Sonos Results Presentation Deck

Q3 revenue, constant currency growth, and stable profitability

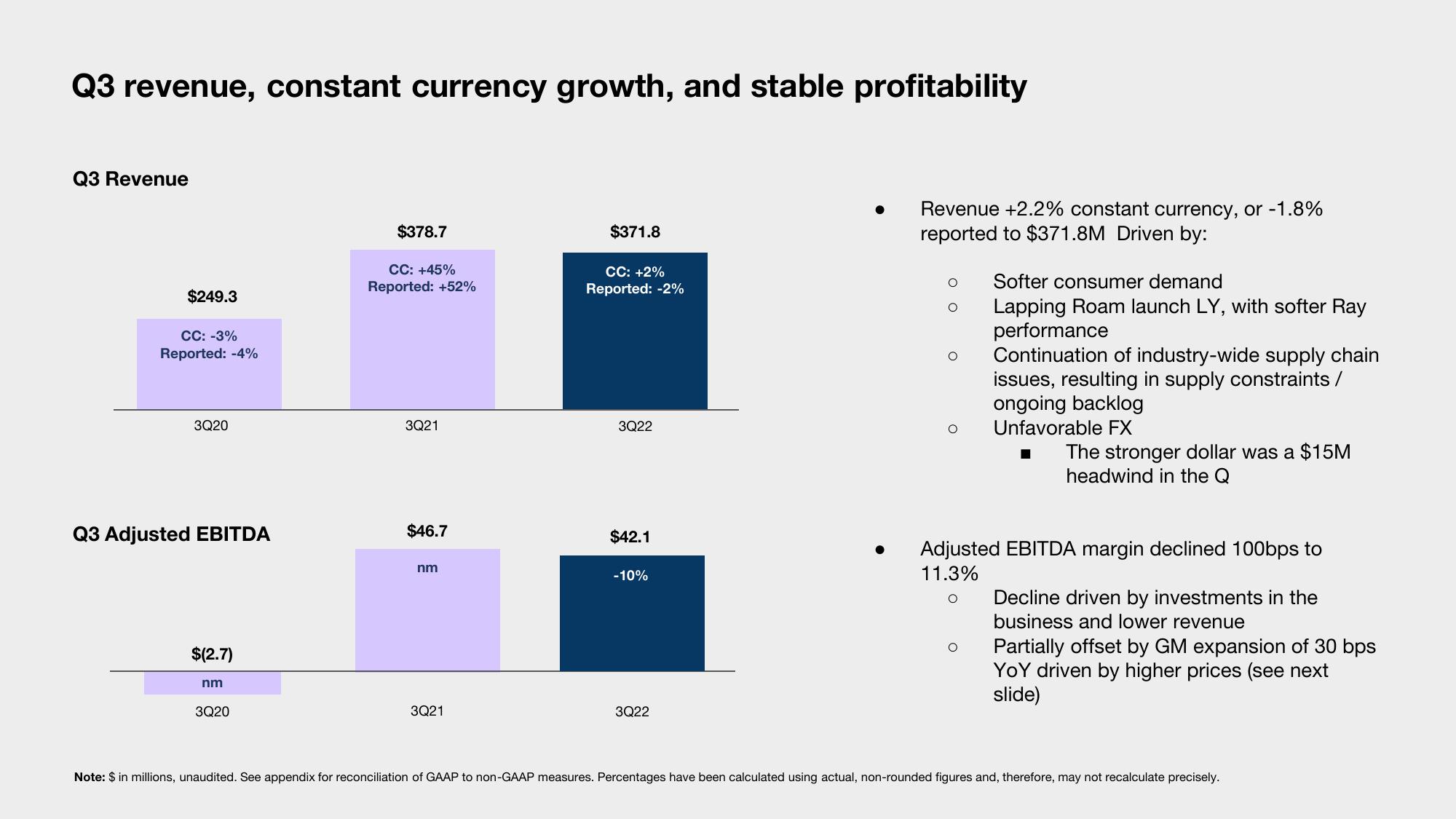

Q3 Revenue

$249.3

CC: -3%

Reported: -4%

3Q20

Q3 Adjusted EBITDA

$(2.7)

nm

3Q20

$378.7

CC: +45%

Reported: +52%

3Q21

$46.7

nm

3Q21

$371.8

CC: +2%

Reported: -2%

3Q22

$42.1

-10%

3Q22

Revenue +2.2% constant currency, or -1.8%

reported to $371.8M Driven by:

O

O

Softer consumer demand

Lapping Roam launch LY, with softer Ray

performance

Continuation of industry-wide supply chain

issues, resulting in supply constraints /

ongoing backlog

Unfavorable FX

The stronger dollar was a $15M

headwind in the Q

Adjusted EBITDA margin declined 100bps to

11.3%

Decline driven by investments in the

business and lower revenue

Partially offset by GM expansion of 30 bps

YoY driven by higher prices (see next

slide)

Note: $ in millions, unaudited. See appendix for reconciliation of GAAP to non-GAAP measures. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.View entire presentation