FY 2018 Fourth Quarter Earnings Call

Non-GAAP reconciliations

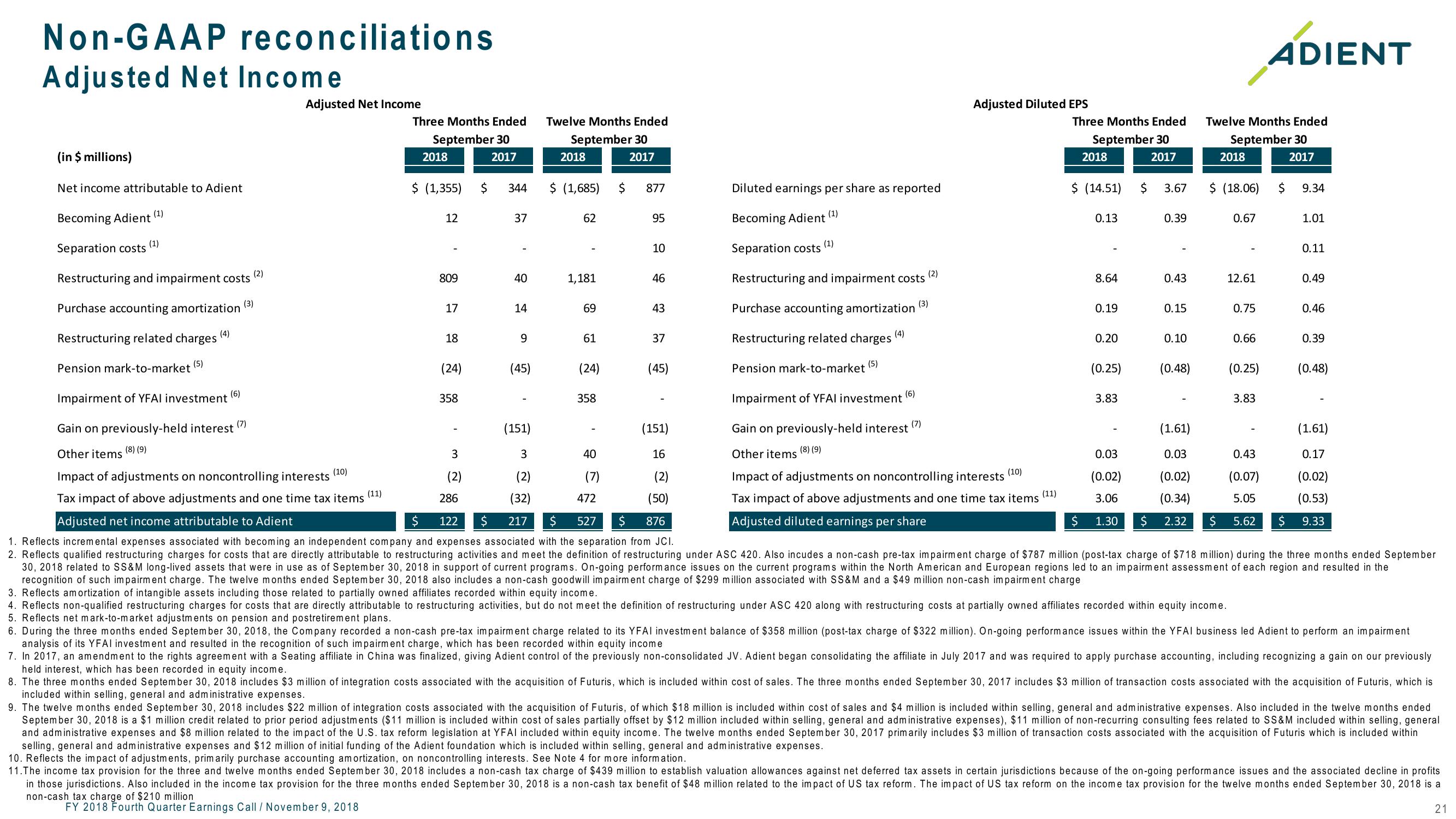

Adjusted Net Income

ADIENT

(in $ millions)

Adjusted Net Income

2018

Three Months Ended

September 30

2017

Twelve Months Ended

September 30

Adjusted Diluted EPS

Three Months Ended

September 30

Twelve Months Ended

September 30

2018

2017

2018

2017

2018

2017

Net income attributable to Adient

$ (1,355) $ 344

$ (1,685)

$

877

Diluted earnings per share as reported

$ (14.51)

$ 3.67

$ (18.06)

$ 9.34

Becoming Adient

(1)

Separation costs

(1)

Restructuring and impairment costs

(2)

809

40

Purchase accounting amortization

(3)

Restructuring related charges

(4)

Pension mark-to-market

(5)

Impairment of YFAI investment

(6)

Gain on previously-held interest

(7)

Other items

(8) (9)

