Bank of America Investment Banking Pitch Book

Take Private Process Overview

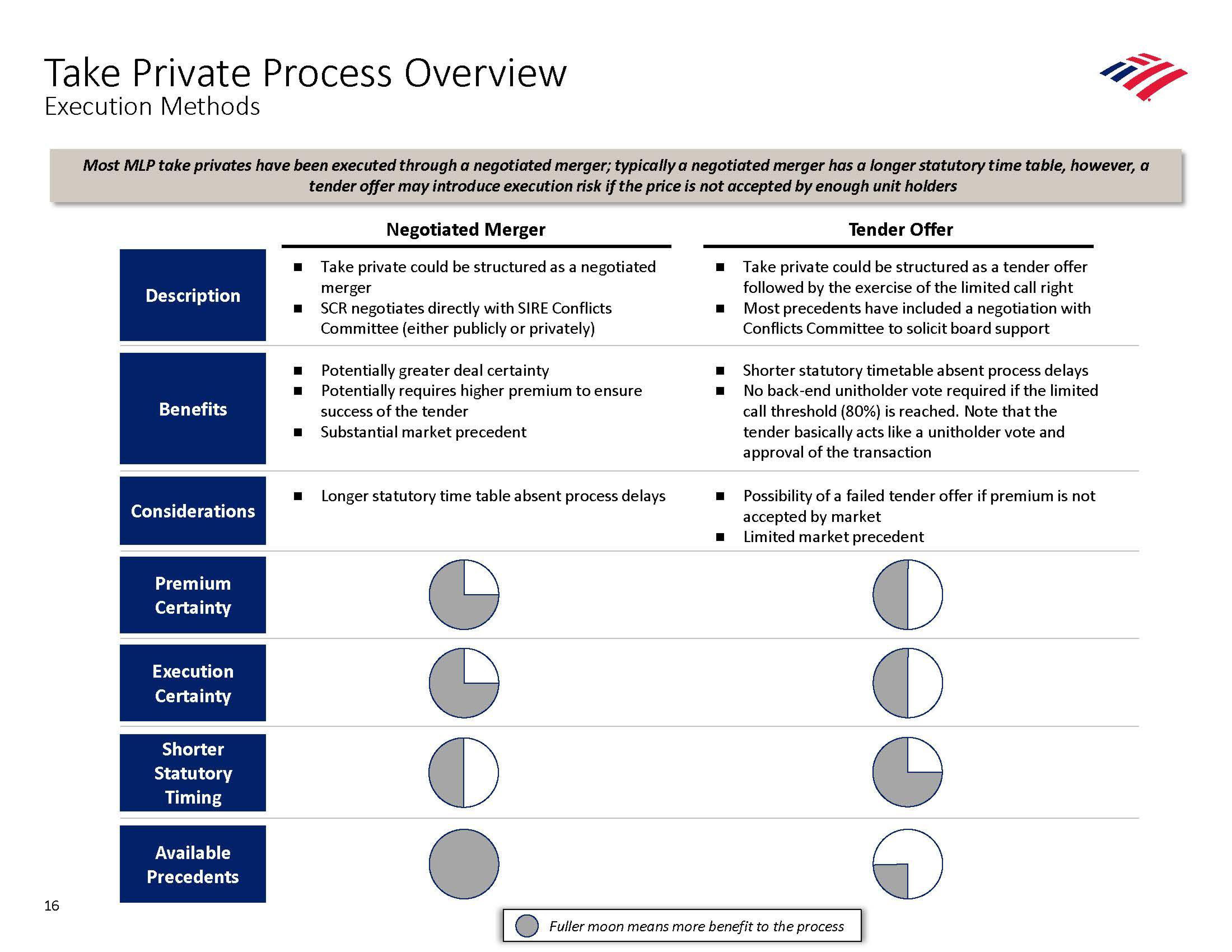

Execution Methods

16

Most MLP take privates have been executed through a negotiated merger; typically a negotiated merger has a longer statutory time table, however, a

tender offer may introduce execution risk if the price is not accepted by enough unit holders

Description

Benefits

Considerations

Premium

Certainty

Execution

Certainty

Shorter

Statutory

Timing

Available

Precedents

Negotiated Merger

■ Take private could be structured as a negotiated

merger

SCR negotiates directly with SIRE Conflicts

Committee (either publicly or privately)

■

■ Potentially greater deal certainty

■

Potentially requires higher premium to ensure

success of the tender

■ Substantial market precedent

■ Longer statutory time table absent process delays

OO

Tender Offer

Take private could be structured as a tender offer

followed by the exercise of the limited call right

Most precedents have included a negotiation with

Conflicts Committee to solicit board support

Shorter statutory timetable absent process delays

No back-end unitholder vote required if the limited

call threshold (80%) is reached. Note that the

tender basically acts like a unitholder vote and

approval of the transaction

■ Possibility of a failed tender offer if premium is not

accepted by market

Limited market precedent

all

Fuller moon means more benefit to the processView entire presentation