dLocal Results Presentation Deck

Adjusted

Net

Income

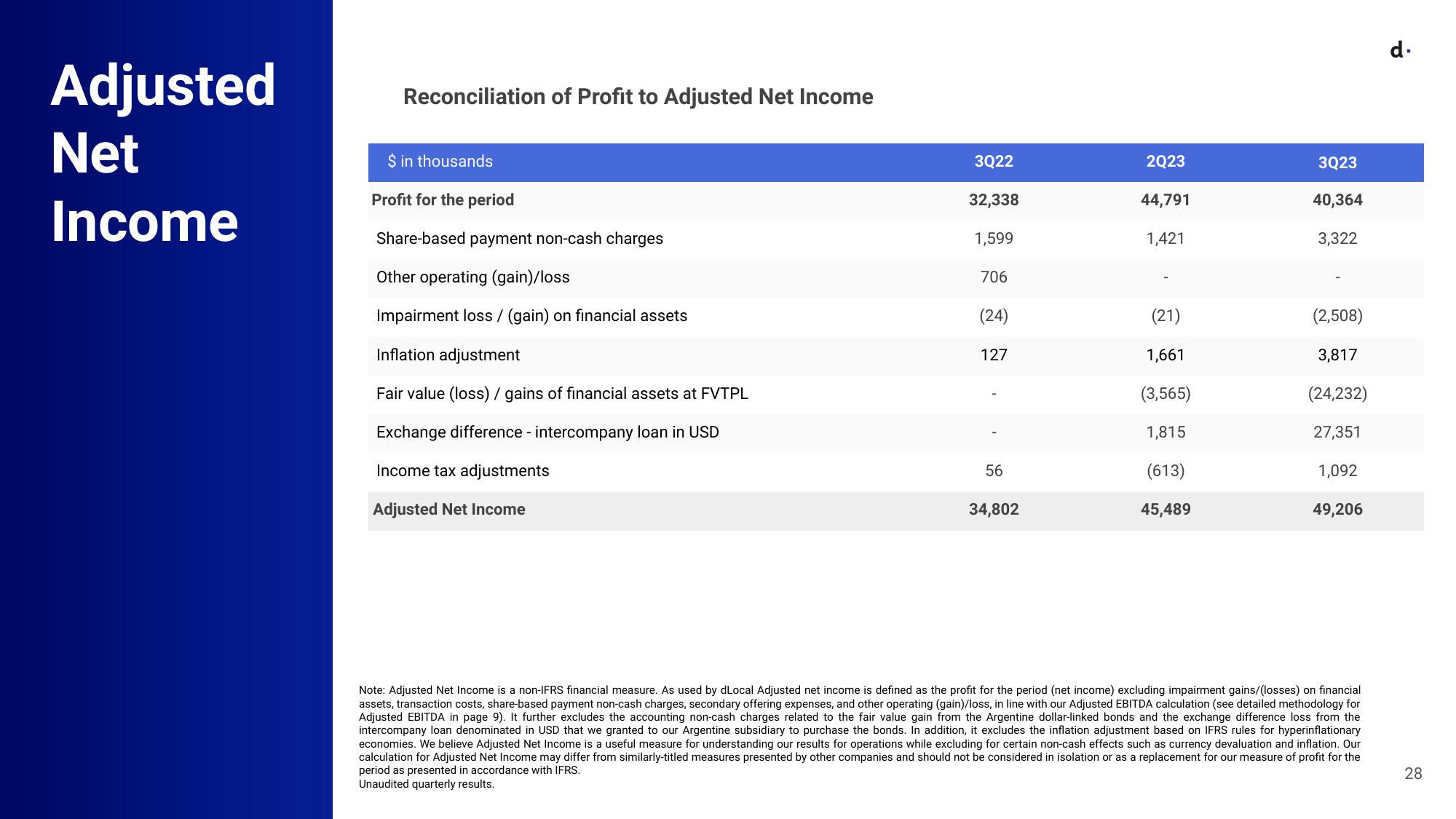

Reconciliation of Profit to Adjusted Net Income

$ in thousands

Profit for the period

Share-based payment non-cash charges

Other operating (gain)/loss

Impairment loss / (gain) on financial assets

Inflation adjustment

Fair value (loss) / gains of financial assets at FVTPL

Exchange difference - intercompany loan in USD

Income tax adjustments

Adjusted Net Income

3Q22

32,338

1,599

706

(24)

127

56

34,802

2Q23

44,791

1,421

(21)

1,661

(3,565)

1,815

(613)

45,489

3Q23

40,364

3,322

(2,508)

3,817

(24,232)

27,351

1,092

49,206

Note: Adjusted Net Income is a non-IFRS financial measure. As used by dLocal Adjusted net income is defined as the profit for the period (net income) excluding impairment gains/(losses) on financial

assets, transaction costs, share-based payment non-cash charges, secondary offering expenses, and other operating (gain)/loss, in line with our Adjusted EBITDA calculation (see detailed methodology for

Adjusted EBITDA in page 9). It further excludes the accounting non-cash charges related to the fair value gain from the Argentine dollar-linked bonds and the exchange difference loss from the

intercompany loan denominated in USD that we granted to our Argentine subsidiary to purchase the bonds. In addition, it excludes the inflation adjustment based on IFRS rules for hyperinflationary

economies. We believe Adjusted Net Income is a useful measure for understanding our results for operations while excluding for certain non-cash effects such as currency devaluation and inflation. Our

calculation for Adjusted Net Income may differ from similarly-titled measures presented by other companies and should not be considered in isolation or as a replacement for our measure of profit for the

period as presented in accordance with IFRS.

Unaudited quarterly results.

d.

28View entire presentation