Granite Ridge Investor Presentation Deck

●

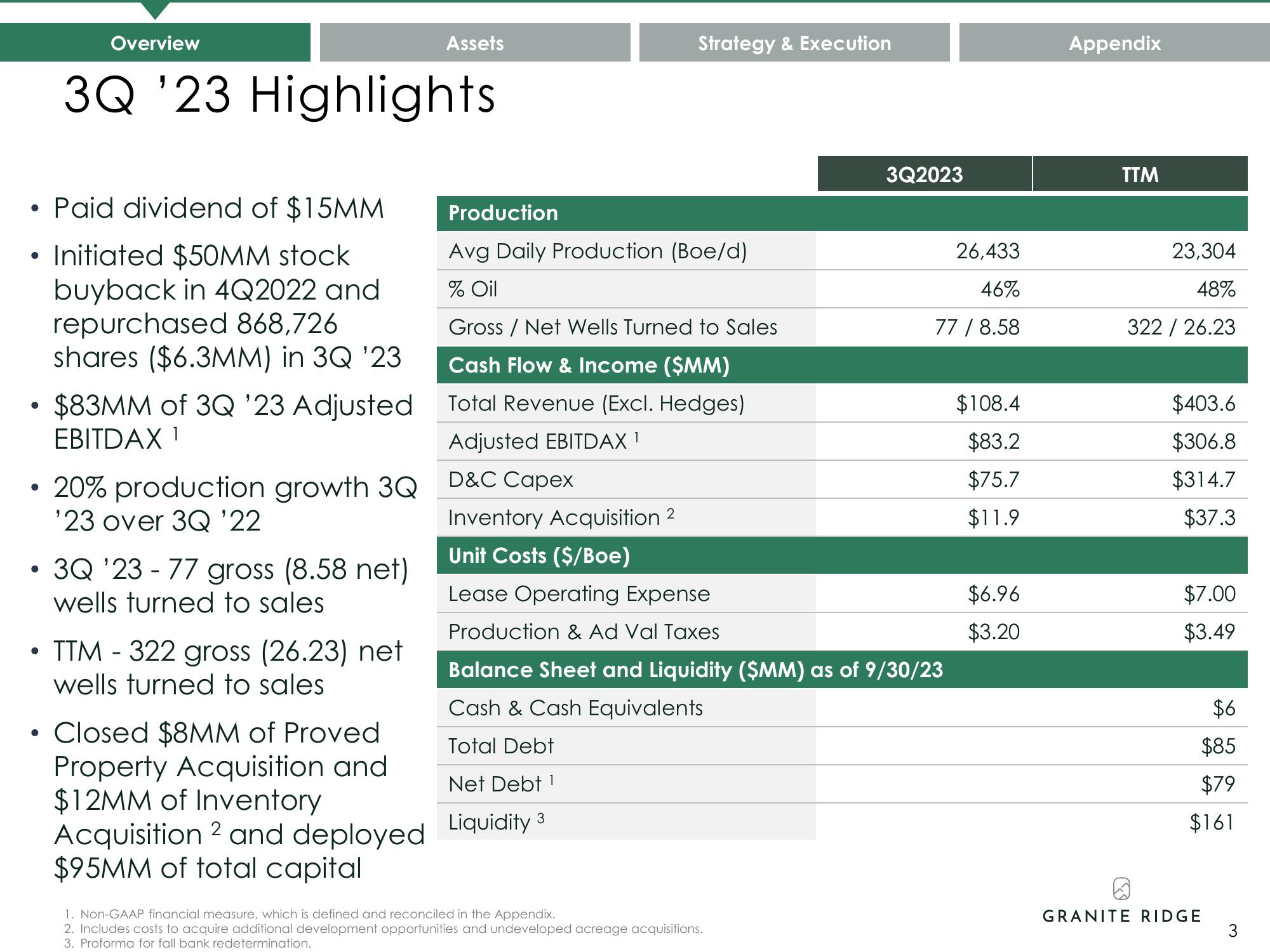

• Paid dividend of $15MM

Initiated $50MM stock

buyback in 4Q2022 and

repurchased 868,726

shares ($6.3MM) in 3Q '23

●

●

●

Overview

●

3Q '23 Highlights

$83MM of 3Q '23 Adjusted

EBITDAX ¹

20% production growth 3Q

'23 over 3Q '22

3Q '23 - 77 gross (8.58 net)

wells turned to sales

• TTM - 322 gross (26.23) net

wells turned to sales

Assets

Closed $8MM of Proved

Property Acquisition and

$12MM of Inventory

Acquisition 2 and deployed

$95MM of total capital

Strategy & Execution

Production

Avg Daily Production (Boe/d)

% Oil

Gross / Net Wells Turned to Sales

Cash Flow & Income ($MM)

Total Revenue (Excl. Hedges)

Adjusted EBITDAX ¹

D&C Capex

3Q2023

1. Non-GAAP financial measure, which is defined and reconciled in the Appendix.

2. Includes costs to acquire additional development opportunities and undeveloped acreage acquisitions.

3. Proforma for fall bank redetermination.

26,433

46%

77 / 8.58

Inventory Acquisition 2

Unit Costs ($/Boe)

Lease Operating Expense

Production & Ad Val Taxes

Balance Sheet and Liquidity ($MM) as of 9/30/23

Cash & Cash Equivalents

Total Debt

Net Debt ¹

Liquidity 3

$108.4

$83.2

$75.7

$11.9

$6.96

$3.20

Appendix

TTM

23,304

48%

322 / 26.23

$403.6

$306.8

$314.7

$37.3

$7.00

$3.49

$6

$85

$79

$161

GRANITE RIDGE

3View entire presentation