J.P.Morgan Investment Banking Pitch Book

VALUATION SUMMARY

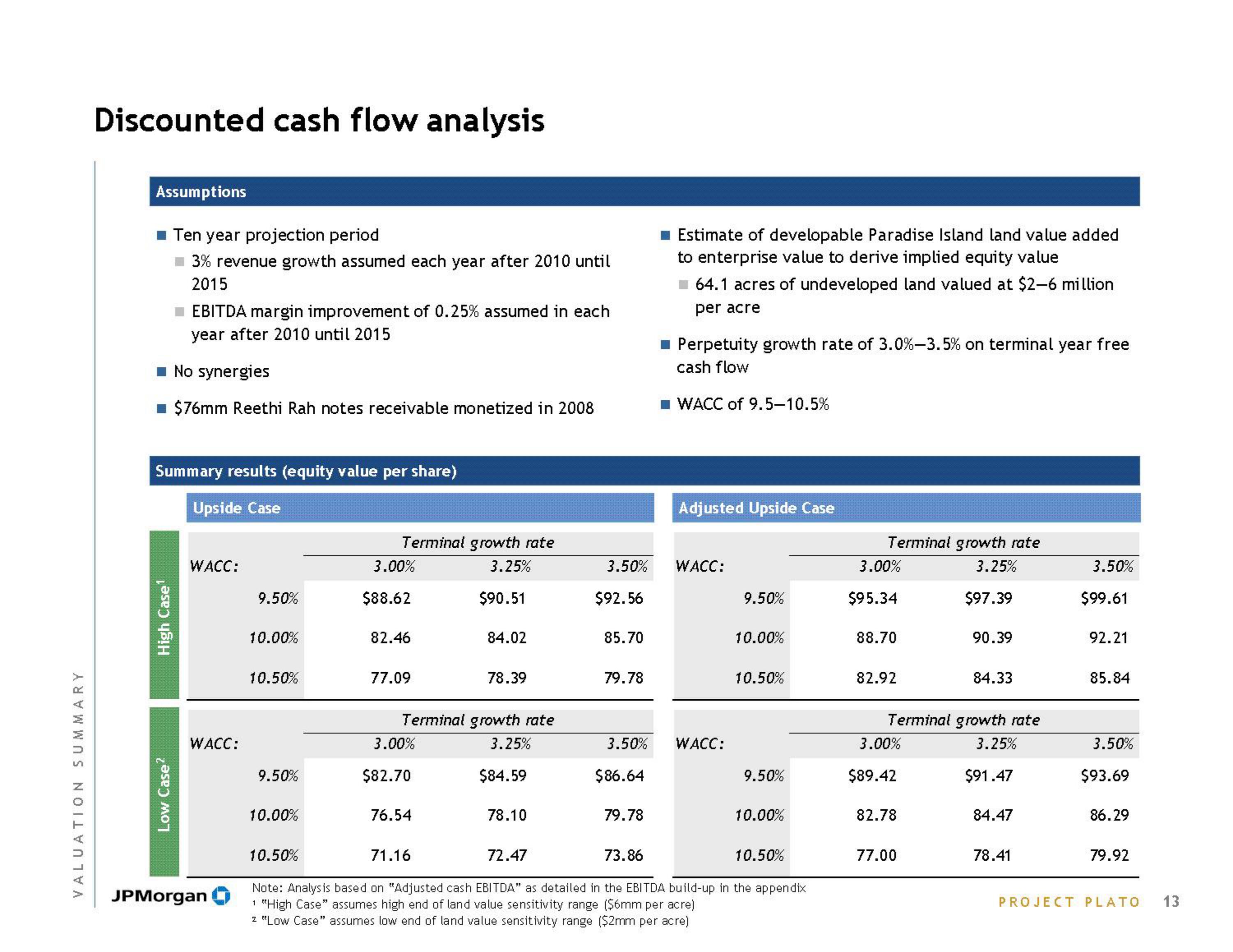

Discounted cash flow analysis

Assumptions

■ EBITDA margin improvement of 0.25% assumed in each

year after 2010 until 2015

■ No synergies

$76mm Reethi Rah notes receivable monetized in 2008

Ten year projection period

■ 3% revenue growth assumed each year after 2010 until

2015

Summary results (equity value per share)

Upside Case

High Case¹

Low Case²

WACC:

WACC:

JPMorgan

9.50%

10.00%

10.50%

9.50%

10.00%

Terminal growth rate

3.25%

3.00%

$88.62

82.46

77.09

3.00%

$82.70

Terminal growth rate

3.25%

$84.59

76.54

$90.51

84.02

71.16

78.39

78.10

3.50%

72.47

$92.56

85.70

79.78

■ Estimate of developable Paradise Island land value added

to enterprise value to derive implied equity value

64.1 acres of undeveloped land valued at $2-6 million

per acre

79.78

■ Perpetuity growth rate of 3.0%-3.5% on terminal year free

cash flow

■WACC of 9.5-10.5%

Adjusted Upside Case

WACC:

3.50% WACC:

$86.64

9.50%

10.00%

10.50%

9.50%

10.50%

73.86

Note: Analysis based on "Adjusted cash EBITDA" as detailed in the EBITDA build-up in the appendix

1 "High Case" assumes high end of land value sensitivity range ($6mm per acre)

z "Low Case" assumes low end of land value sensitivity range ($2mm per acre)

10.00%

10.50%

Terminal growth rate

3.25%

$97.39

3.00%

$95.34

88.70

82.92

3.00%

$89.42

Terminal growth rate

3.25%

$91.47

82.78

90.39

77.00

84.33

84.47

78.41

3.50%

$99.61

92.21

85.84

3.50%

$93.69

86.29

79.92

PROJECT PLATO 13View entire presentation