Benson Hill SPAC Presentation Deck

BENSON HILL

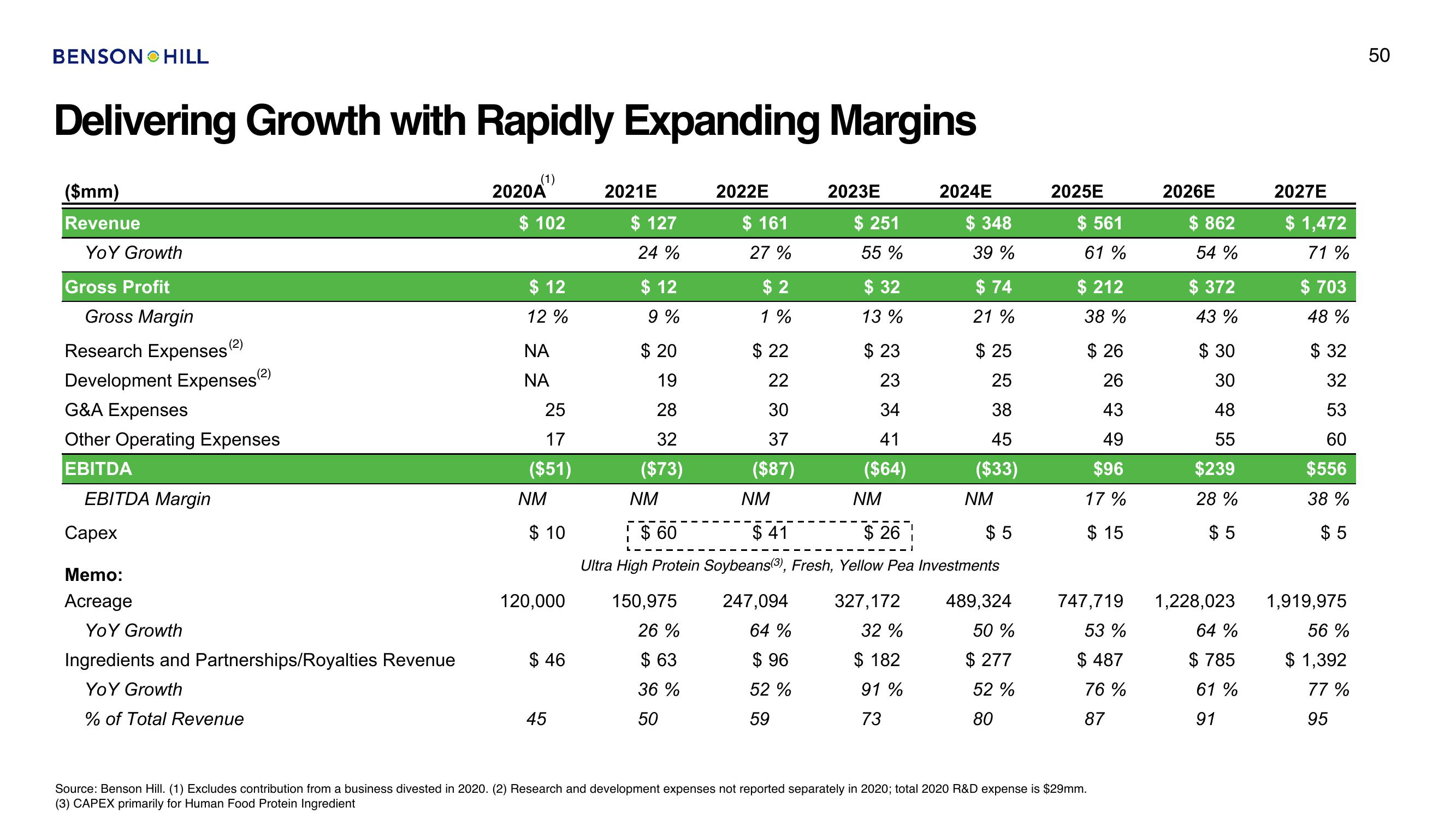

Delivering Growth with Rapidly Expanding Margins

($mm)

Revenue

YoY Growth

Gross Profit

Gross Margin

Research Expenses

Development Expenses (²)

G&A Expenses

Other Operating Expenses

EBITDA

EBITDA Margin

Capex

Memo:

Acreage

(2)

YoY Growth

Ingredients and Partnerships/Royalties Revenue

Yo Y Growth

% of Total Revenue

2020A

$ 102

$ 12

12%

ΝΑ

ΝΑ

25

17

($51)

NM

$10

120,000

$ 46

45

2021E

$ 127

24 %

$ 12

9%

$20

19

28

32

($73)

NM

¦ $ 60

I

2022E

150,975

26%

$63

36%

50

$ 161

27%

$2

1%

$22

22

30

37

($87)

NM

$41

2023E

247,094

64 %

$96

52%

59

$ 251

55 %

$ 32

13%

$23

23

34

41

($64)

NM

2024E

$26

Ultra High Protein Soybeans(3), Fresh, Yellow Pea Investments

327,172

32 %

$ 182

91%

73

$ 348

39 %

$ 74

21 %

$ 25

25

38

45

($33)

NM

$5

489,324

50 %

$277

52%

80

2025E

$ 561

61%

$ 212

38 %

$ 26

26

43

49

$96

17%

$15

747,719

53 %

$ 487

76%

87

Source: Benson Hill. (1) Excludes contribution from a business divested in 2020. (2) Research and development expenses not reported separately in 2020; total 2020 R&D expense is $29mm.

(3) CAPEX primarily for Human Food Protein Ingredient

2026E

$ 862

54%

$ 372

43%

$30

30

48

55

$239

28%

$5

1,228,023

64 %

$ 785

61 %

91

2027E

$ 1,472

71%

$ 703

48 %

$32

32

53

60

$556

38 %

$5

1,919,975

56 %

$ 1,392

77%

95

50View entire presentation