Main Street Capital Fixed Income Presentation Deck

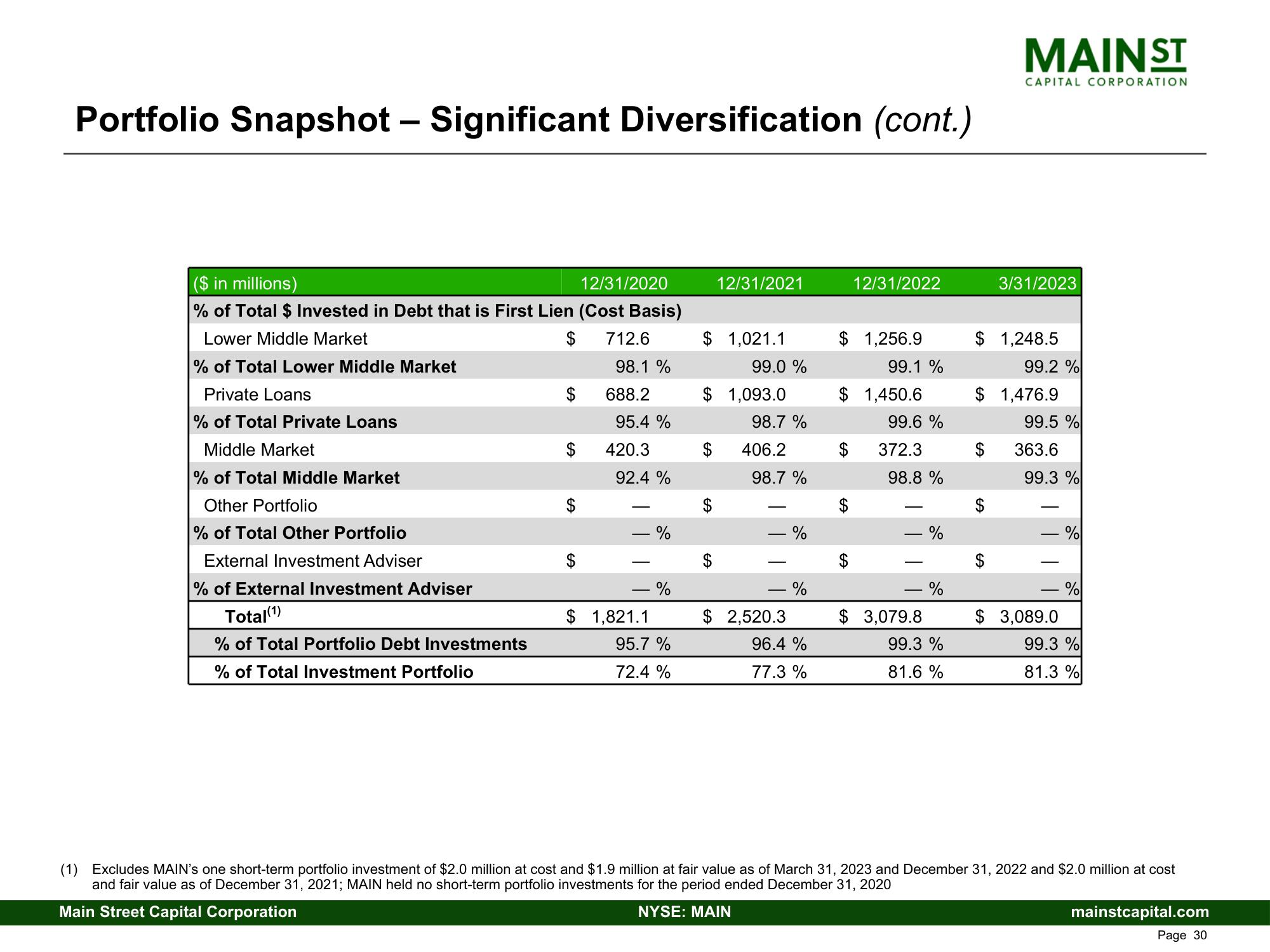

Portfolio Snapshot - Significant Diversification (cont.)

($ in millions)

12/31/2020

% of Total $ Invested in Debt that is First Lien (Cost Basis)

Lower Middle Market

% of Total Lower Middle Market

Private Loans

% of Total Private Loans

Middle Market

% of Total Middle Market

Other Portfolio

% of Total Other Portfolio

External Investment Adviser

% of External Investment Adviser

Total(1)

% of Total Portfolio Debt Investments

% of Total Investment Portfolio

$ 712.6

$

98.1 %

688.2

95.4 %

420.3

92.4 %

- %

$ 1,821.1

%

95.7 %

72.4 %

$ 1,021.1

12/31/2021

EA

$ 1,093.0

GA

99.0 %

98.7 %

406.2

98.7 %

- %

- %

$ 2,520.3

96.4 %

77.3 %

$1,256.9

SA

12/31/2022

$ 1,450.6

SA

$

99.1 %

99.6 %

372.3

98.8 %

$3,079.8

%

%

99.3 %

81.6 %

MAIN ST

CAPITAL CORPORATION

$ 1,248.5

$

3/31/2023

A

$ 1,476.9

99.2 %

99.5 %

363.6

99.3 %

- %

1

$ 3,089.0

%

99.3 %

81.3%

(1) Excludes MAIN's one short-term portfolio investment of $2.0 million at cost and $1.9 million at fair value as of March 31, 2023 and December 31, 2022 and $2.0 million at cost

and fair value as of December 31, 2021; MAIN held no short-term portfolio investments for the period ended December 31, 2020

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 30View entire presentation