Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

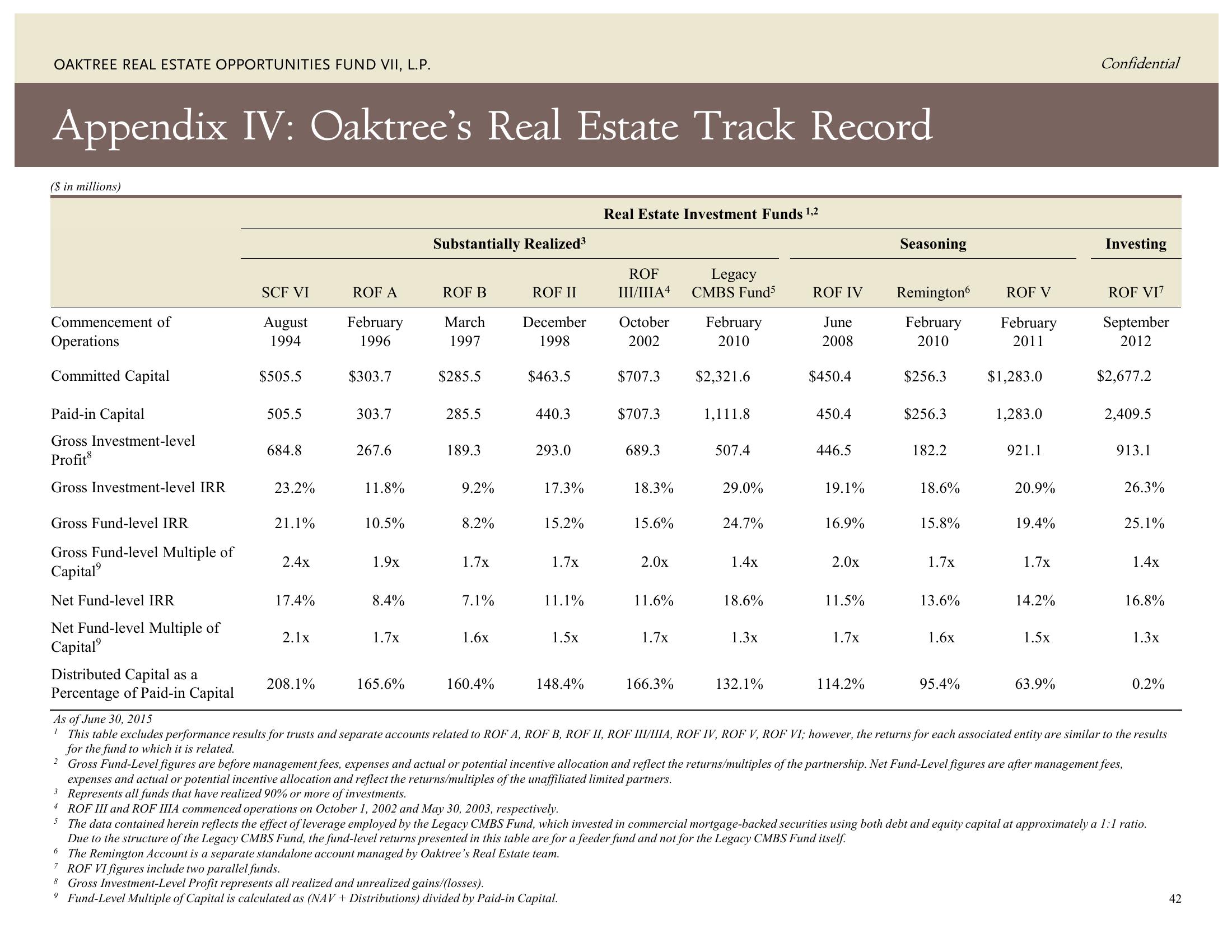

Appendix IV: Oaktree's Real Estate Track Record

($ in millions)

Commencement of

Operations

Committed Capital

Paid-in Capital

Gross Investment-level

Profit

Gross Investment-level IRR

Gross Fund-level IRR

Gross Fund-level Multiple of

Capital

Net Fund-level IRR

Net Fund-level Multiple of

Capital

Distributed Capital as a

Percentage of Paid-in Capital

SCF VI

August

1994

$505.5

505.5

684.8

23.2%

21.1%

2.4x

17.4%

2.1x

208.1%

ROF A

February

1996

$303.7

303.7

267.6

11.8%

10.5%

1.9x

8.4%

1.7x

165.6%

Substantially Realized³

ROF B

March

1997

$285.5

285.5

189.3

9.2%

8.2%

1.7x

7.1%

1.6x

160.4%

ROF II

December

1998

$463.5

440.3

293.0

17.3%

15.2%

1.7x

11.1%

1.5x

148.4%

Real Estate Investment Funds ¹,2

ROF

III/IIIA 4

October

2002

6 The Remington Account is a separate standalone account managed by Oaktree's Real Estate team.

7 ROF VI figures include two parallel funds.

$707.3

8 Gross Investment-Level Profit represents all realized and unrealized gains/(losses).

9 Fund-Level Multiple of Capital is calculated as (NAV+ Distributions) divided by Paid-in Capital.

$707.3

689.3

18.3%

15.6%

2.0x

11.6%

1.7x

166.3%

Legacy

CMBS Fund5

February

2010

$2,321.6

1,111.8

507.4

29.0%

24.7%

1.4x

18.6%

1.3x

132.1%

ROF IV

June

2008

$450.4

450.4

446.5

19.1%

16.9%

2.0x

11.5%

1.7x

114.2%

Seasoning

ROF V

Remington

February February

2010

2011

$256.3

$256.3

182.2

18.6%

15.8%

1.7x

13.6%

1.6x

95.4%

$1,283.0

1,283.0

921.1

20.9%

19.4%

1.7x

14.2%

1.5x

63.9%

Confidential

Investing

ROF VI7

September

2012

$2,677.2

2,409.5

913.1

2 Gross Fund-Level figures are before management fees, expenses and actual or potential incentive allocation and reflect the returns/multiples of the partnership. Net Fund-Level figures are after management fees,

expenses and actual or potential incentive allocation and reflect the returns/multiples of the unaffiliated limited partners.

3 Represents all funds that have realized 90% or more of investments.

4

26.3%

25.1%

1.4x

16.8%

As of June 30, 2015

1 This table excludes performance results for trusts and separate accounts related to ROF A, ROF B, ROF II, ROF III/IIIA, ROF IV, ROF V, ROF VI; however, the returns for each associated entity are similar to the results

for the fund to which it is related.

1.3x

0.2%

ROF III and ROF IIIA commenced operations on October 1, 2002 and May 30, 2003, respectively.

5 The data contained herein reflects the effect of leverage employed by the Legacy CMBS Fund, which invested in commercial mortgage-backed securities using both debt and equity capital at approximately a 1:1 ratio.

Due to the structure of the Legacy CMBS Fund, the fund-level returns presented in this table are for a feeder fund and not for the Legacy CMBS Fund itself.

42View entire presentation