OpenText Investor Day Presentation Deck

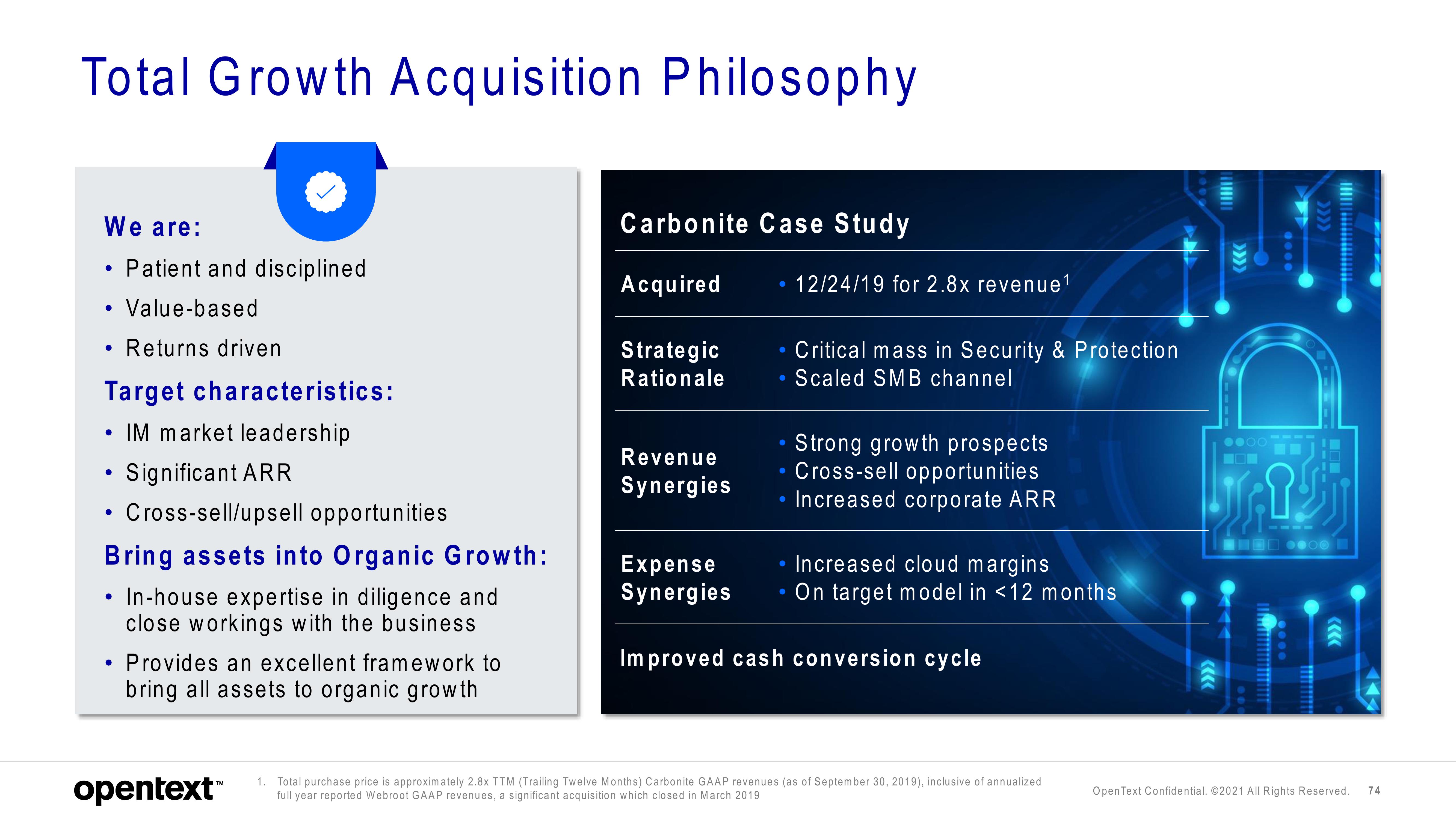

Total Growth Acquisition Philosophy

We are:

Patient and disciplined

Value-based

• Returns driven

Target characteristics:

●

• IM market leadership

Significant ARR

●

●

●

• Cross-sell/upsell opportunities

Bring assets into Organic Growth:

In-house expertise in diligence and

close workings with the business

• Provides an excellent framework to

bring all assets to organic growth

opentext™

Carbonite Case Study

Acquired

Strategic

Rationale

Revenue

Synergies

●

.

●

12/24/19 for 2.8x revenue ¹

Critical mass in Security & Protection

Scaled SMB channel

Strong growth prospects

Cross-sell opportunities

Increased corporate ARR

Increased cloud margins

On target model in <12 months

Expense

Synergies

Improved cash conversion cycle

1. Total purchase price is approximately 2.8x TTM (Trailing Twelve Months) Carbonite GAAP revenues (as of September 30, 2019), inclusive of annualized

full year reported Webroot GAAP revenues, a significant acquisition which closed in March 2019

●●00

P

00

Open Text Confidential. ©2021 All Rights Reserved.

74View entire presentation