J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

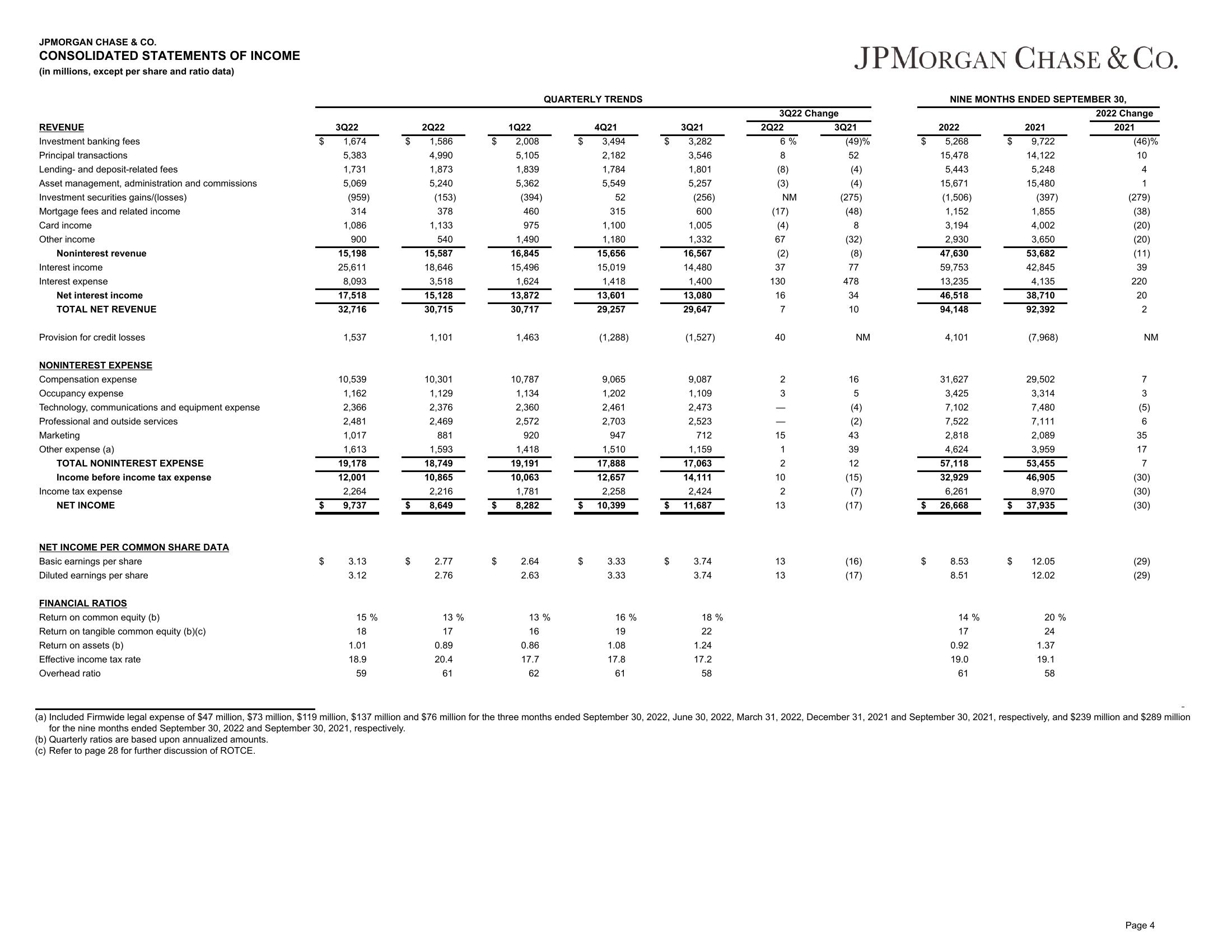

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share and ratio data)

REVENUE

Investment banking fees

Principal transactions

Lending- and deposit-related fees

Asset management, administration and commissions

Investment securities gains/(losses)

