Bank of America Investment Banking Pitch Book

Historical Price / SNL consensus NAV

2014 - 2016YTD

120.0%

110.0%

100.0%

90.0%

80.0%

70.0%

50.0%

123

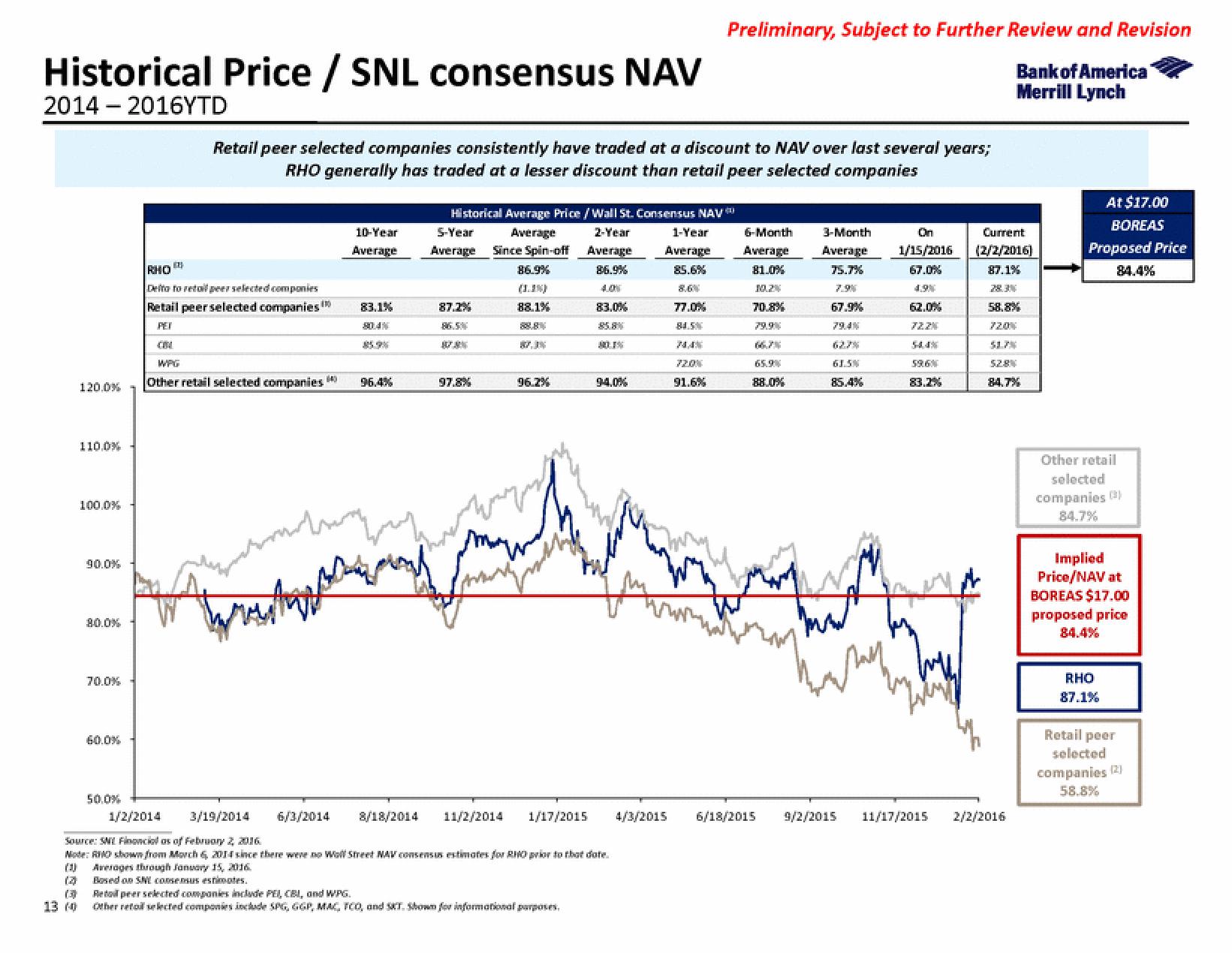

Retail peer selected companies consistently have traded at a discount to NAV over last several years;

RHO generally has traded at a lesser discount than retail peer selected companies

RHO

Delto to retail peer selected companies

Retail peer selected companies

PET

WPG

Other retail selected companies

6/3/2014

10-Year

Average

83.1%

96.4%

Historical Average Price/Wall St. Consensus NAV

Average 2-Year

Since Spin-off Average

86.9%

4.01

83.0%

8/18/2014

5-Year

Average

87.2%

97.8%

(1.1%)

88.1%

11/2/2014

96.2%

1/2/2014

3/19/2014

Source: SML Finoncial as of February 2 2016

Note: RO shown from Morch 6, 2014 since there were no Woll Street NAV consensus estimates for RHO prior to that date.

10 Averages through January 15, 2016.

(3

Bosed on SM consemus estimates.

(3)

13 (0

94.0%

1/17/2015 4/3/2015

Repeer selected companies include PEI, CBI, and WPG.

Other retail selected companies include SPG, GGP, MAC, TCO, and ST. Shown for informational purposes.

1-Year

Average

85.6%

77.0%

81.5%

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

91.6%

6-Month

Average

81.0%

10.2%

70.8%

65.9%

88.0%

6/18/2015

3-Month

Average

75.7%

7.9%

67.9%

61.5%

85.4%

mat

On

1/15/2016

67.0%

4.9%

62.0%

596%

83.2%

Weny

9/2/2015 11/17/2015

Current

(2/2/2016)

87.1%

58.8%

84.7%

2/2/2016

At $17.00

BOREAS

Proposed Price

Other retail

selected

companies (3)

84.7%

Implied

Price/NAV at

BOREAS $17.00

proposed price

RHO

87.1%

Retail peer

selected

companies (2)

58.8%View entire presentation