Liberty Global Results Presentation Deck

RECONCILIATIONS

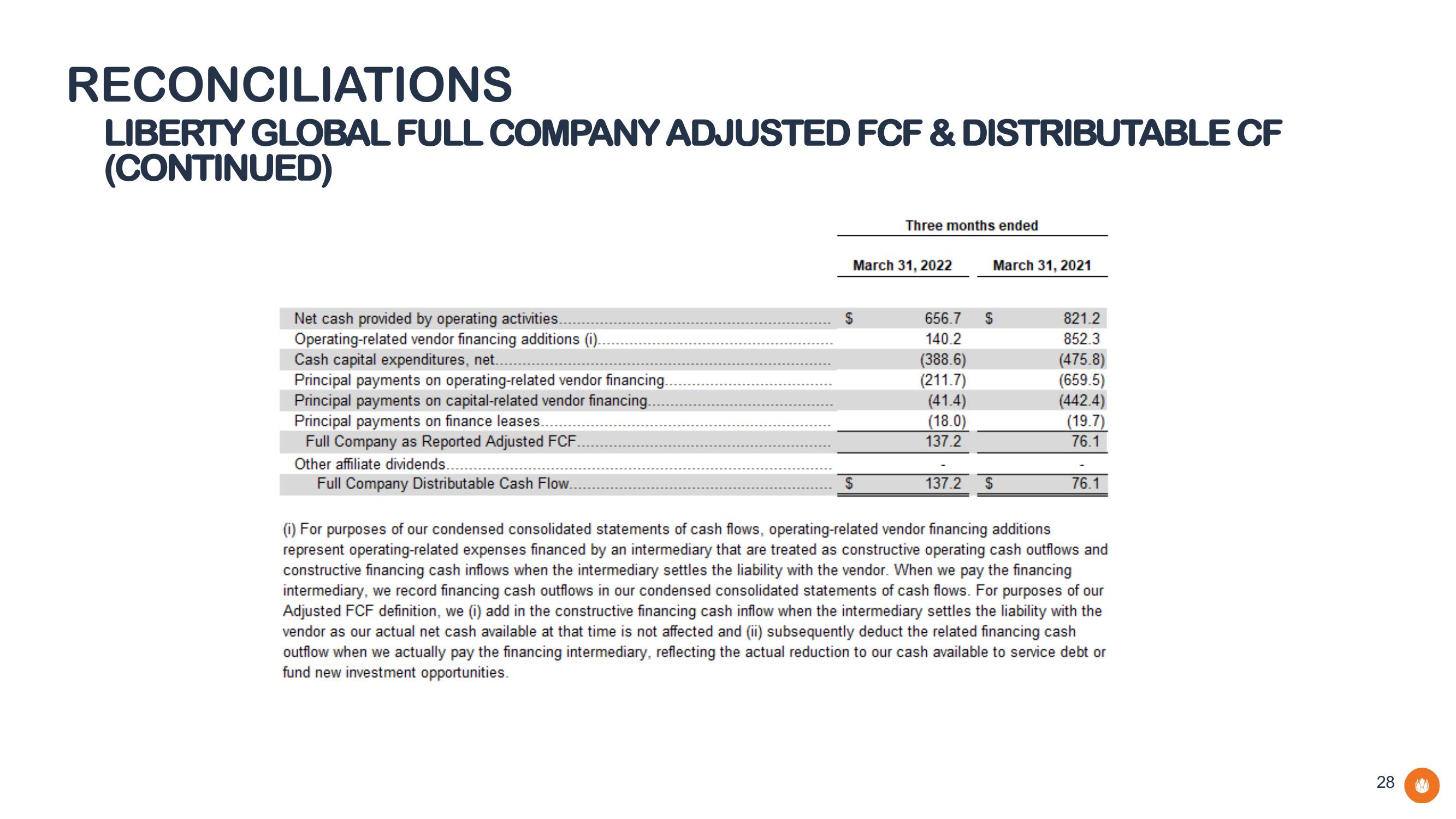

LIBERTY GLOBAL FULL COMPANY ADJUSTED FCF & DISTRIBUTABLE CF

(CONTINUED)

Net cash provided by operating activities......

Operating-related vendor financing additions (i).

Cash capital expenditures, net.

Principal payments on operating-related vendor financing..

Principal payments on capital-related vendor financing..

Principal payments on finance leases.

Full Company as Reported Adjusted FCF.

Other affiliate dividends..

Full Company Distributable Cash Flow..

Three months ended

March 31, 2022

$

656.7

140.2

(388.6)

(211.7)

(41.4)

(18.0)

137.2

March 31, 2021

$

137.2 $

821.2

852.3

(475.8)

(659.5)

(442.4)

(19.7)

76.1

76.1

(i) For purposes of our condensed consolidated statements of cash flows, operating-related vendor financing additions

represent operating-related expenses financed by an intermediary that are treated as constructive operating cash outflows and

constructive financing cash inflows when the intermediary settles the liability with the vendor. When we pay the financing

intermediary, we record financing cash outflows in our condensed consolidated statements of cash flows. For purposes of our

Adjusted FCF definition, we (i) add in the constructive financing cash inflow when the intermediary settles the liability with the

vendor as our actual net cash available at that time is not affected and (ii) subsequently deduct the related financing cash

outflow when we actually pay the financing intermediary, reflecting the actual reduction to our cash available to service debt or

fund new investment opportunities.

28View entire presentation