12

37

62

95

Becoming Adient'

(1)

0.13

0.39

0.67

1.01

(1)

10

Separation costs

0.11

00

1,181

46

40

(2)

Restructuring and impairment costs

8.64

0.43

12.61

0.49

17

17

14

69

69

(3)

43

Purchase accounting amortization

0.19

0.15

0.75

0.46

18

6

61

37

(4)

Restructuring related charges

0.20

0.10

0.66

0.39

(5)

(24)

(45)

(24)

(45)

Pension mark-to-market

(0.25)

(0.48)

(0.25)

(0.48)

358

358

Impairment of YFAI investment (6)

3.83

3.83

(151)

(151)

Gain on previously-held interest

(8) (9)

(7)

(1.61)

(1.61)

3

3

40

16

Other items

0.03

0.03

0.43

0.17

Impact of adjustments on noncontrolling interests

(10)

Tax impact of above adjustments and one time tax items (11)

Adjusted net income attributable to Adient

(2)

286

(2)

(32)

(7)

(2)

472

(50)

$

122 $ 217 $ 527 $ 876

Impact of adjustments on noncontrolling interests

Tax impact of above adjustments and one time tax items (11)

Adjusted diluted earnings per share

(10)

(0.02)

(0.02)

(0.07)

(0.02)

3.06

(0.34)

5.05

(0.53)

$ 1.30 $ 2.32 $ 5.62

$ 9.33

1. Reflects incremental expenses associated with becoming an independent company and expenses associated with the separation from JCI.

2. Reflects qualified restructuring charges for costs that are directly attributable to restructuring activities and meet the definition of restructuring under ASC 420. Also incudes a non-cash pre-tax impairment charge of $787 million (post-tax charge of $718 million) during the three months ended September

30, 2018 related to SS&M long-lived assets that were in use as of September 30, 2018 in support of current programs. On-going performance issues on the current programs within the North American and European regions led to an impairment assessment of each region and resulted in the

recognition of such impairment charge. The twelve months ended September 30, 2018 also includes a non-cash goodwill impairment charge of $299 million associated with SS&M and a $49 million non-cash impairment charge

3. Reflects amortization of intangible assets including those related to partially owned affiliates recorded within equity income.

4. Reflects non-qualified restructuring charges for costs that are directly attributable to restructuring activities, but do not meet the definition of restructuring under ASC 420 along with restructuring costs at partially owned affiliates recorded within equity income.

5. Reflects net mark-to-market adjustments on pension and postretirement plans.

6. During the three months ended September 30, 2018, the Company recorded a non-cash pre-tax impairment charge related to its YFAI investment balance of $358 million (post-tax charge of $322 million). On-going performance issues within the YFAI business led Adient to perform an impairment

analysis of its YFAI investment and resulted in the recognition of such impairment charge, which has been recorded within equity income

7. In 2017, an amendment to the rights agreement with a Seating affiliate in China was finalized, giving Adient control of the previously non-consolidated JV. Adient began consolidating the affiliate in July 2017 and was required to apply purchase accounting, including recognizing a gain on our previously

held interest, which has been recorded in equity income.

8. The three months ended September 30, 2018 includes $3 million of integration costs associated with the acquisition of Futuris, which is included within cost of sales. The three months ended September 30, 2017 includes $3 million of transaction costs associated with the acquisition of Futuris, which is

included within selling, general and administrative expenses.

9. The twelve months ended September 30, 2018 includes $22 million of integration costs associated with the acquisition of Futuris, of which $18 million is included within cost of sales and $4 million is included within selling, general and administrative expenses. Also included in the twelve months ended

September 30, 2018 is a $1 million credit related to prior period adjustments ($11 million is included within cost of sales partially offset by $12 million included within selling, general and administrative expenses), $11 million of non-recurring consulting fees related to SS&M included within selling, general

and administrative expenses and $8 million related to the impact of the U.S. tax reform legislation at YFAI included within equity income. The twelve months ended September 30, 2017 primarily includes $3 million of transaction costs associated with the acquisition of Futuris which is included within

selling, general and administrative expenses and $12 million of initial funding of the Adient foundation which is included within selling, general and administrative expenses.

10. Reflects the impact of adjustments, primarily purchase accounting amortization, on noncontrolling interests. See Note 4 for more information.

11. The income tax provision for the three and twelve months ended September 30, 2018 includes a non-cash tax charge of $439 million to establish valuation allowances against net deferred tax assets in certain jurisdictions because of the on-going performance issues and the associated decline in profits

in those jurisdictions. Also included in the income tax provision for the three months ended September 30, 2018 is a non-cash tax benefit of $48 million related to the impact of US tax reform. The impact of US tax reform on the income tax provision for the twelve months ended September 30, 2018 is a

non-cash tax charge of $210 million

FY 2018 Fourth Quarter Earnings Call / November 9, 2018

21View entire presentation