Tudor, Pickering, Holt & Co Investment Banking

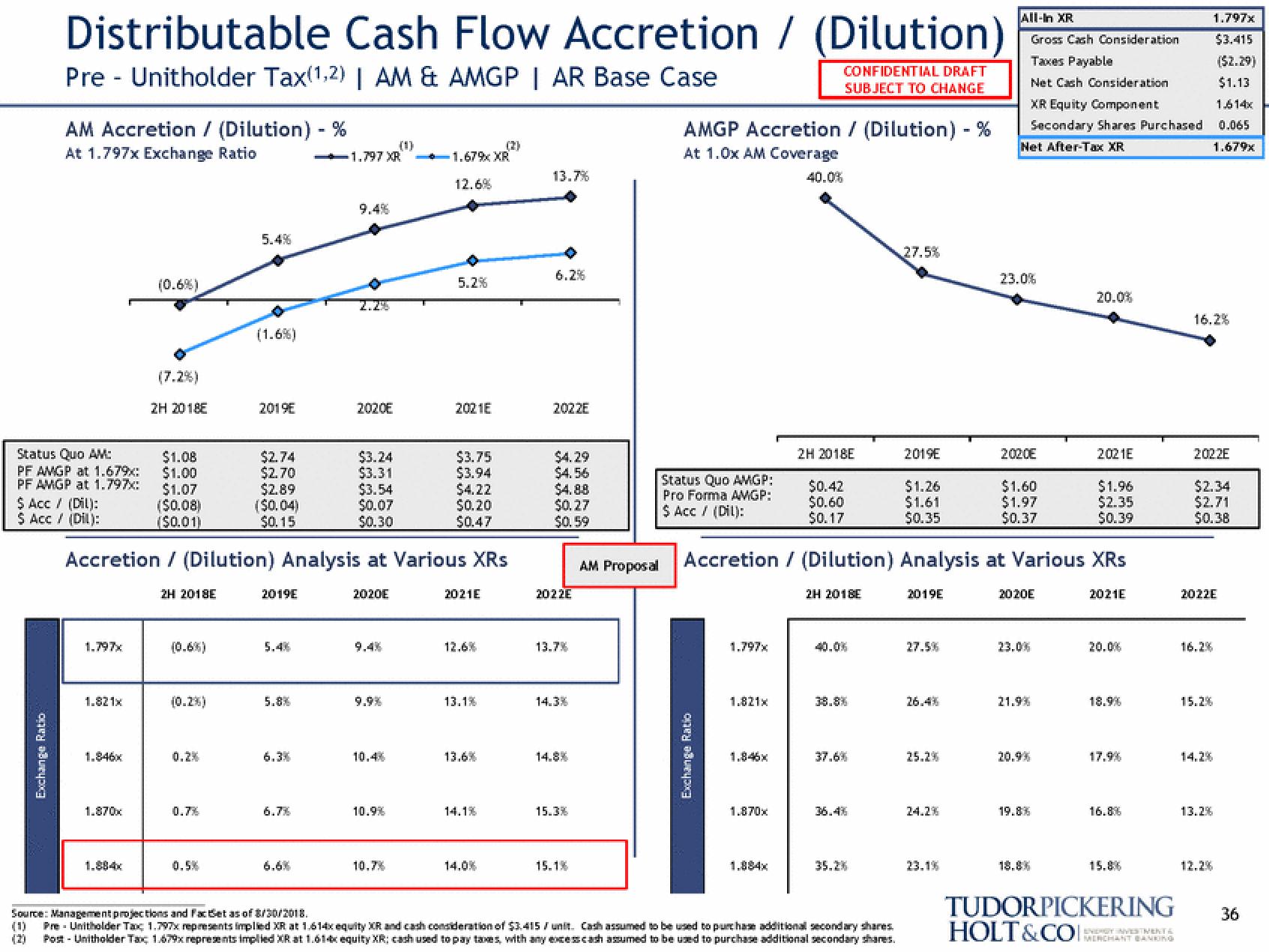

Distributable Cash Flow Accretion / (Dilution)

Pre Unitholder Tax(1,2) | AM & AMGP | AR Base Case

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

AM Accretion / (Dilution) - %

At 1.797x Exchange Ratio

Status Quo AM:

PF AMGP at 1.679x:

PF AMGP at 1.797x:

Exchange Ratio

$ Acc / (Dil):

$ Acc / (Dil):

1.797x

1.821x

1.846x

1.870x

(0.6%)

1.884x

(7.2%)

2H 2018E

$1.08

$1.00

$1.07

($0.08)

($0.01)

2H 2018E

(0.6%)

(0.2%)

0.2%

0.7%

5.4%

0.5%

(1.6%)

2019E

$2.74

$2.70

$2.89

Accretion / (Dilution) Analysis at Various XRs

2020E

($0.04)

$0.15

2019E

5.8%

6.3%

6.6%

-1.797 XR

2020E

$3.24

$3.31

$3.54

$0.07

$0.30

9.9%

10.4%

(1)

10.9%

10.7%

1.67% XR

12.6%

5.2%

2021E

$3.75

$3.94

$4.22

$0.20

$0.47

2021E

12.6%

13.1%

13.6%

(2)

14.1%

14.0%

13.7%

2022E

$4.29

$4.56

$4.88

$0.27

$0.59

2022E

13.7%

14.3%

14.8%

15.3%

15.1%

AM Proposal

AMGP Accretion / (Dilution) - %

At 1.0x AM Coverage

40.0%

Status Quo AMGP:

Pro Forma AMGP:

$ Acc / (Dil):

Exchange Ratio

1.797x

1.821x

1.846x

1.870x

2H 2018E

1.884x

$0.42

$0.60

$0.17

38.8%

37.6%

36.4%

Accretion / (Dilution) Analysis at Various XRs

2H 2018E

35.2%

27.5%

Source: Management projections and FacBet as of 8/30/2018.

(1) Pre Unitholder Tax 1.797x represents implied XR at 1.614x equity XR and cash consideration of $3.415 / unit. Cash assumed to be used to purchase additional secondary shares.

Post - Unitholder Tax 1.679x represents implied XR at 1.61-equity XR; cash used to pay taxes, with any excesscash assumed to be used to purchase additional secondary shares.

2019E

$1.26

$1.61

$0.35

2019E

27.5%

26.4%

25.2%

24.2%

All-In XR

Gross Cash Consideration

Taxes Payable

1.614x

Net Cash Consideration

XR Equity Component

Secondary Shares Purchased 0.065

Net After-Tax XR

1.679x

23.1%

23.0%

2020E

$1.60

$1.97

$0.37

2020E

23.0%

21.9%

20.9%

19.8%

20.0%

18.8%

2021E

$1.96

$2.35

$0.39

2021E

20.0%

18.9%

17.9%

16.8%

15.8%

TUDORPICKERING

HOLT&COI:

EVERT INVESTMENT &

MERCHANT BANKING

16.2%

2022E

$2.34

$2.71

$0.38

2022E

16.2%

1.797x

$3.415

(52.29)

$1.13

15.2%

14.2%

13.2%

12.2%

36View entire presentation