Bed Bath & Beyond Results Presentation Deck

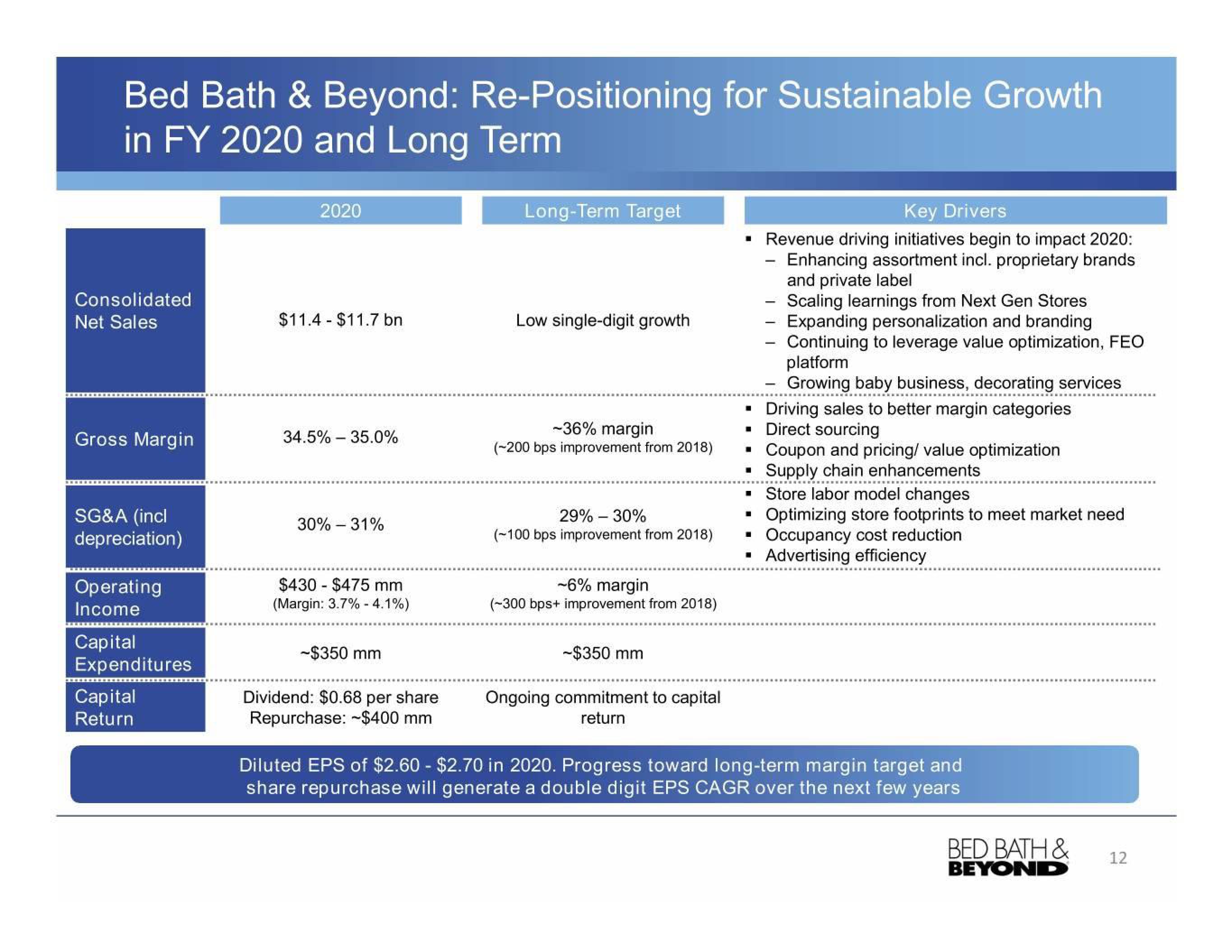

Bed Bath & Beyond: Re-Positioning for Sustainable Growth

in FY 2020 and Long Term

Consolidated

Net Sales

Gross Margin

SG&A (incl

depreciation)

Operating

Income

Capital

Expenditures

Capital

Return

2020

$11.4 $11.7 bn

-

34.5% - 35.0%

30% -31%

$430 $475 mm

(Margin: 3.7% -4.1%)

-$350 mm

Dividend: $0.68 per share

Repurchase: $400 mm

Long-Term Target

Low single-digit growth

-36% margin

(-200 bps improvement from 2018)

29% - 30%

(~100 bps improvement from 2018)

~6% margin

(-300 bps+ improvement from 2018)

-$350 mm

Ongoing commitment to capital

return

Key Drivers

▪ Revenue driving initiatives begin to impact 2020:

Enhancing assortment incl. proprietary brands

and private label

-Scaling learnings from Next Gen Stores

Expanding personalization and branding

Continuing to leverage value optimization, FEO

platform

Growing baby business, decorating services

■

Driving sales to better margin categories

Direct sourcing

Coupon and pricing/ value optimization

Supply chain enhancements

■ Store labor model changes

Optimizing store footprints to meet market need

Occupancy cost reduction

Advertising efficiency

■

■

■

-

■

Diluted EPS of $2.60 - $2.70 in 2020. Progress toward long-term margin target and

share repurchase will generate a double digit EPS CAGR over the next few years

BED BATH &

BEYOND

12View entire presentation