WCG IPO Presentation Deck

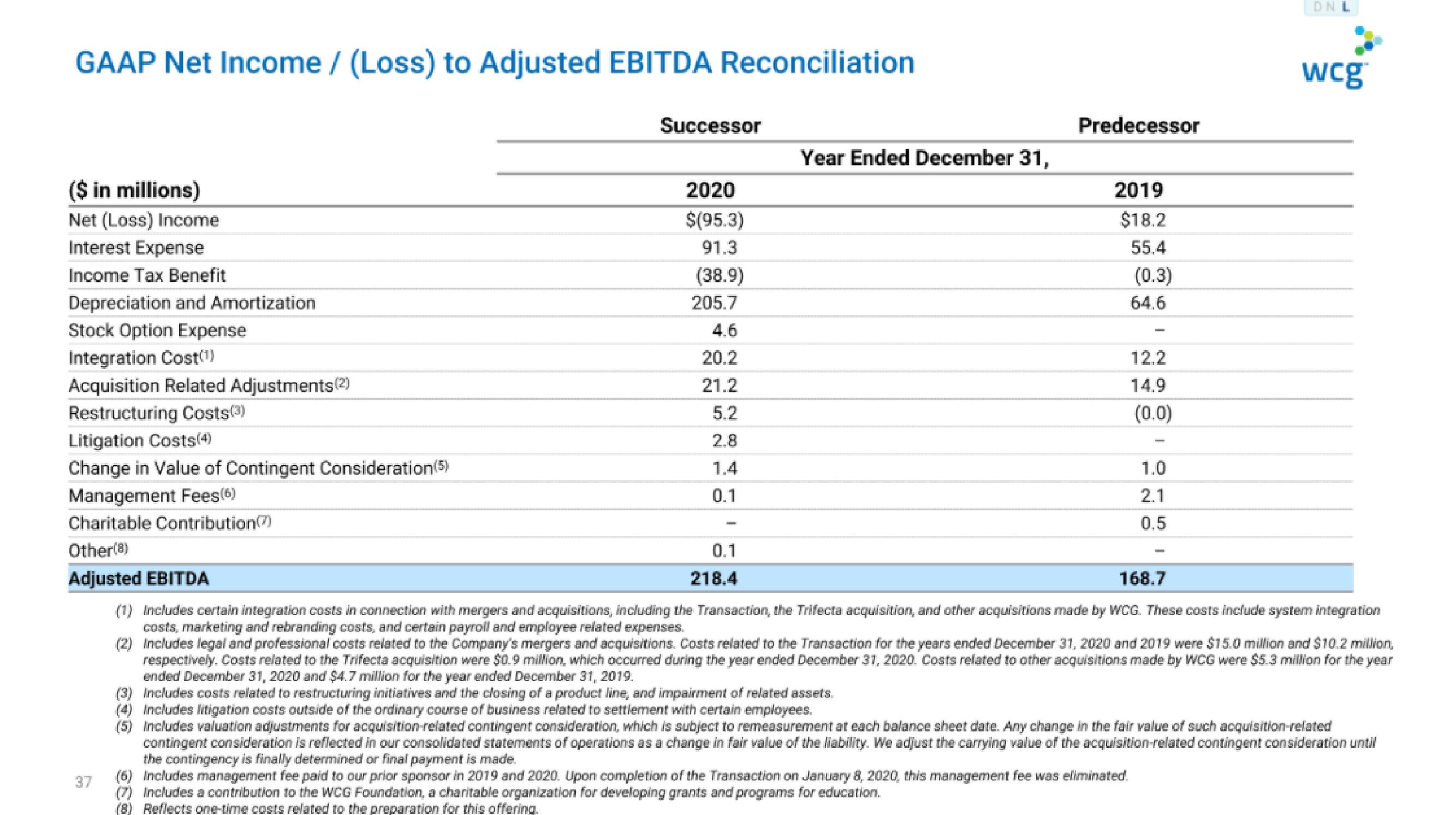

GAAP Net Income / (Loss) to Adjusted EBITDA Reconciliation

($ in millions)

Net (Loss) Income

Interest Expense

Income Tax Benefit

Depreciation and Amortization

Stock Option Expense

Integration Cost(¹)

Acquisition Related Adjustments (2)

Restructuring Costs(3)

Litigation Costs(4)

Change in Value of Contingent Consideration (5)

Management Fees(6)

Charitable Contribution()

Other(8)

Adjusted EBITDA

37

Successor

2020

$(95.3)

91.3

(38.9)

205.7

4.6

20.2

21.2

5.2

2.8

1.4

0.1

0.1

218.4

Year Ended December 31,

Predecessor

2019

$18.2

55.4

(0.3)

64.6

12.2

14.9

(0.0)

1.0

2.1

0.5

(6) Includes management fee paid to our prior sponsor in 2019 and 2020. Upon completion of the Transaction on January 8, 2020, this management fee was eliminated.

(7) Includes a contribution to the WCG Foundation, a charitable organization for developing grants and programs for education.

(8) Reflects one-time costs related to the preparation for this offering.

DN L

wcg

168.7

(1) Includes certain integration costs in connection with mergers and acquisitions, including the Transaction, the Trifecta acquisition, and other acquisitions made by WCG. These costs include system integration

costs, marketing and rebranding costs, and certain payroll and employee related expenses.

(2) Includes legal and professional costs related to the Company's mergers and acquisitions. Costs related to the Transaction for the years ended December 31, 2020 and 2019 were $15.0 million and $10.2 million,

respectively. Costs related to the Trifecta acquisition were $0.9 million, which occurred during the year ended December 31, 2020. Costs related to other acquisitions made by WCG were $5.3 million for the year

ended December 31, 2020 and $4.7 million for the year ended December 31, 2019.

(3) Includes costs related to restructuring initiatives and the closing of a product line, and impairment of related assets.

(4) Includes litigation costs outside of the ordinary course of business related to settlement with certain employees.

(5) Includes valuation adjustments for acquisition-related contingent consideration, which is subject to remeasurement at each balance sheet date. Any change in the fair value of such acquisition-related

contingent consideration is reflected in our consolidated statements of operations as a change in fair value of the liability. We adjust the carrying value of the acquisition-related contingent consideration until

the contingency is finally determined or final payment is made.View entire presentation