Bausch+Lomb Results Presentation Deck

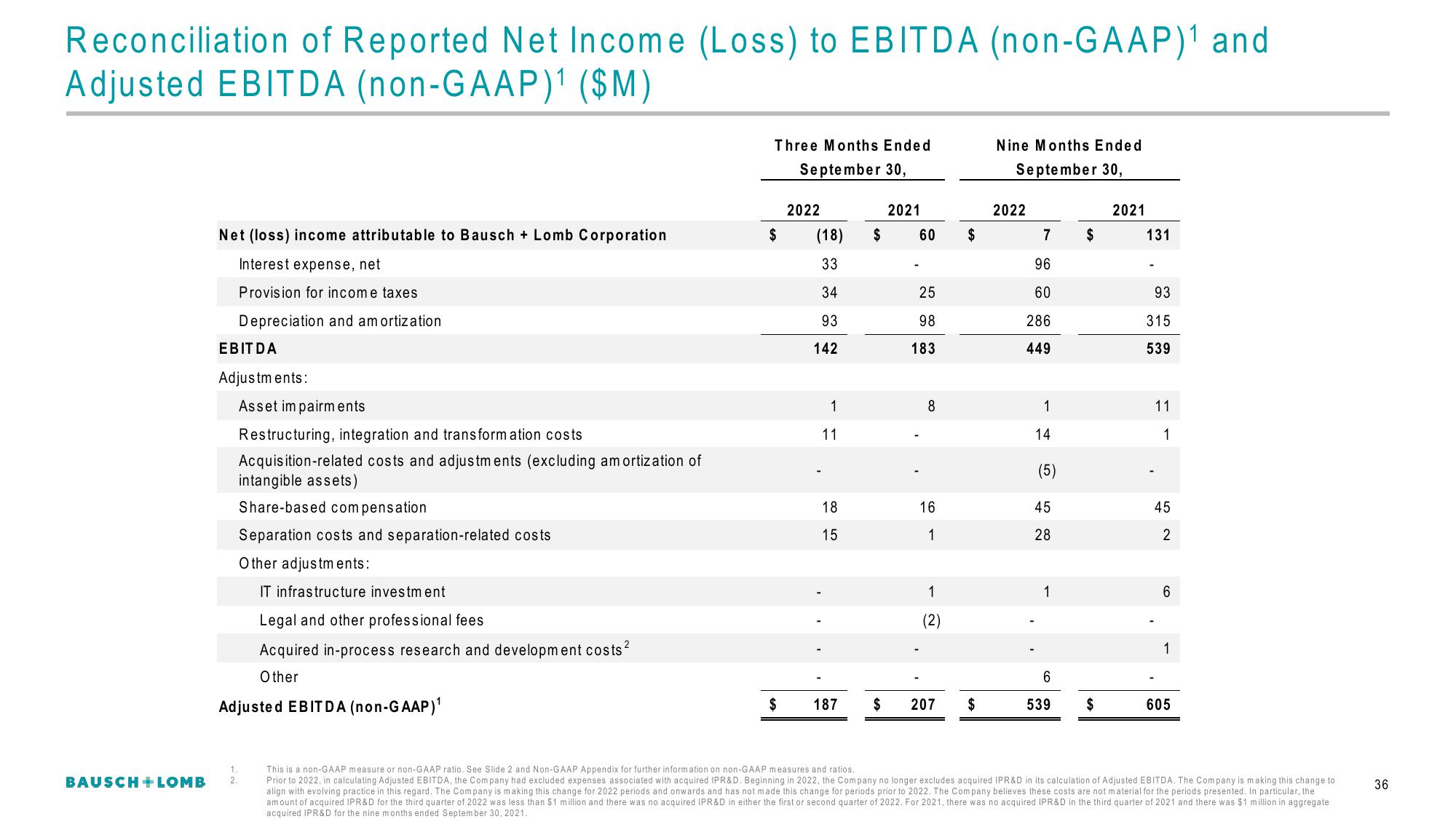

Reconciliation of Reported Net Income (Loss) to EBITDA (non-GAAP)¹ and

Adjusted EBITDA (non-GAAP)¹ ($M)

BAUSCH + LOMB

Net (loss) income attributable to Bausch + Lomb Corporation

Interest expense, net

Provision for income taxes

Depreciation and amortization

EBITDA

Adjustments:

Asset impairments

Restructuring, integration and transformation costs

Acquisition-related costs and adjustments (excluding amortization of

intangible assets)

Share-based compensation

Separation costs and separation-related costs

Other adjustments:

IT infrastructure investment

2.

Legal and other professional fees

Acquired in-process research and development costs ²

Other

Adjusted EBITDA (non-GAAP)¹

Three Months Ended

September 30,

$

$

2022

(18)

33

34

93

142

1

11

18

15

187

2021

$ 60

$

-

25

98

183

8

16

1

1

(2)

207

$

$

Nine Months Ended

September 30,

2022

7 $

96

60

286

449

1

14

(5)

45

28

1

6

539

$

2021

131

93

315

539

11

1

45

2

6

1

605

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

Prior to 2022, in calculating Adjusted EBITDA, the Company had excluded expenses associated with acquired IPR&D. Beginning in 2022, the Company no longer excludes acquired IPR&D in its calculation of Adjusted EBITDA. The Company is making this change to

align with evolving practice in this regard. The Company is making this change for 2022 periods and onwards and has not made this change for periods prior to 2022. The Company believes these costs are not material for the periods presented. In particular, the

amount of acquired IPR&D for the third quarter of 2022 was less than $1 million and there was no acquired IPR&D in either the first or second quarter of 2022. For 2021, there was no acquired IPR&D in the third quarter of 2021 and there was $1 million in aggregate

acquired IPR&D for the nine months ended September 30, 2021.

36View entire presentation