Mondee Investor Presentation

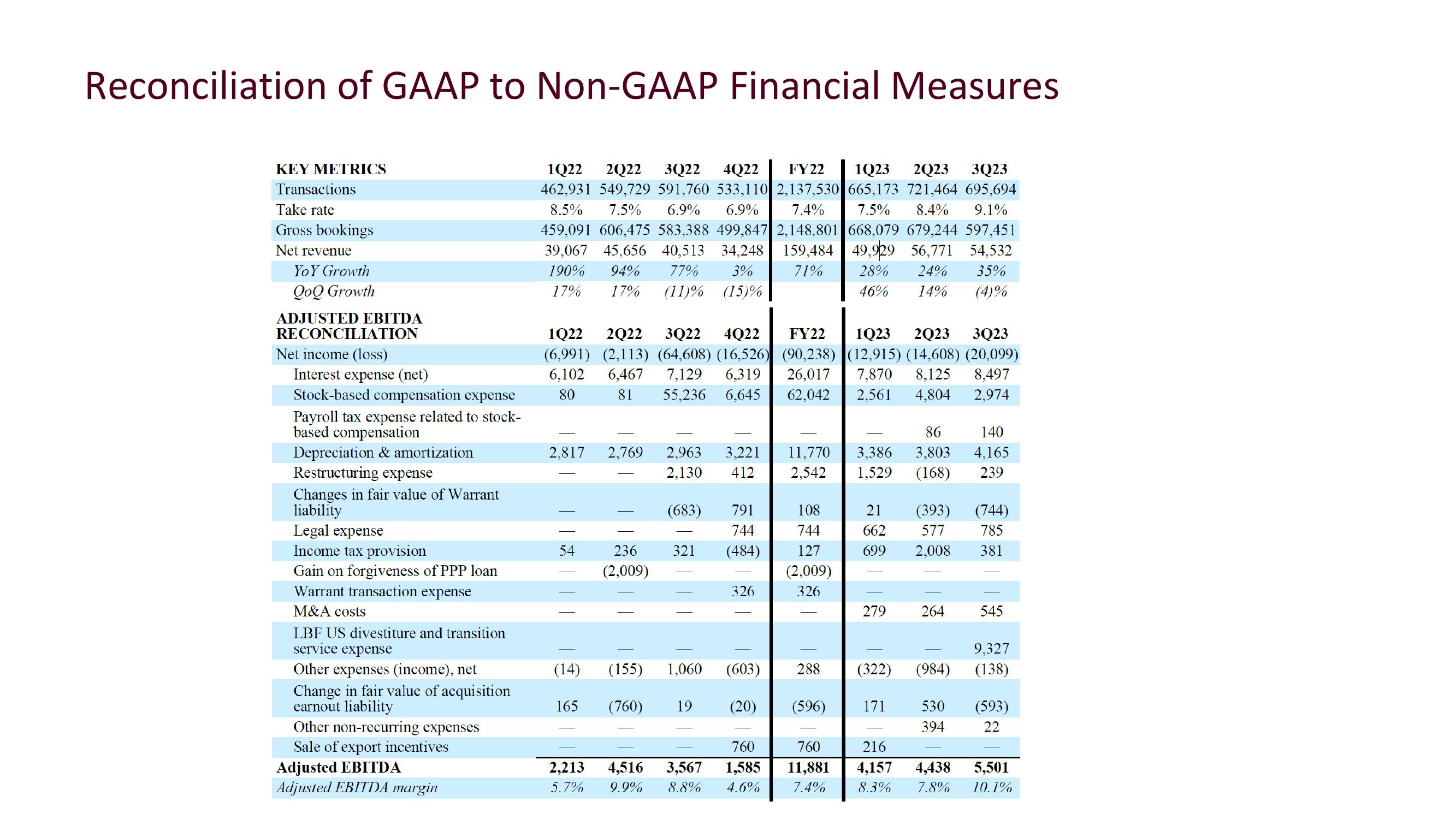

Reconciliation of GAAP to Non-GAAP Financial Measures

KEY METRICS

Transactions

Take rate

Gross bookings

Net revenue

YoY Growth

QoQ Growth

ADJUSTED EBITDA

RECONCILIATION

Net income (loss)

Interest expense (net)

Stock-based compensation expense

Payroll tax expense related to stock-

based compensation

Depreciation & amortization

Restructuring expense

Changes in fair value of Warrant

liability

Legal expense

Income tax provision

Gain on forgiveness of PPP loan

Warrant transaction expense

M&A costs

LBF US divestiture and transition

service expense

Other expenses (income), net

Change in fair value of acquisition

earnout liability

Other non-recurring expenses

Sale of export incentives

Adjusted EBITDA

Adjusted EBITDA margin

1Q22 2Q22 3Q22 4Q22 FY22 1Q23 2Q23 3Q23

462,931 549,729 591,760 533,110 2,137,530 665,173 721,464 695,694

8.5% 7.5% 6.9% 6.9% 7.4% 7.5% 8.4% 9.1%

459,091 606,475 583,388 499,847 2,148,801 668,079 679,244 597,451

39,067 45,656 40,513 34,248 159,484 49,929 56,771 54,532

190% 94% 77% 3% 71%

28% 24% 35%

17% 17% (11)% (15)%

46% 14% (4)%

1Q22 2Q22 3Q22 4Q22

(6,991) (2,113) (64,608) (16,526)

6,102 6,467 7,129 6,319

80

81 55,236 6,645

2,817 2,769

|||||

(14)

165

236

(2,009)

T

2,963 3,221 11,770

2,130 412 2,542

(683)

791

744

321 (484)

326

(155) 1,060 (603)

(760) 19

(20)

FY22 1Q23 2Q23 3Q23

(90,238) (12,915) (14,608) (20,099)

26,017 7,870 8,125 8,497

62,042 2,561 4,804 2,974

760

2,213 4,516 3,567 1,585

9.9% 8.8% 4.6%

5.7%

108

744

127

(2,009)

326

288

(596)

760

11,881

7.4%

86

3,386 3,803

1,529 (168)

21

662

699

279

(393)

577

2,008

171

264

(322) (984)

140

4,165

239

(744)

785

381

545

9,327

(138)

530 (593)

394

22

216

4,157 4,438

5,501

8.3% 7.8% 10.1%View entire presentation