Pathward Financial Results Presentation Deck

STRONG REVENUE GROWTH AND DISCIPLINED

EXPENSE MANAGEMENT DRIVE PROFITABILITY

FIRST QUARTER ENDED DECEMBER 31, 2020

4

●

●

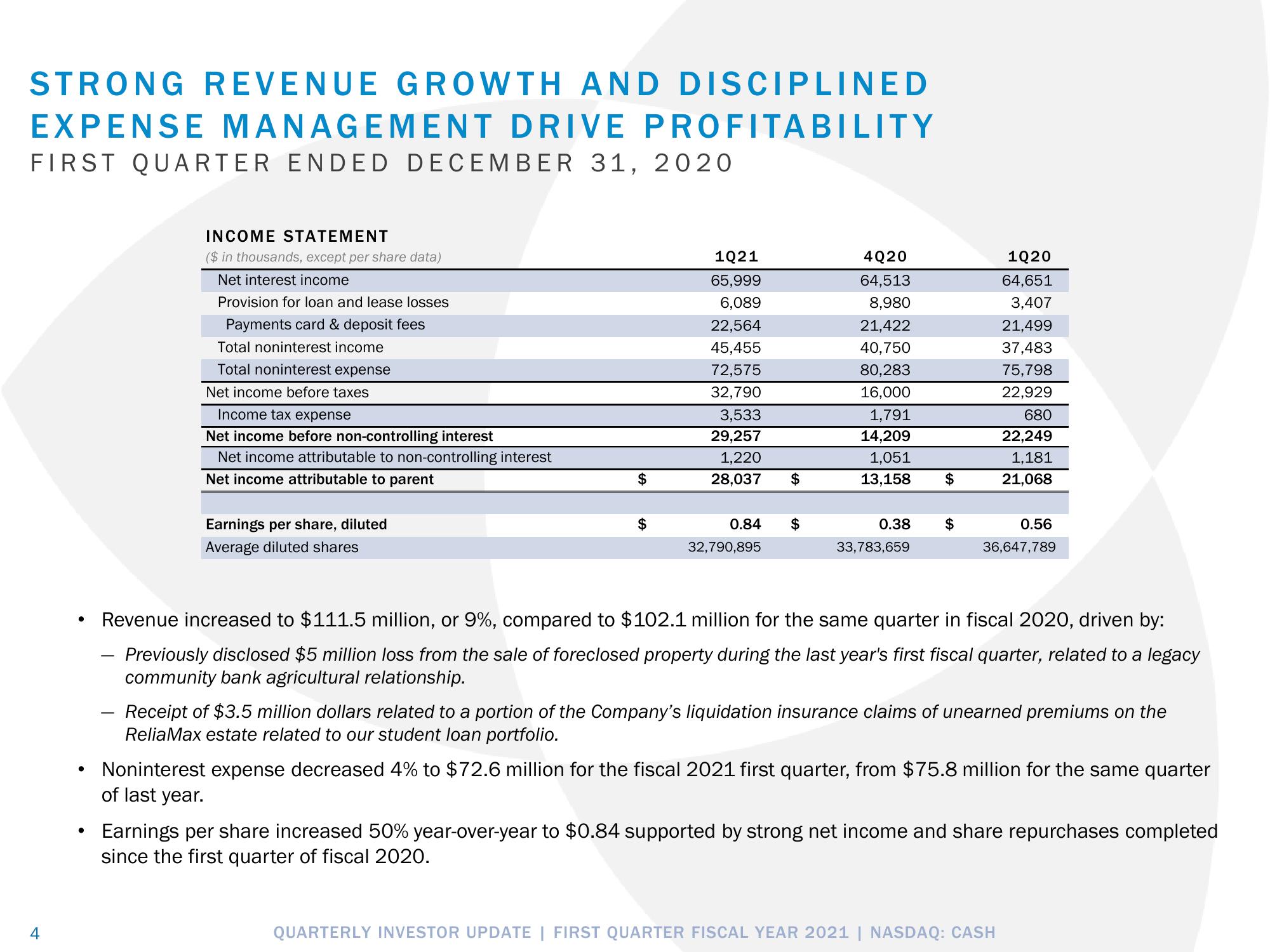

INCOME STATEMENT

($ in thousands, except per share data)

Net interest income

Provision for loan and lease losses

Payments card & deposit fees

Total noninterest income

Total noninterest expense

Net income before taxes

Income tax expense

Net income before non-controlling interest

Net income attributable to non-controlling interest

Net income attributable to parent

Earnings per share, diluted

Average diluted shares

$

$

1021

65,999

6,089

22,564

45,455

72,575

32,790

3,533

29,257

1,220

28,037

0.84

32,790,895

$

$

4Q20

64,513

8,980

21,422

40,750

80,283

16,000

1,791

14,209

1,051

13,158 $

0.38 $

33,783,659

1Q20

64,651

3,407

21,499

37,483

75,798

22,929

680

22,249

1,181

21,068

0.56

36,647,789

Revenue increased to $111.5 million, or 9%, compared to $102.1 million for the same quarter in fiscal 2020, driven by:

Previously disclosed $5 million loss from the sale of foreclosed property during the last year's first fiscal quarter, related to a legacy

community bank agricultural relationship.

Receipt of $3.5 million dollars related to a portion of the Company's liquidation insurance claims of unearned premiums on the

Relia Max estate related to our student loan portfolio.

Noninterest expense decreased 4% to $72.6 million for the fiscal 2021 first quarter, from $75.8 million for the same quarter

of last year.

Earnings per share increased 50% year-over-year to $0.84 supported by strong net income and share repurchases completed

since the first quarter of fiscal 2020.

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation