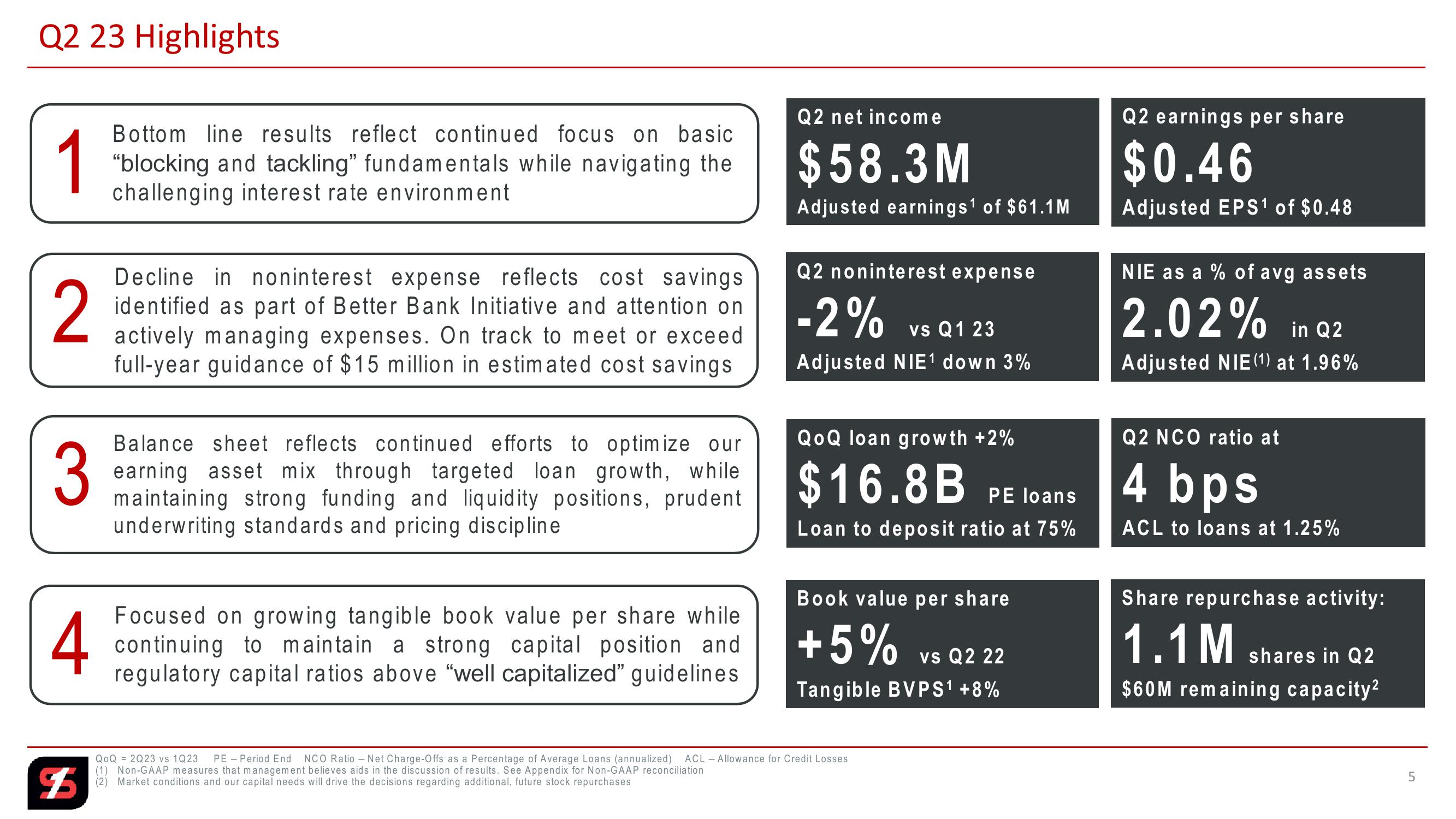

1

2

3

4

Bottom line results reflect continued focus on basic

"blocking and tackling" fundamentals while navigating the

challenging interest rate environment

Decline in noninterest expense reflects cost savings

identified as part of Better Bank Initiative and attention on

actively managing expenses. On track to meet or exceed

full-year guidance of $15 million in estimated cost savings

Balance sheet reflects continued efforts to optimize our

earning asset mix through targeted loan growth, while

maintaining strong funding and liquidity positions, prudent

underwriting standards and pricing discipline

Focused on growing tangible book value per share while

continuing to maintain a strong capital position and

regulatory capital ratios above "well capitalized" guidelines

Q2 net income

$58.3M

Adjusted earnings of $61.1M

Q2 noninterest expense

-2%

vs Q1 23

Adjusted NIE¹ down 3%

QoQ loan growth +2%

$16.8B

PE loans

Loan to deposit ratio at 75%

Book value per share

+5%

vs Q2 22

Tangible BVPS¹ +8%

Q2 earnings per share

$0.46

Adjusted EPS1 of $0.48

NIE as a % of avg assets

2.02% in Q2

Adjusted NIE (1) at 1.96%

Q2 NCO ratio at

4 bps

ACL to loans at 1.25%

Share repurchase activity:

1.1M

shares in Q2

$60M remaining capacity2

$

QoQ 2Q23 vs 1Q23 PE Period End NCO Ratio -Net Charge-Offs as a Percentage of Average Loans (annualized) ACL Allowance for Credit Losses

(1) Non-GAAP measures that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation

(2) Market conditions and our capital needs will drive the decisions regarding additional, future stock repurchases

5View entire presentation