Cyxtera SPAC Presentation Deck

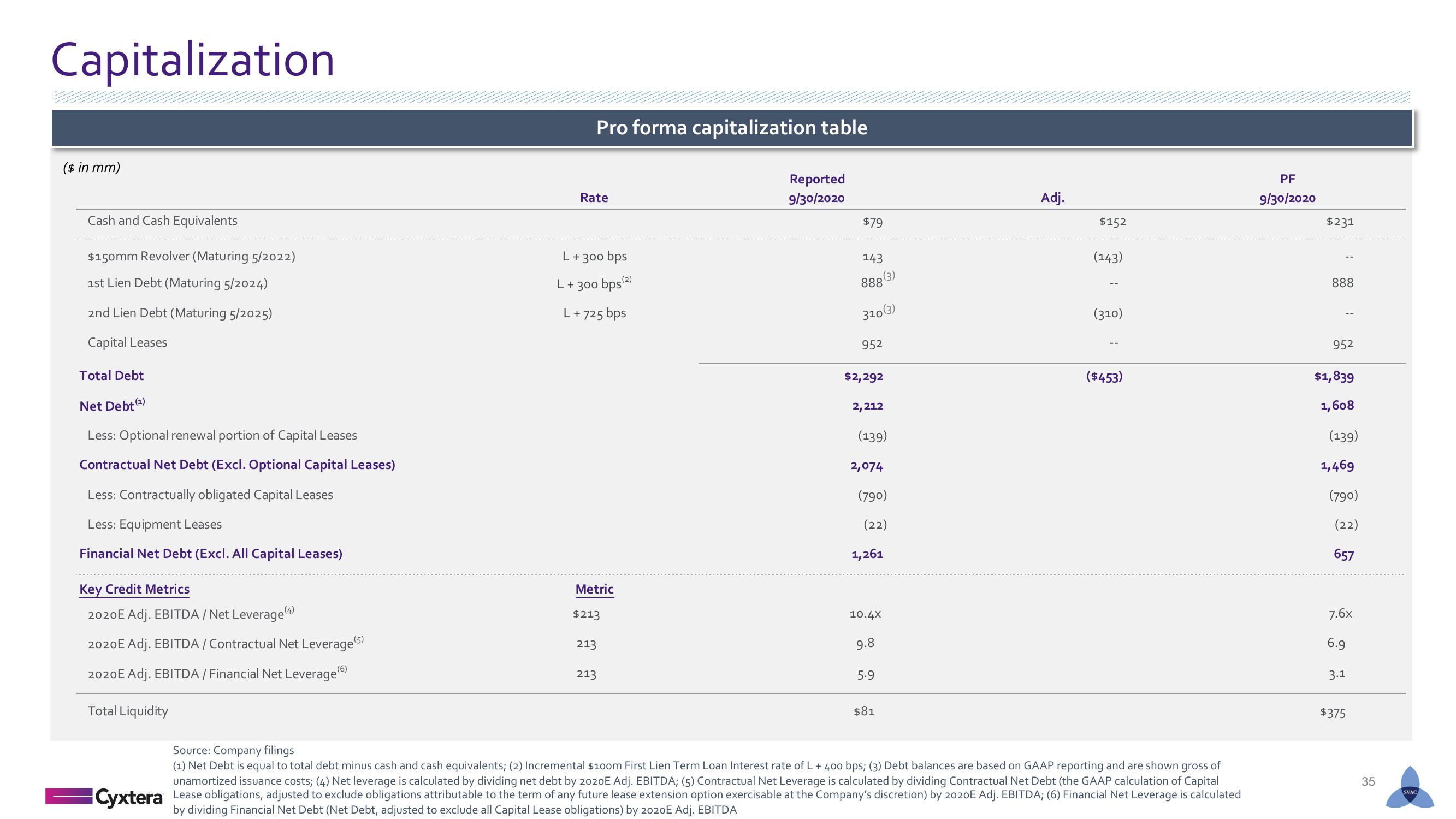

Capitalization

($ in mm)

Cash and Cash Equivalents

$150mm Revolver (Maturing 5/2022)

1st Lien Debt (Maturing 5/2024)

2nd Lien Debt (Maturing 5/2025)

Capital Leases

Total Debt

Net Debt (¹)

Less: Optional renewal portion of Capital Leases

Contractual Net Debt (Excl. Optional Capital Leases)

Less: Contractually obligated Capital Leases

Less: Equipment Leases

Financial Net Debt (Excl. All Capital Leases)

Key Credit Metrics

2020E Adj. EBITDA / Net Leverage (4)

2020E Adj. EBITDA/ Contractual Net Leverage (5)

2020E Adj. EBITDA / Financial Net Leverage (6)

Total Liquidity

Pro forma capitalization table

Rate

L + 300 bps

L + 300 bps(2)

L + 725 bps

Metric

$213

213

213

Reported

9/30/2020

$79

143

888

310 (3)

952

$2,292

2,212

(139)

2,074

(3)

(790)

(22)

1,261

10.4x

9.8

5.9

$81

Adj.

$152

(143)

(310)

($453)

Source: Company filings

(1) Net Debt is equal to total debt minus cash and cash equivalents; (2) Incremental $100m First Lien Term Loan Interest rate of L + 400 bps; (3) Debt balances are based on GAAP reporting and are shown gross of

unamortized issuance costs; (4) Net leverage is calculated by dividing net debt by 2020E Adj. EBITDA; (5) Contractual Net Leverage is calculated by dividing Contractual Net Debt (the GAAP calculation of Capital

Cyxtera Lease obligations, adjusted to exclude obligations attributable to the term of any future lease extension option exercisable at the Company's discretion) by 2020E Adj. EBITDA; (6) Financial Net Leverage is calculated

by dividing Financial Net Debt (Net Debt, adjusted to exclude all Capital Lease obligations) by 2020E Adj. EBITDA

PF

9/30/2020

$231

888

952

$1,839

1,608

(139)

1,469

(790)

(22)

657

7.6x

6.9

3.1

$375

35

SVACView entire presentation