Carlyle Investor Conference Presentation Deck

Carlyle Presents An Attractive Investment Opportunity

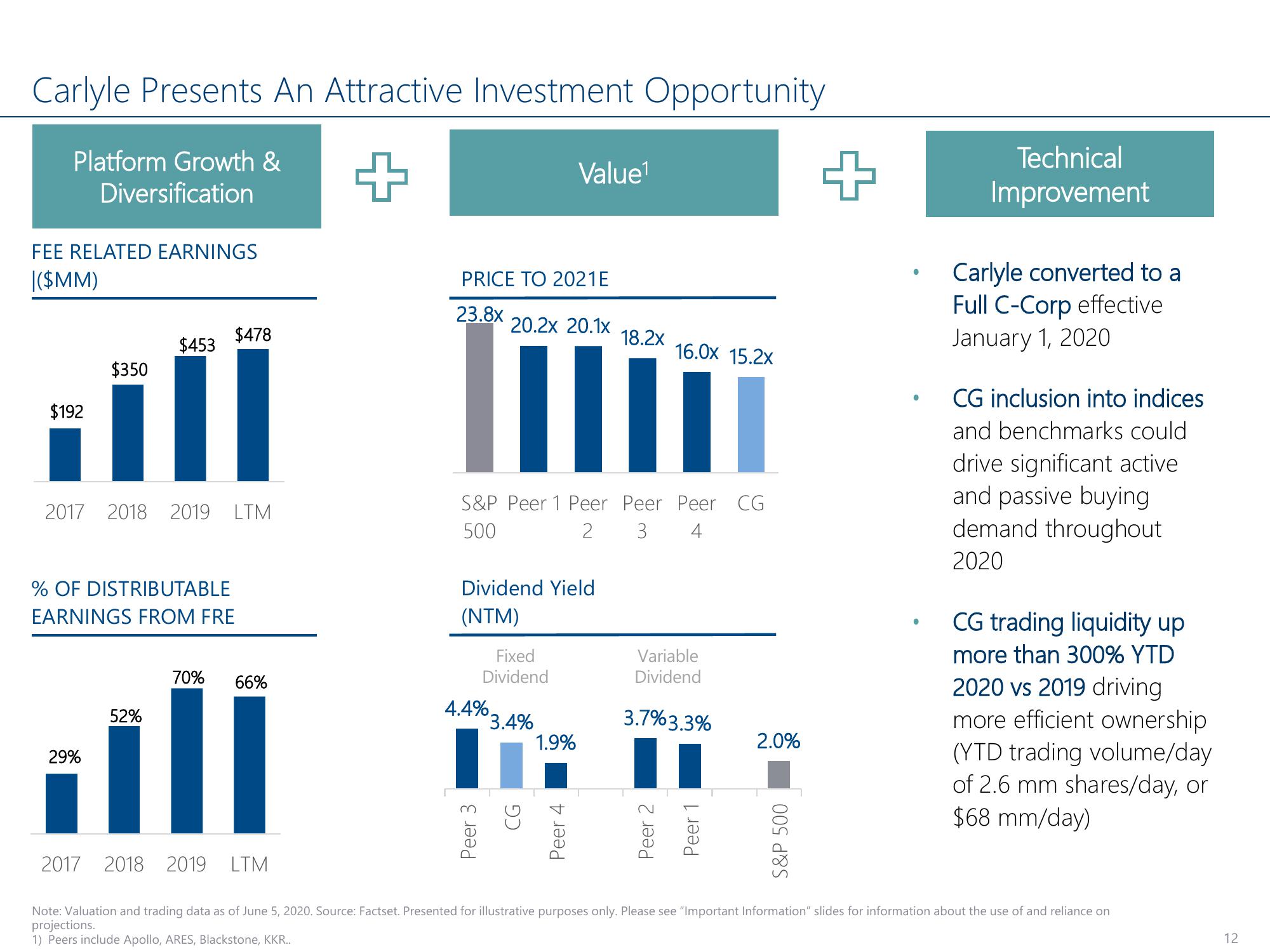

Platform Growth &

Diversification

FEE RELATED EARNINGS

|($MM)

$192

$350

29%

$453

2017 2018 2019 LTM

$478

% OF DISTRIBUTABLE

EARNINGS FROM FRE

52%

70% 66%

2017 2018 2019 LTM

PRICE TO 2021E

23.8x

20.2x 20.1x

S&P Peer 1 Peer

500

2

Dividend Yield

(NTM)

Fixed

Dividend

4.4%.

Value¹

3.4%

1.9%

CG

Peer 3

Peer 4

18.2x

16.0x 15.2x

11

Peer

3 4

Peer CG

Variable

Dividend

3.7%3.3%

Peer 2

Peer 1

2.0%

S&P 500

+

●

●

●

Technical

Improvement

Carlyle converted to a

Full C-Corp effective

January 1, 2020

CG inclusion into indices

and benchmarks could

drive significant active

and passive buying

demand throughout

2020

CG trading liquidity up

more than 300% YTD

2020 vs 2019 driving

more efficient ownership

(YTD trading volume/day

of 2.6 mm shares/day, or

$68 mm/day)

Note: Valuation and trading data as of June 5, 2020. Source: Factset. Presented for illustrative purposes only. Please see "Important Information" slides for information about the use of and reliance on

projections.

1) Peers include Apollo, ARES, Blackstone, KKR..

12View entire presentation