Comcast Results Presentation Deck

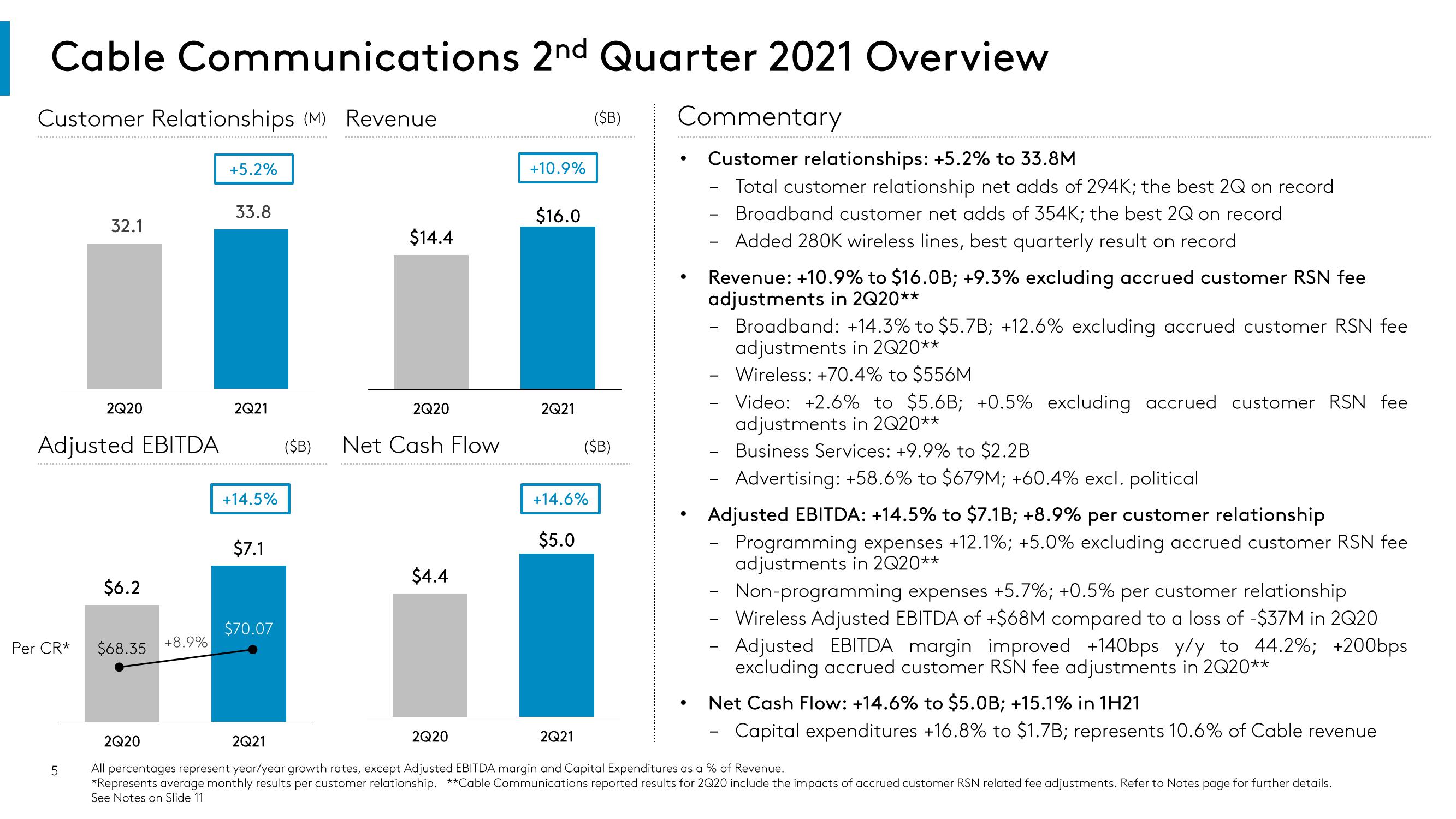

Cable Communications 2nd Quarter 2021 Overview

Customer Relationships (M) Revenue

Per CR*

32.1

Adjusted EBITDA

5

2Q20

$6.2

$68.35

+8.9%

2Q20

+5.2%

33.8

2Q21

+14.5%

$7.1

$70.07

$14.4

2Q20

($B) Net Cash Flow

$4.4

+10.9%

$16.0

2Q21

+14.6%

$5.0

($B)

($B)

2Q21

Commentary

Customer relationships: +5.2% to 33.8M

Total customer relationship net adds of 294K; the best 2Q on record

Broadband customer net adds of 354K; the best 2Q on record

Added 280K wireless lines, best quarterly result on record

●

Revenue: +10.9% to $16.0B; +9.3% excluding accrued customer RSN fee

adjustments in 2Q20**

Broadband: +14.3% to $5.7B; +12.6% excluding accrued customer RSN fee

adjustments in 2Q20**

Wireless: +70.4% to $556M

Video: +2.6% to $5.6B; +0.5% excluding accrued customer RSN fee

adjustments in 2Q20**

Business Services: +9.9% to $2.2B

Advertising: +58.6% to $679M; +60.4% excl. political

Adjusted EBITDA: +14.5% to $7.1B; +8.9% per customer relationship

Programming expenses +12.1%; +5.0% excluding accrued customer RSN fee

adjustments in 2Q20**

Non-programming expenses +5.7%; +0.5% per customer relationship

Wireless Adjusted EBITDA of +$68M compared to a loss of -$37M in 2Q20

Adjusted EBITDA margin improved +140bps y/y to 44.2%; +200bps

excluding accrued customer RSN fee adjustments in 2Q20**

2Q20

2Q21

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

*Represents average monthly results per customer relationship. **Cable Communications reported results for 2Q20 include the impacts of accrued customer RSN related fee adjustments. Refer to Notes page for further details.

See Notes on Slide 11

Net Cash Flow: +14.6% to $5.0B; +15.1% in 1H21

Capital expenditures +16.8% to $1.7B; represents 10.6% of Cable revenueView entire presentation