Toyota Investor Presentation Deck

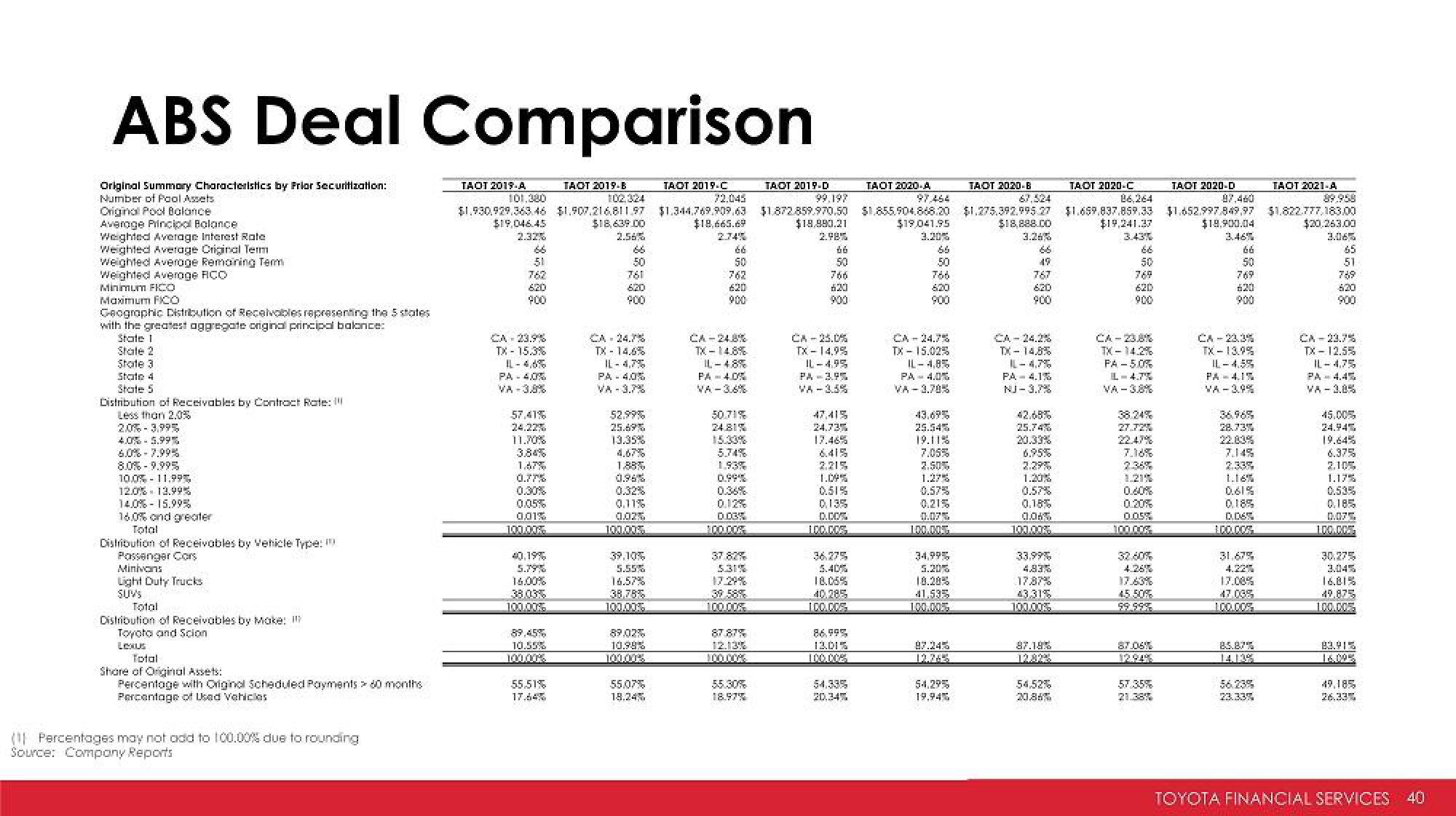

ABS Deal Comparison

TAOT 2019-B

102,324

Original Summary Characteristics by Prior Securitization:

Number of Pool Assets

Original Pool Balance.

