Kinnevik Results Presentation Deck

KEY STRATEGIC HIGHLIGHTS IN THE THIRD QUARTER OF 2020

■

Key Highlights

Zalando raised its full-year 2020 outlook on the back of exceptionally strong and

profitable growth in the third quarter

■

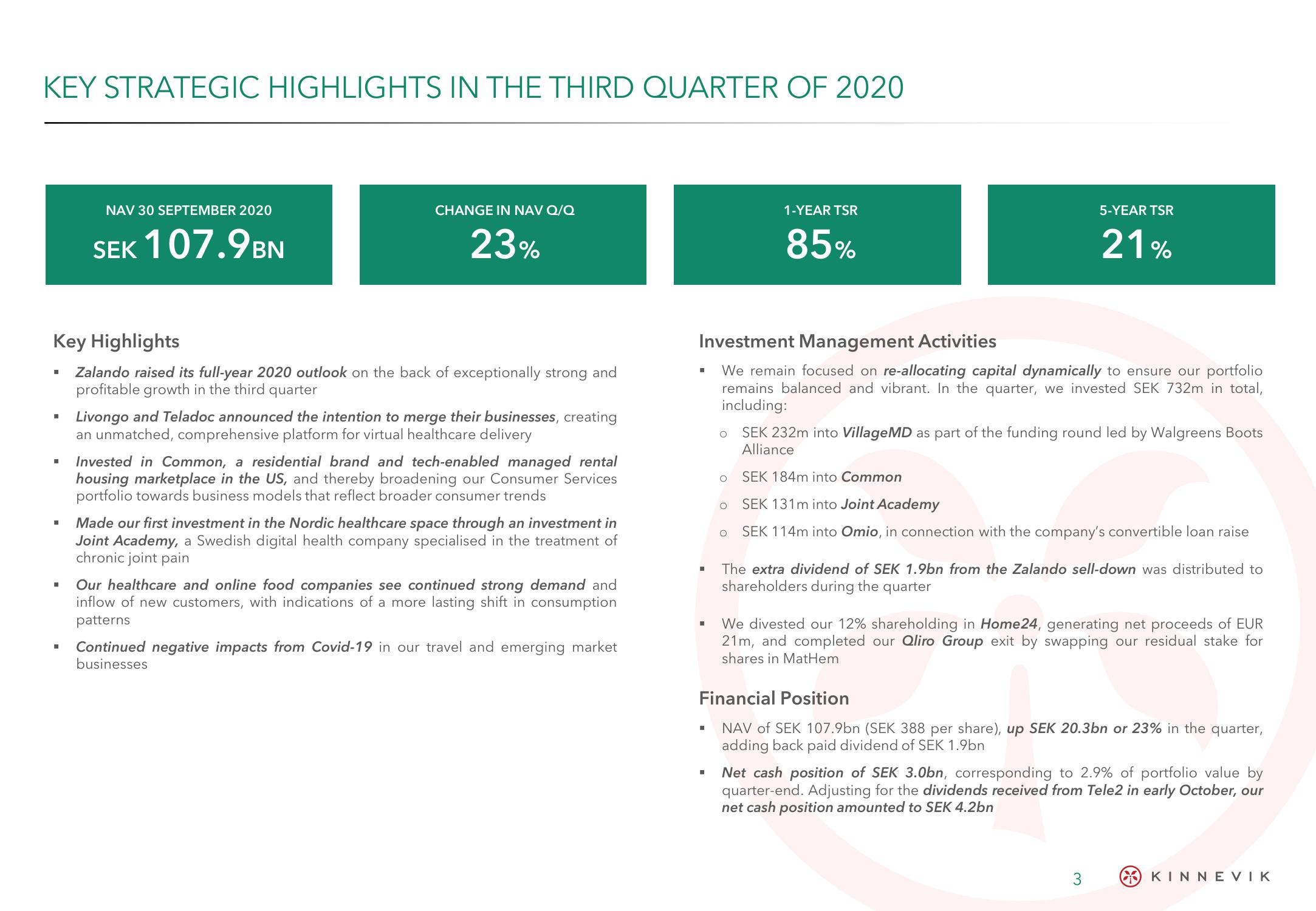

NAV 30 SEPTEMBER 2020

SEK 107.9BN

■

CHANGE IN NAV Q/Q

23%

Livongo and Teladoc announced the intention to merge their businesses, creating

an unmatched, comprehensive platform for virtual healthcare delivery

Invested in Common, a residential brand and tech-enabled managed rental

housing marketplace in the US, and thereby broadening our Consumer Services

portfolio towards business models that reflect broader consumer trends

Made our first investment in the Nordic healthcare space through an investment in

Joint Academy, a Swedish digital health company specialised in the treatment of

chronic joint pain

Our healthcare and online food companies see continued strong demand and

inflow of new customers, with indications of a more lasting shift in consumption

patterns

Continued negative impacts from Covid-19 in our travel and emerging market

businesses

I

Investment Management Activities

We remain focused on re-allocating capital dynamically to ensure our portfolio

remains balanced and vibrant. In the quarter, we invested SEK 732m in total,

including:

1-YEAR TSR

85%

■

5-YEAR TSR

21%

I The extra dividend of SEK 1.9bn from the Zalando sell-down was distributed to

shareholders during the quarter

■

O SEK 232m into Village MD as part of the funding round led by Walgreens Boots

Alliance

O SEK 184m into Common

O SEK 131m into Joint Academy

O SEK 114m into Omio, in connection with the company's convertible loan raise

We divested our 12% shareholding in Home24, generating net proceeds of EUR

21m, and completed our Qliro Group exit by swapping our residual stake for

shares in MatHem

Financial Position

NAV of SEK 107.9bn (SEK 388 per share), up SEK 20.3bn or 23% in the quarter,

adding back paid dividend of SEK 1.9bn

Net cash position of SEK 3.0bn, corresponding to 2.9% of portfolio value by

quarter-end. Adjusting for the dividends received from Tele2 in early October, our

net cash position amounted to SEK 4.2bn

3

KINNEVIKView entire presentation