Acquisition of ECM Transport Group

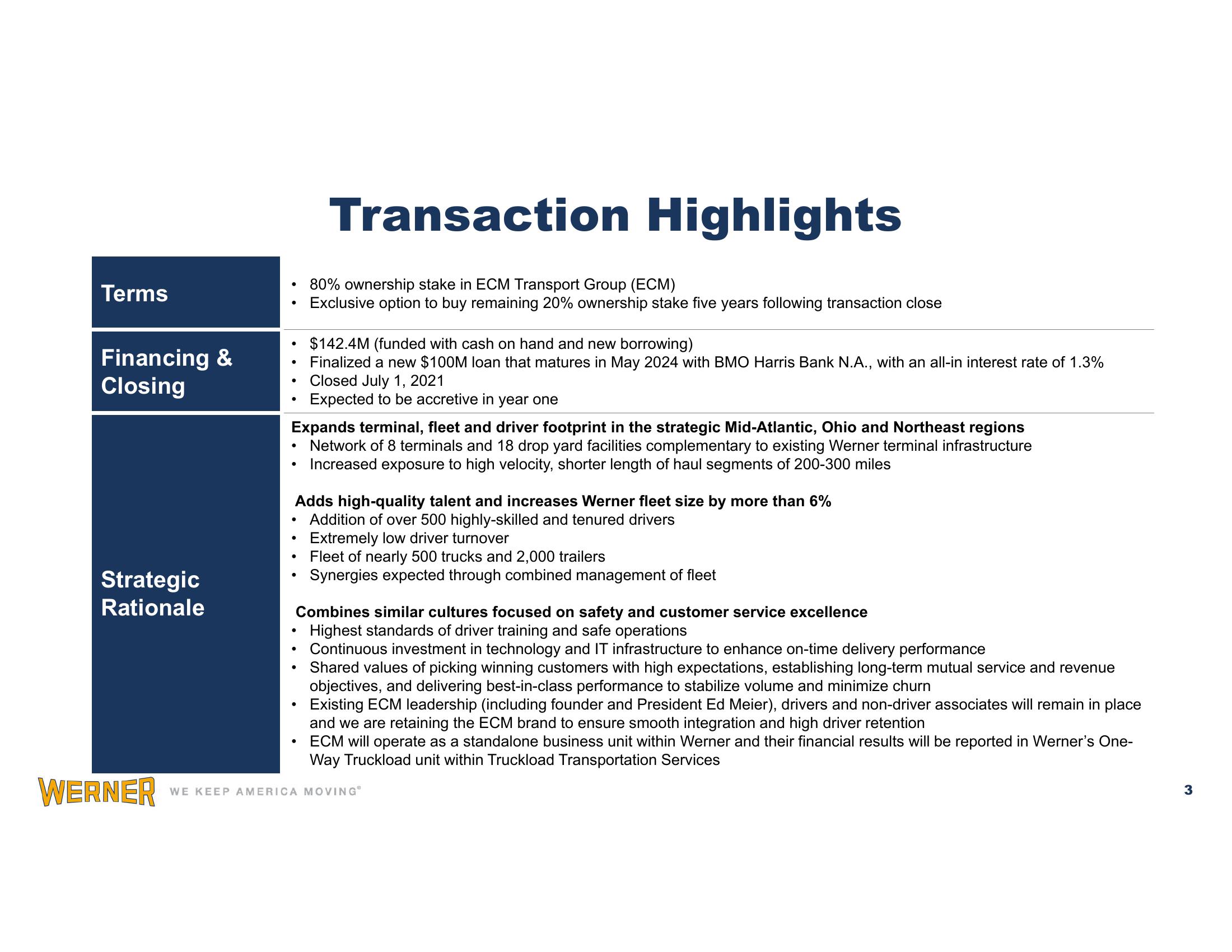

Terms

Financing &

Closing

Strategic

Rationale

WERNER

Transaction Highlights

80% ownership stake in ECM Transport Group (ECM)

Exclusive option to buy remaining 20% ownership stake five years following transaction close

$142.4M (funded with cash on hand and new borrowing)

Finalized a new $100M loan that matures in May 2024 with BMO Harris Bank N.A., with an all-in interest rate of 1.3%

Closed July 1, 2021

Expected to be accretive in year one

Expands terminal, fleet and driver footprint in the strategic Mid-Atlantic, Ohio and Northeast regions

Network of 8 terminals and 18 drop yard facilities complementary to existing Werner terminal infrastructure

Increased exposure to high velocity, shorter length of haul segments of 200-300 miles

●

Adds high-quality talent and increases Werner fleet size by more than 6%

Addition of over 500 highly-skilled and tenured drivers

Extremely low driver turnover

Fleet of nearly 500 trucks and 2,000 trailers

Synergies expected through combined management of fleet

Combines similar cultures focused on safety and customer service excellence

Highest standards of driver training and safe operations

Continuous investment in technology and IT infrastructure to enhance on-time delivery performance

Shared values of picking winning customers with high expectations, establishing long-term mutual service and revenue

objectives, and delivering best-in-class performance to stabilize volume and minimize churn

Existing ECM leadership (including founder and President Ed Meier), drivers and non-driver associates will remain in place

and we are retaining the ECM brand to ensure smooth integration and high driver retention

ECM will operate as a standalone business unit within Werner and their financial results will be reported in Werner's One-

Way Truckload unit within Truckload Transportation Services

WE KEEP AMERICA MOVINGⓇ

3View entire presentation