Recommendation Report

●

●

●

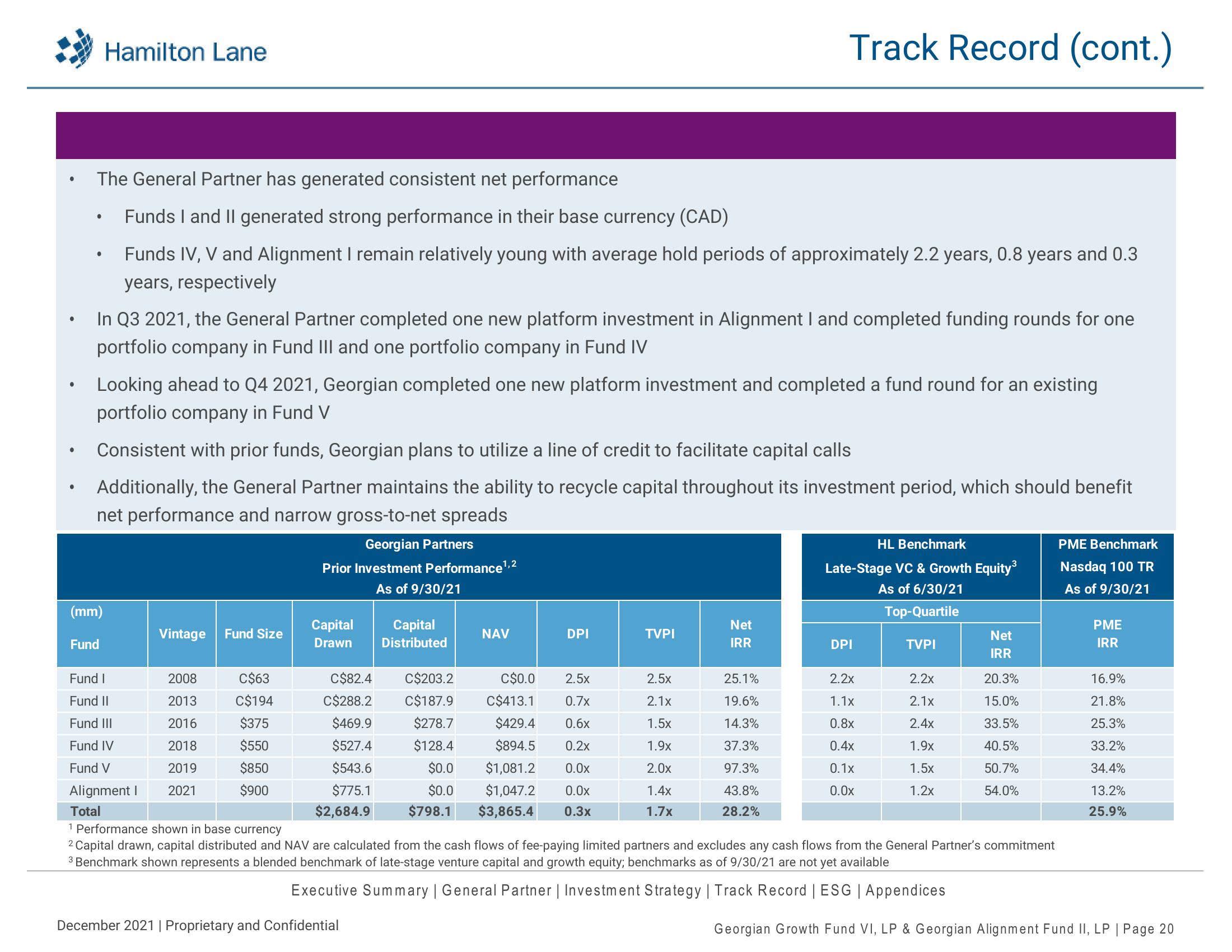

The General Partner has generated consistent net performance

Funds I and II generated strong performance in their base currency (CAD)

●

Hamilton Lane

• Funds IV, V and Alignment I remain relatively young with average hold periods of approximately 2.2 years, 0.8 years and 0.3

years, respectively

In Q3 2021, the General Partner completed one new platform investment in Alignment I and completed funding rounds for one

portfolio company in Fund III and one portfolio company in Fund IV

(mm)

Looking ahead to Q4 2021, Georgian completed one new platform investment and completed a fund round for an existing

portfolio company in Fund V

Consistent with prior funds, Georgian plans to utilize a line of credit to facilitate capital calls

Additionally, the General Partner maintains the ability to recycle capital throughout its investment period, which should benefit

net performance and narrow gross-to-net spreads

Fund

Vintage Fund Size

2008

2013

2016

2018

2019

2021

C$63

C$194

$375

$550

$850

$900

Georgian Partners

Prior Investment Performance ¹,²

1,2

As of 9/30/21

Capital

Drawn

C$82.4

C$288.2

$469.9

$527.4

$543.6

$775.1

$2,684.9

Capital

Distributed

December 2021 | Proprietary and Confidential

C$203.2

C$187.9

$278.7

$128.4

$0.0

$0.0

$798.1

NAV

DPI

C$0.0 2.5x

0.7x

0.6x

0.2x

0.0x

0.0x

0.3x

C$413.1

$429.4

$894.5

$1,081.2

$1,047.2

$3,865.4

TVPI

Track Record (cont.)

2.5x

2.1x

1.5x

1.9x

2.0x

1.4x

1.7x

Net

IRR

25.1%

19.6%

14.3%

37.3%

97.3%

43.8%

28.2%

HL Benchmark

Late-Stage VC & Growth Equity³

As of 6/30/21

Top-Quartile

DPI

Fund I

Fund II

Fund III

Fund IV

Fund V

Alignment I

Total

1 Performance shown in base currency

2 Capital drawn, capital distributed and NAV are calculated from the cash flows of fee-paying limited partners and excludes any cash flows from the General Partner's commitment

3 Benchmark shown represents a blended benchmark of late-stage venture capital and growth equity; benchmarks as of 9/30/21 are not yet available

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

2.2x

1.1x

0.8x

0.4x

0.1x

0.0x

TVPI

2.2x

2.1x

2.4x

1.9x

1.5x

1.2x

Net

IRR

20.3%

15.0%

33.5%

40.5%

50.7%

54.0%

PME Benchmark

Nasdaq 100 TR

As of 9/30/21

PME

IRR

16.9%

21.8%

25.3%

33.2%

34.4%

13.2%

25.9%

Georgian Growth Fund VI, LP & Georgian Alignment Fund II, LP | Page 20View entire presentation