Apollo Global Management Mergers and Acquisitions Presentation Deck

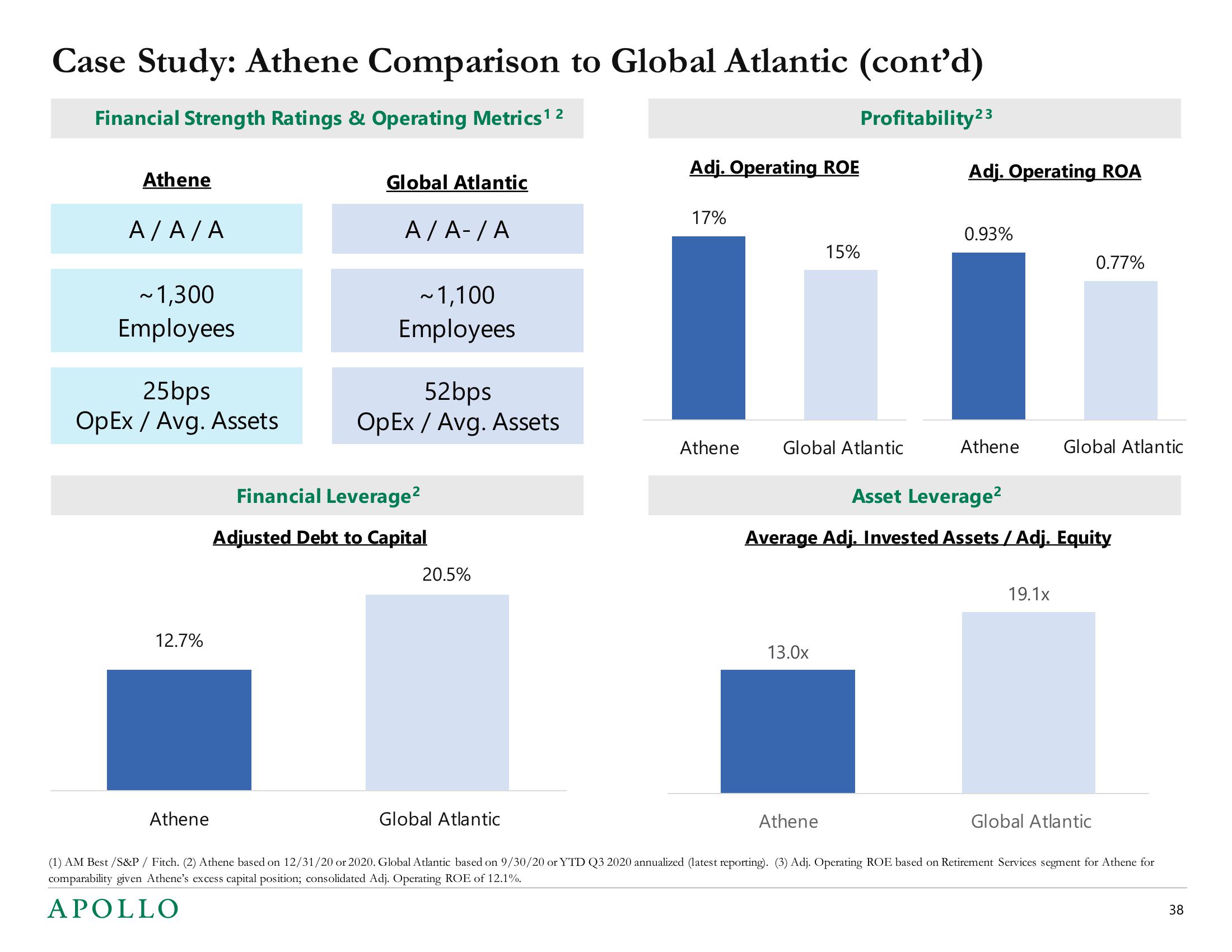

Case Study: Athene Comparison to Global Atlantic (cont'd)

Financial Strength Ratings & Operating Metrics ¹ 2

Profitability 23

Athene

A/A/A

~ 1,300

Employees

25bps

OpEx / Avg. Assets

12.7%

Global Atlantic

Athene

A/A-/A

~1,100

Employees

52bps

OpEx / Avg. Assets

Financial Leverage²

Adjusted Debt to Capital

20.5%

Adj. Operating ROE

Global Atlantic

17%

Athene

Global Atlantic

15%

13.0x

Adj. Operating ROA

Athene

0.93%

Athene

Asset Leverage²

Average Adj. Invested Assets / Adj. Equity

0.77%

19.1x

Global Atlantic

(1) AM Best /S&P / Fitch. (2) Athene based on 12/31/20 or 2020. Global Atlantic based on 9/30/20 or YTD Q3 2020 annualized (latest reporting). (3) Adj. Operating ROE based on Retirement Services segment for Athene for

comparability given Athene's excess capital position; consolidated Adj. Operating ROE of 12.1%.

APOLLO

Global Atlantic

38View entire presentation