Q2 Quarter 2023

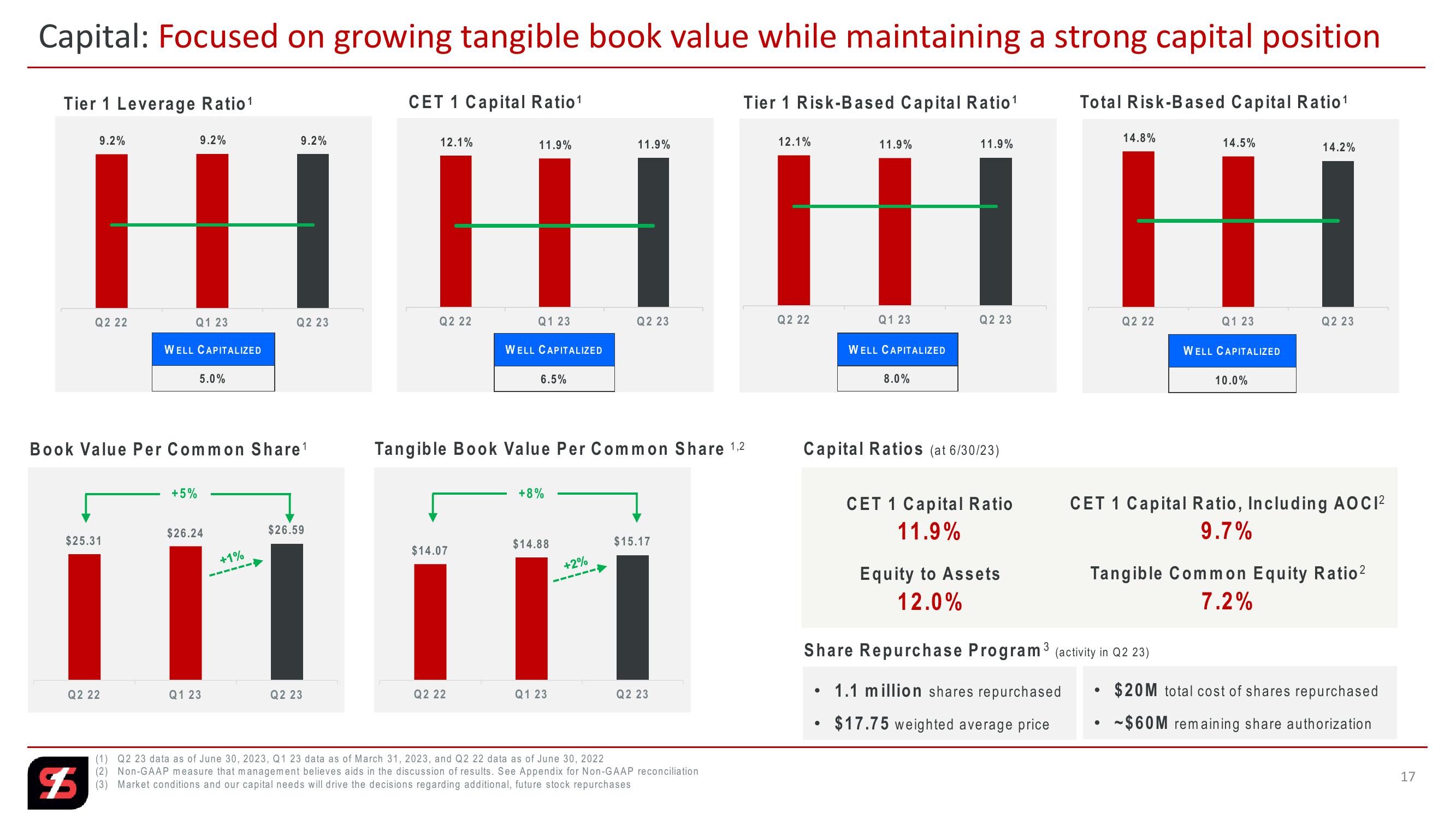

Capital: Focused on growing tangible book value while maintaining a strong capital position

Tier 1 Leverage Ratio¹

CET 1 Capital Ratio¹

Tier 1 Risk-Based Capital Ratio 1

Total Risk-Based Capital Ratio¹

9.2%

9.2%

9.2%

12.1%

11.9%

11.9%

12.1%

11.9%

11.9%

14.8%

14.5%

14.2%

HI HI

H

HI

Q2 22

Q1 23

Q2 23

Q2 22

WELL CAPITALIZED

5.0%

Q1 23

Q2 23

Q2 22

WELL CAPITALIZED

6.5%

Q1 23

Q2 23

Q2 22

Q1 23

Q2 23

WELL CAPITALIZED

WELL CAPITALIZED

8.0%

10.0%

Book Value Per Common Share1

Tangible Book Value Per Common Share 1,2

Capital Ratios (at 6/30/23)

$25.31

+5%

$26.24

+8%

$26.59

+1%

$14.07

$14.88

$15.17

+2%

Q2 22

Q1 23

Q2 23

Q2 22

Q1 23

Q2 23

$5

(1) Q2 23 data as of June 30, 2023, Q1 23 data as of March 31, 2023, and Q2 22 data as of June 30, 2022

(2) Non-GAAP measure that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation

(3) Market conditions and our capital needs will drive the decisions regarding additional, future stock repurchases

CET 1 Capital Ratio

11.9%

Equity to Assets

12.0%

3

CET 1 Capital Ratio, Including AOCI²

9.7%

Tangible Common Equity Ratio²

7.2%

Share Repurchase Program ³ (activity in Q2 23)

1.1 million shares repurchased

•

$20M total cost of shares repurchased

• $17.75 weighted average price

$60M remaining share authorization

17View entire presentation