Maersk Investor Presentation Deck

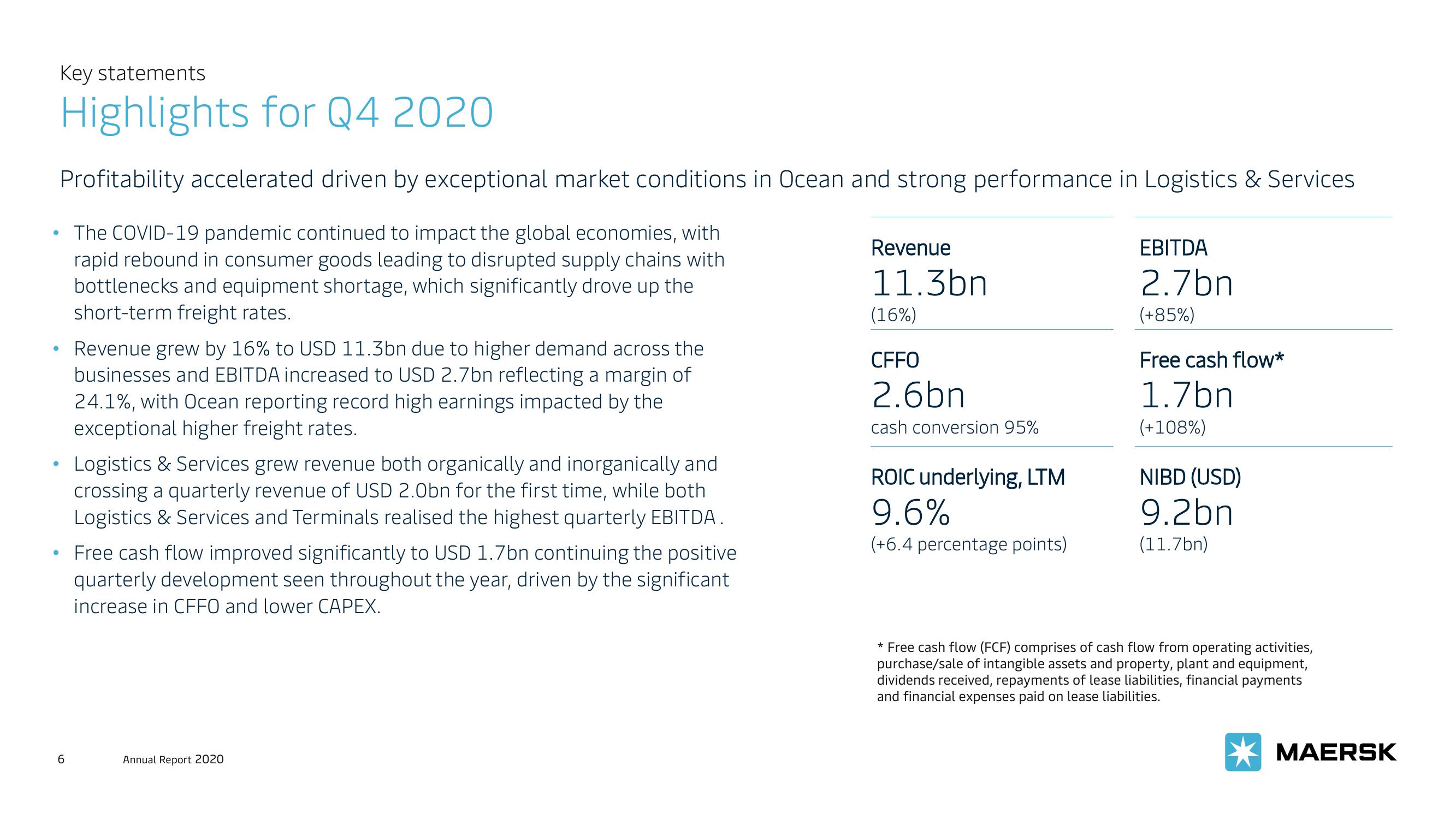

Profitability accelerated driven by exceptional market conditions in Ocean and strong performance in Logistics & Services

• The COVID-19 pandemic continued to impact the global economies, with

rapid rebound in consumer goods leading to disrupted supply chains with

bottlenecks and equipment shortage, which significantly drove up the

short-term freight rates.

●

Key statements

Highlights for Q4 2020

●

6

Revenue grew by 16% to USD 11.3bn due to higher demand across the

businesses and EBITDA increased to USD 2.7bn reflecting a margin of

24.1%, with Ocean reporting record high earnings impacted by the

exceptional higher freight rates.

Logistics & Services grew revenue both organically and inorganically and

crossing a quarterly revenue of USD 2.0bn for the first time, while both

Logistics & Services and Terminals realised the highest quarterly EBITDA.

Free cash flow improved significantly to USD 1.7bn continuing the positive

quarterly development seen throughout the year, driven by the significant

increase in CFFO and lower CAPEX.

Annual Report 2020

Revenue

11.3bn

(16%)

CFFO

2.6bn

cash conversion 95%

ROIC underlying, LTM

9.6%

(+6.4 percentage points)

EBITDA

2.7bn

(+85%)

Free cash flow*

1.7bn

(+108%)

NIBD (USD)

9.2bn

(11.7bn)

* Free cash flow (FCF) comprises of cash flow from operating activities,

purchase/sale of intangible assets and property, plant and equipment,

dividends received, repayments of lease liabilities, financial payments

and financial expenses paid on lease liabilities.

MAERSKView entire presentation