Strategically Positioning Truist Insurance Holdings for Long-Term Success

Executive summary

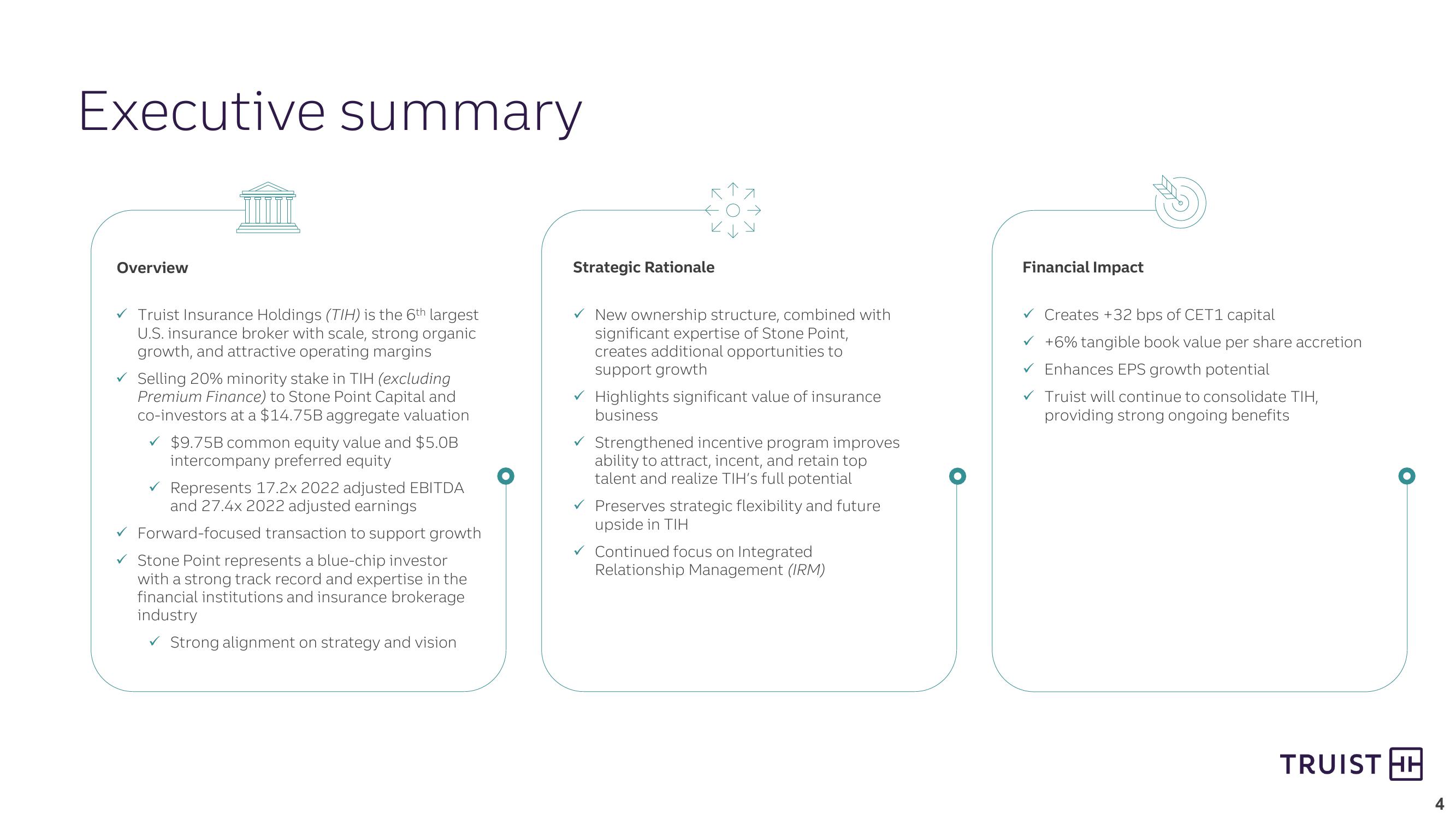

Overview

Truist Insurance Holdings (TIH) is the 6th largest

U.S. insurance broker with scale, strong organic

growth, and attractive operating margins

Selling 20% minority stake in TIH (excluding

Premium Finance) to Stone Point Capital and

co-investors at a $14.75B aggregate valuation

$9.75B common equity value and $5.0B

intercompany preferred equity

✓ Represents 17.2x 2022 adjusted EBITDA

and 27.4x 2022 adjusted earnings

✓ Forward-focused transaction to support growth

Stone Point represents a blue-chip investor

with a strong track record and expertise in the

financial institutions and insurance brokerage

industry

✓ Strong alignment on strategy and vision

Strategic Rationale

New ownership structure, combined with

significant expertise of Stone Point,

creates additional opportunities to

support growth

✓ Highlights significant value of insurance

business

✓ Strengthened incentive program improves

ability to attract, incent, and retain top

talent and realize TIH's full potential

✓ Preserves strategic flexibility and future

upside in TIH

Continued focus on Integrated

Relationship Management (IRM)

Financial Impact

Creates +32 bps of CET1 capital

✓ +6% tangible book value per share accretion

Enhances EPS growth potential

✓ Truist will continue to consolidate TIH,

providing strong ongoing benefits

TRUIST HH

4View entire presentation