Mortgage fees and related income

Card income

Other income

Noninterest revenue

Interest income

Interest expense

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Occupancy expense

Technology, communications and equipment expense

Professional and outside services

Marketing

Other expense (a)

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

NET INCOME PER COMMON SHARE DATA

Basic earnings per share

Diluted earnings per share

FINANCIAL RATIOS

Return on common equity (b)

Return on tangible common equity (b)(c)

Return on assets (b)

Effective income tax rate

Overhead ratio

$

$

3Q22

1,674

5,383

1,731

5,069

(959)

314

1,086

900

15,198

25,611

8,093

17,518

32,716

1,537

10,539

1,162

2,366

2,481

1,017

1,613

19,178

12,001

2,264

9,737

3.13

3.12

15 %

18

1.01

18.9

59

$

$

$

2Q22

1,586

4,990

1,873

5,240

(153)

378

1,133

540

15,587

18,646

3,518

15,128

30,715

1,101

10,301

1,129

2,376

2,469

881

1,593

18,749

10,865

2,216

8,649

2.77

2.76

13%

17

0.89

20.4

61

$

$

$

1Q22

2,008

5,105

1,839

5,362

(394)

460

975

1,490

16,845

15,496

1,624

13,872

30,717

1,463

10,787

1,134

2,360

2,572

920

1,418

19,191

10,063

1,781

8,282

2.64

2.63

QUARTERLY TRENDS

13 %

16

0.86

17.7

62

$

$

$

4Q21

3,494

2,182

1,784

5,549

52

315

1,100

1,180

15,656

15,019

1,418

13,601

29,257

(1,288)

9,065

1,202

2,461

2,703

947

1,510

17,888

12,657

2,258

10,399

3.33

3.33

16 %

19

1.08

17.8

61

$

$

$

3Q21

3,282

3,546

1,801

5,257

(256)

600

1,005

1,332

16,567

14,480

1,400

13,080

29,647

(1,527)

9,087

1,109

2,473

2,523

712

1,159

17,063

14,111

2,424

11,687

3.74

3.74

18%

22

1.24

17.2

58

3Q22 Change

2Q22

6%

8

(8)

(3)

NM

(17)

(4)

67

(2)

37

130

16

7

40

2

3

15

1

2

10

2

13

13

13

JPMORGAN CHASE & CO.

3Q21

(49)%

52

(4)

(4)

(275)

(48)

8

(32)

(8)

77

478

34

10

NM

16

5

(4)

(2)

43

39

12

(15)

(7)

(17)

(16)

(17)

$

$

$

NINE MONTHS ENDED SEPTEMBER 30,

2022

5,268

15,478

5,443

15,671

(1,506)

1,152

3,194

2,930

47,630

59,753

13,235

46,518

94,148

4,101

31,627

3,425

7,102

7,522

2,818

4,624

57,118

32,929

6,261

26,668

8.53

8.51

14%

17

0.92

19.0

61

2021

$ 9,722

14,122

5,248

15,480

$

$

(397)

1,855

4,002

3,650

53,682

42,845

4,135

38,710

92,392

(7,968)

29,502

3,314

7,480

7,111

2,089

3,959

53,455

46,905

8,970

37,935

12.05

12.02

20%

24

1.37

19.1

58

2022 Change

2021

(46)%

10

4

1

(279)

(38)

(20)

(20)

(11)

39

220

20

2

NM

7

3

(5)

6

35

17

7

(30)

(30)

(30)

(29)

(29)

(a) Included Firmwide legal expense of $47 million, $73 million, $119 million, $137 million and $76 million for the three months ended September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, respectively, and $239 million and $289 million

for the nine months ended September 30, 2022 and September 30, 2021, respectively.

(b) Quarterly ratios are based upon annualized amounts.

(c) Refer to page 28 for further discussion of ROTCE.

Page 4View entire presentation