Average Principal Balance

Weighted Average Interest Rate

Weighted Average Original Term

Weighted Average Remaining Term

Weighted Average RCC

Minimum FICO

Maximum FICO

Geographic Distribution of Receivables representing the 5 states

with the greatest aggregate original principal balance:

State 1

State 2

State 3

State 4

State 5

Distribution of Receivables by Contract Rate:

Less than 2.0%

20% 3.995

4.0%-5.99%

6.0%-7.995

8.0%-9.99%

10.0% 11,99%

12.0% 13.995

14.0%-15.99%

16.0% and greater

Total

Distribution of Receivables by Vehicle Type:

Passenger Cors

Minivans

Light Duty Trucks

Total

Distribution of Receivables by Make:

Toyoto and Scion

Lexus

Total

Share of Original Assets:

Percentage with Original Scheduled Payments 60 months

Percentage of Used Vehicles

(Percentages may not add to 100.00% due to rounding

Source: Company Reports

TAOT 2019-A

101.380

$1.930,929.363.46 $1,907,216811.97

$19,046.45

$18,639.00

2.32%

2.56%5

66

51

762

620

900

CA 23.9%

TX - 15.3%

IL-4,6%

PA 4.0%

57,41%

24.22%

11.70%

147%

0.775

0.30%

0.05%

0.01%

100.00%

5.79%

16.00%

38.036

100.00%

10.55%

100.00%

55.51%

17.64%

50

761

900

CA 24.7%

TX - 14.6%

IL-4,7%

PA 4.0%

VA 3.7%

52.99%

25.69%

13.35%

0.11%

0.02%

100.00%

39.10%

5.55%

16.57%

38.78%

100.00%

89.02%

10.99%

100.00%

55.07%

18.24%

TAOT 2019-C

72,045

$1.344.769.909.63 $1.872.859.970.50

$18,665.69

$18.990.21

2.74%

2.98%

66

66

50

50

762

766

620

620

900

CA-24.8%

TX-14.8%

IL-48%

PA 4.0%

50.71%

24.81%

15.33%

1.93%

0.99%

0.03%

100.000

37 82%

5.31%

17.29%

39 58%

100.00%

87.87%

12.13%

100.000

TAOT 2019-D

55.30%

18.97%

CA-25.0%

TX- 14.9%

IL-4.9%

PA 3.95

VA-3.5%

47.41%

24.735

17.46%

2.21%

1.09%

0.51%

0.13%

D.CO%

100.00%

36.27%

5.40%

18.05%

40.285

100.00%

86,995

12.015

54,335

20.34

TAOT 2020-A

97,464

$1.855.904.868.20

$19,041.95

66

50

766

620

TX - 15.025

IL-4,8%

PA - 4.05

VA 3.70%

25.545

19.11%

7.05%

2.50%

1.27%

0.57%

0.21%

0.07%

100.00%

34,995

5.20%

18.28%

41.535

12.745

54.29%

TAOT 2020-B

67,524

$1.275.392.995 27

$18,888.00

3.26%

68

49

767

620

900

TX-14.8%

PA 4.1%

NJ-3.7%

25.74%

20.33%

2.29%

1.20%

0.57%

0.18%

0.06%

100.00%

33,99%

4.83%

17.87%

43.31%

100.00%

87.18%

54,52%

20.86%

TAOT 2020-C

B6,264

$1.659.837.859.33 $1.652.997.849.97

$19,241.37

3.43%

66

50

769

620

900

CA-23.8%

TX-14.2%

FA-50%

L-4.75

VA-38%

38.24%

27.72%

22.47%

7.18%

1.21%

0.20%

0.05%

100.00%

32.40%

4.26%

17.63%

45.50%

99.998

TAOT 2020-D

87.460

87.06%

12.94%

57.35%

$18.900.04

3.46%

66

50

769

620

900

CA-23.35

TX-13.9%

IL-4.5%

PA 4.1%

VA-3.9%

28.73%

1.16%

0.61%

0.18%

0.06%

100.00%

31.67%

17.00%

47.08%

100.00%

85.87%

14.13%

56.23%

23.33%

TAOT 2021-A

89.958

$1.822.777,183.00

$20.263.00

3.06

51

769

620

900

CA 23.7%

TX-12.5%

IL-4.75

PA 4.45

VA-3.8%

45.00%

24.945

19.64%

6.37%

2.105

1.17%

0.52%

0.185

0.075

100.00%

30.275

3.04%

16.81%

49.875

100.00%

83.915

16.095

49.185

26.33

TOYOTA FINANCIAL SERVICES 40View entire presentation