Paya SPAC Presentation Deck

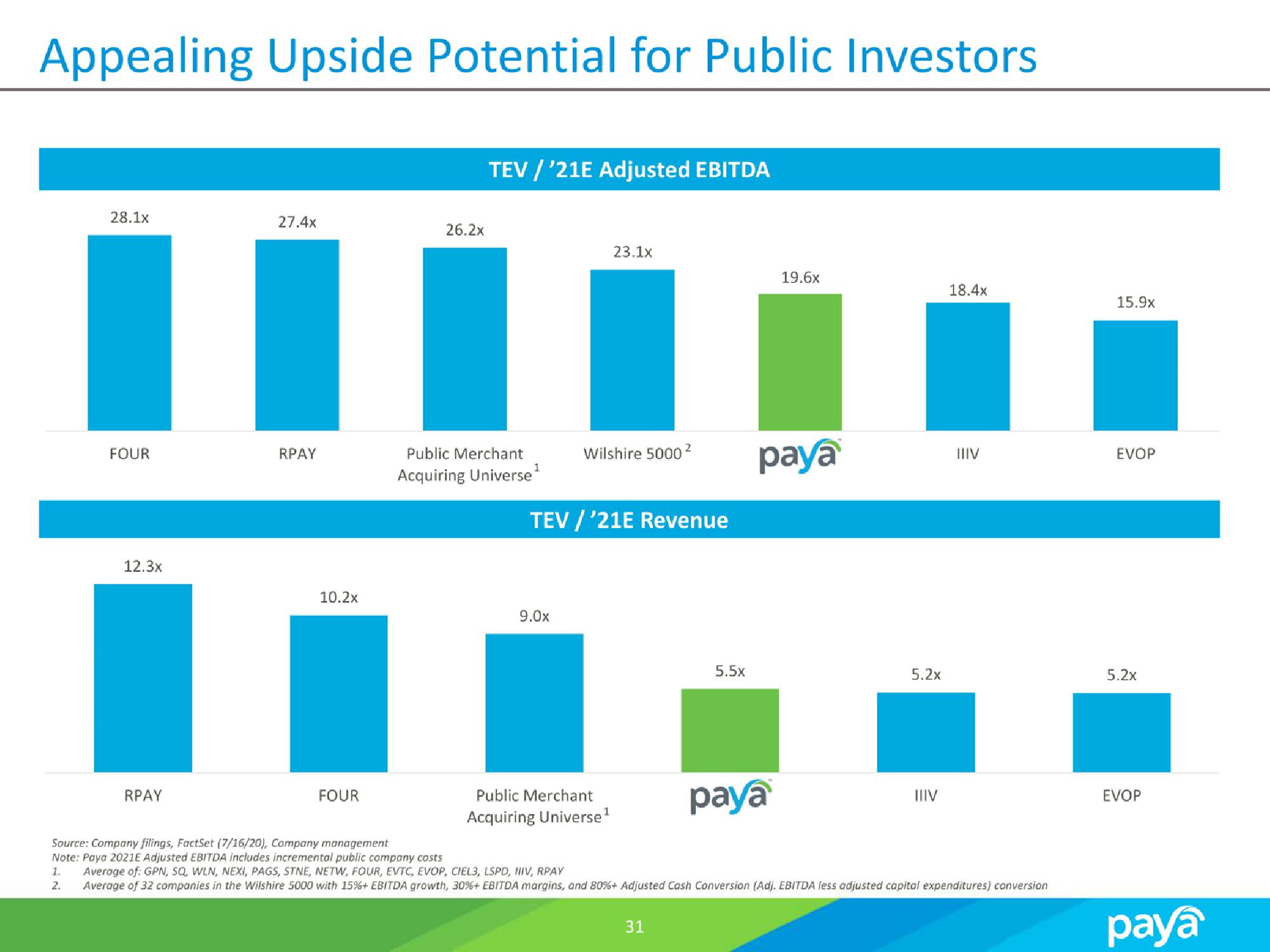

Appealing Upside Potential for Public Investors

28.1x

FOUR

12.3x

RPAY

27.4x

RPAY

10.2x

FOUR

26.2x

TEV /'21E Adjusted EBITDA

Public Merchant

Acquiring Universe¹

9.0x

23.1x

Wilshire 5000²

TEV /'21E Revenue

Public Merchant

Acquiring Universe¹

5.5x

31

19.6x

paya

paya

5.2x

IIIV

18.4x

IIIV

Source: Company filings, FactSet (7/16/20), Company management

Note: Paya 2021E Adjusted EBITDA includes incremental public company costs

1. Average of: GPN, SQ, WLN, NEXI, PAGS, STNE, NETW, FOUR, EVTC, EVOP, CIEL3, LSPD, IIV, RPAY

2. Average of 32 companies in the Wilshire 5000 with 15% + EBITDA growth, 30% + EBITDA margins, and 80%+ Adjusted Cash Conversion (Adj. EBITDA less adjusted capital expenditures) conversion

15.9x

EVOP

5.2x

EVOP

payaView entire presentation