Bank of America Investment Banking Pitch Book

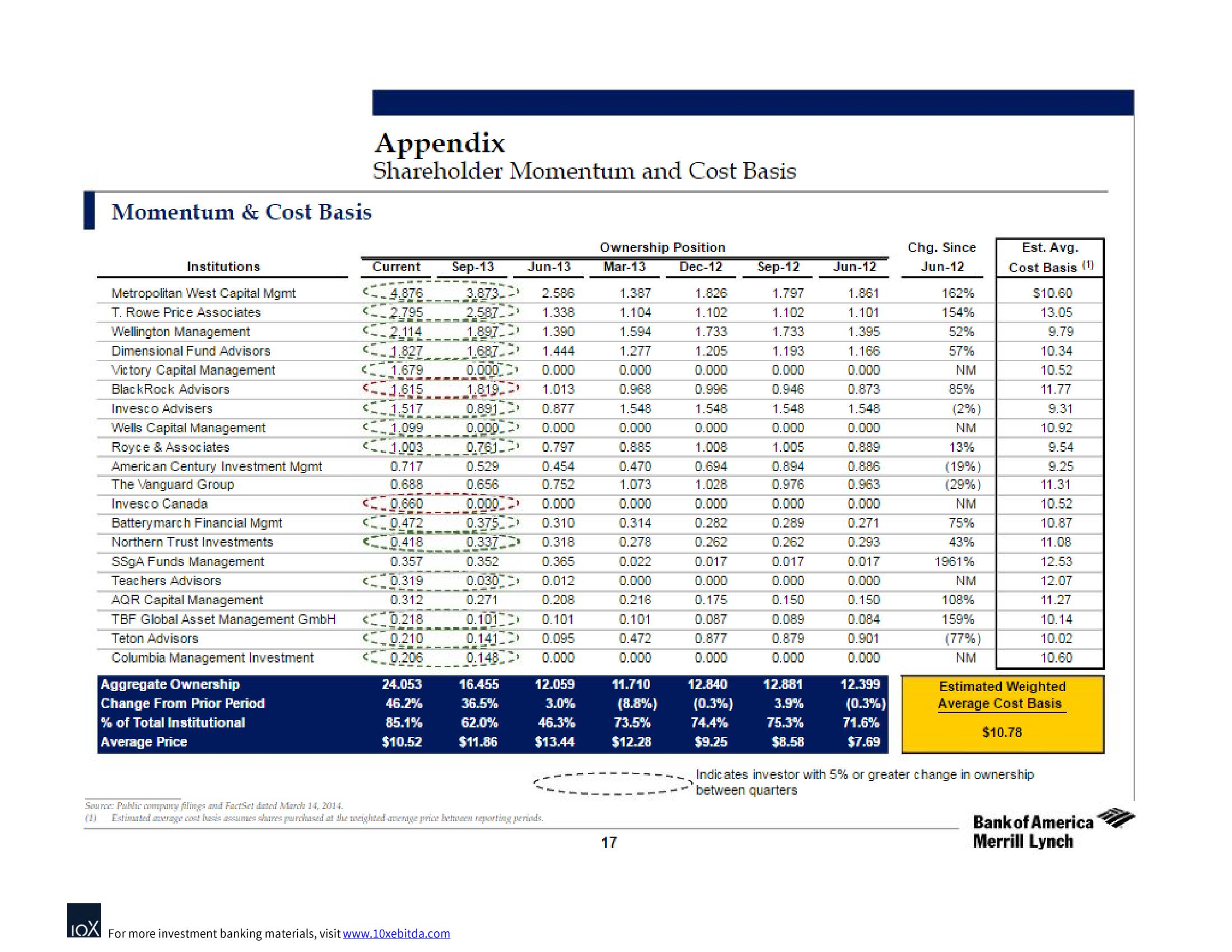

Momentum & Cost Basis

Institutions

Metropolitan West Capital Mgmt

T. Rowe Price Associates

Wellington Management

Dimensional Fund Advisors

Victory Capital Management

BlackRock Advisors

Invesco Advisers

Wells Capital Management

Royce & Associates

American Century Investment Mgmt

The Vanguard Group

Invesco Canada

Batterymarch Financial Mgmt

Northern Trust Investments

SSgA Funds Management

Teachers Advisors

AQR Capital Management

TBF Global Asset Management GmbH

Teton Advisors

Columbia Management Investment

Aggregate Ownership

Change From Prior Period

% of Total Institutional

Average Price

Appendix

Shareholder Momentum and Cost Basis

Current

<4.876

2.795

2.114

<1.827

< 1.679

<1.615

<1.517

< 1.099

<1.003

0.717

0.688

<0.660

<0.472

0.418

0.357

<0.319

0.312

<0.218

<0.210

24.053

46.2%

85.1%

$10.52

Sep-13

LOX For more investment banking materials, visit www.10xebitda.com

3.873-

2.587

1.897

1.687. 3

0.000

1.819

0.891

0.000

0.761-

0.529

0.656

Jun-13

2.586

1.338

1.390

1.444

0.000

1.013

0.877

0.000

0.797

0.454

0.752

0.000 3 0.000

0.375-

7 0.310

=

0.337

0.318

0.352

0.365

0.030

0.012

0.271

0.208

0.101

0.101

0.141

0.095

0.148

0.000

16.455

36.5%

62.0%

$11.86

12.059

3.0%

46.3%

$13.44

Source: Public company filings and FactSet dated March 14, 2014.

(1) Estimated average cost basis assumes shares purchased at the weighted average price between reporting periods.

Ownership Position

Mar-13

Dec-12

1.387

1.104

1.594

1.277

0.000

0.968

1.548

0.000

0.885

0.470

1.073

0.000

0.314

0.278

0.022

0.000

0.216

0.101

0.472

0.000

17

1.826

1.102

1.733

1.205

0.000

0.996

1.548

0.000

1.008

0.694

1.028

0.000

0.282

0.262

0.017

0.000

0.175

0.087

0.877

0.000

11.710

12.840

(8.8%) (0.3%)

73.5%

74.4%

$12.28

$9.25

Sep-12

1.797

1.102

1.733

1.193

0.000

0.946

1.548

0.000

1.005

0.894

0.976

0.000

0.289

0.262

0.017

0.000

0.150

0.089

0.879

0.000

12.881

3.9%

75.3%

$8.58

Jun-12

1.861

1.101

1.395

1.166

0.000

0.873

1.548

0.000

0.889

0.886

0.963

0.000

0.271

0.293

0.017

0.000

0.150

0.084

0.901

0.000

12.399

(0.3%)

71.6%

$7.69

Chg. Since

Jun-12

162%

154%

52%

57%

NM

85%

(2%)

NM

13%

(19%)

(29%)

NM

75%

43%

1961%

NM

108%

159%

(77%)

NM

Est. Avg.

Cost Basis (1)

$10.60

13.05

9.79

10.34

10.52

11.77

9.31

10.92

9.54

9.25

11.31

10.5.2

10.87

11.08

12.53

12.07

11.27

10.14

10.02

10.60

Estimated Weighted

Average Cost Basis

$10.78

Indicates investor with 5% or greater change in ownership

between quarters

Bank of America

Merrill LynchView entire presentation