Kinnevik Results Presentation Deck

Intro

Net Asset Value

SOFTWARE

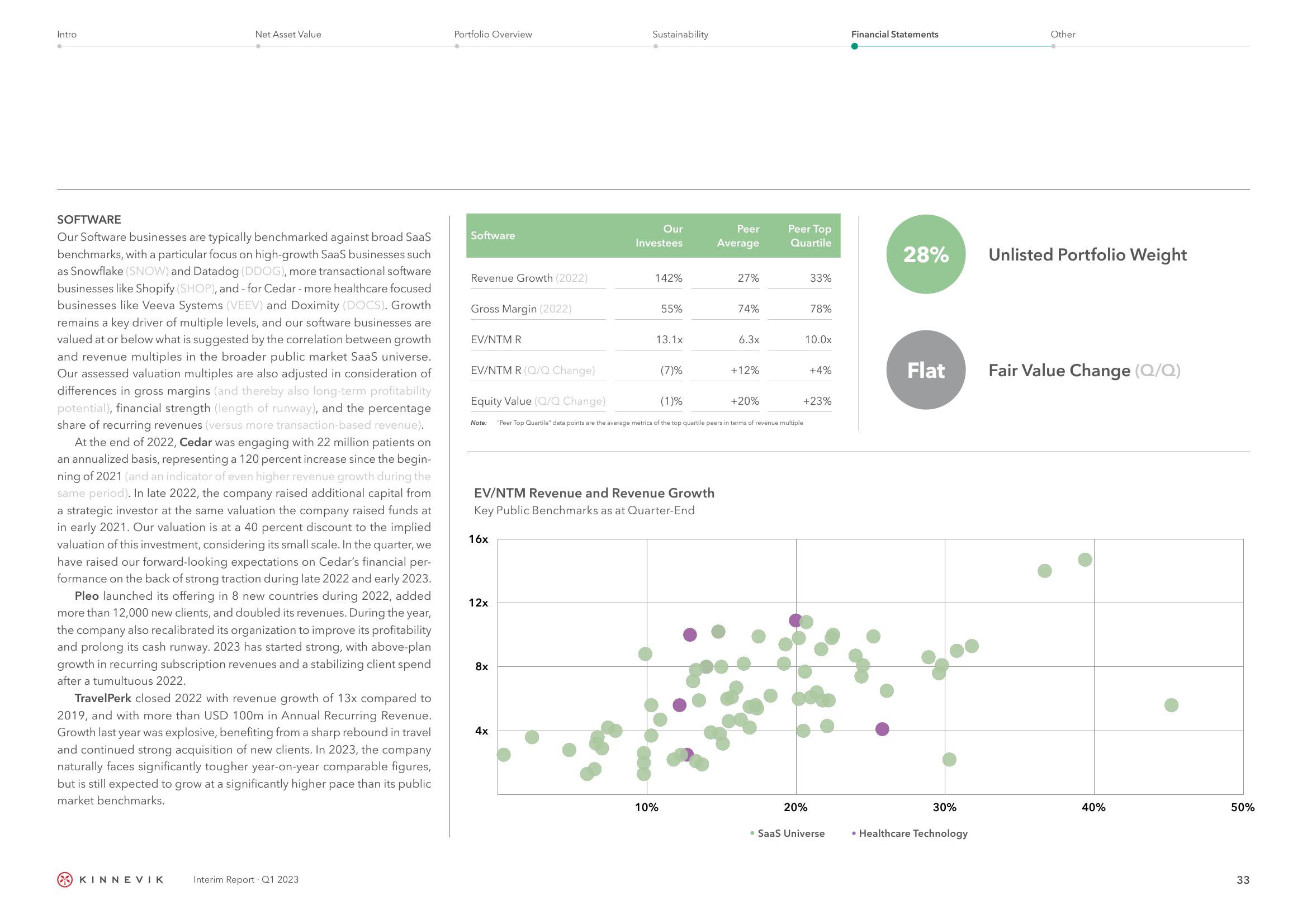

Our Software businesses are typically benchmarked against broad SaaS

benchmarks, with a particular focus on high-growth SaaS businesses such

as Snowflake (SNOW) and Datadog (DDOG), more transactional software

businesses like Shopify (SHOP), and - for Cedar - more healthcare focused

businesses like Veeva Systems (VEEV) and Doximity (DOCS). Growth

remains a key driver of multiple levels, and our software businesses are

valued at or below what is suggested by the correlation between growth

and revenue multiples in the broader public market SaaS universe.

Our assessed valuation multiples are also adjusted in consideration of

differences in gross margins (and thereby also long-term profitability

potential), financial strength (length of runway), and the percentage

share of recurring revenues (versus more transaction-based revenue).

At the end of 2022, Cedar was engaging with 22 million patients on

an annualized basis, representing a 120 percent increase since the begin-

ning of 2021 (and an indicator of even higher revenue growth during the

same period). In late 2022, the company raised additional capital from

a strategic investor at the same valuation the company raised funds at

in early 2021. Our valuation is at a 40 percent discount to the implied

valuation of this investment, considering its small scale. In the quarter, we

have raised our forward-looking expectations on Cedar's financial per-

formance on the back of strong traction during late 2022 and early 2023.

Pleo launched its offering in 8 new countries during 2022, added

more than 12,000 new clients, and doubled its revenues. During the year,

the company also recalibrated its organization to improve its profitability

and prolong its cash runway. 2023 has started strong, with above-plan

growth in recurring subscription revenues and a stabilizing client spend

after a tumultuous 2022.

TravelPerk closed 2022 with revenue growth of 13x compared to

2019, and with more than USD 100m in Annual Recurring Revenue.

Growth last year was explosive, benefiting from a sharp rebound in travel

and continued strong acquisition of new clients. In 2023, the company

naturally faces significantly tougher year-on-year comparable figures,

but is still expected to grow at a significantly higher pace than its public

market benchmarks.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Software

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Equity Value (Q/Q Change)

Note:

16x

12x

8x

Sustainability

4x

Our

Investees

142%

55%

13.1x

EV/NTM Revenue and Revenue Growth

Key Public Benchmarks as at Quarter-End

(7)%

10%

(1)%

Peer

Average

27%

74%

6.3x

+12%

+20%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

Peer Top

Quartile

33%

78%

10.0x

20%

+4%

+23%

• SaaS Universe

Financial Statements

28%

Flat

30%

• Healthcare Technology

Other

Unlisted Portfolio Weight

Fair Value Change (Q/Q)

A

40%

50%

33View entire presentation