Deutsche Bank Results Presentation Deck

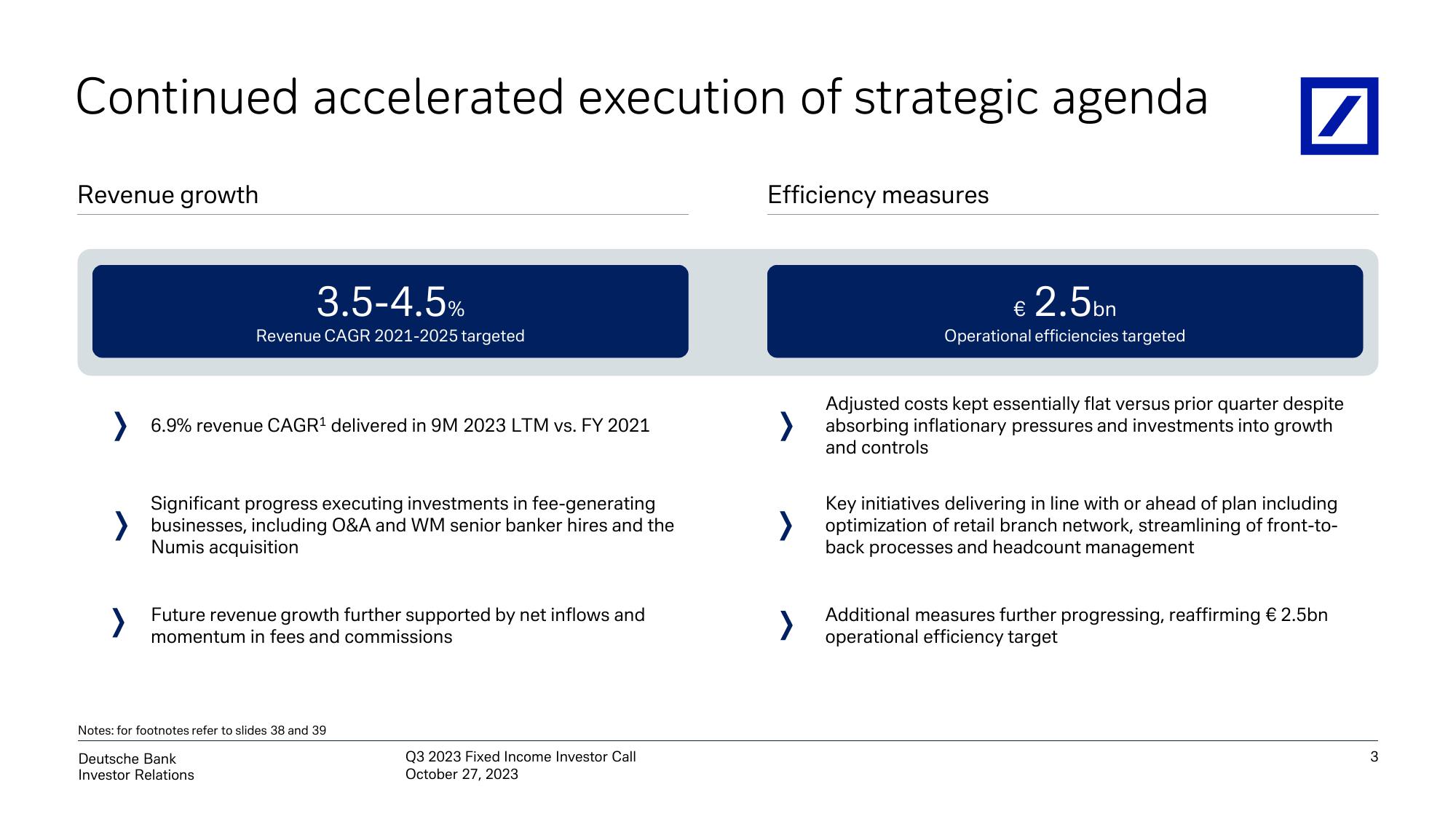

Continued accelerated execution of strategic agenda

Revenue growth

3.5-4.5%

Revenue CAGR 2021-2025 targeted

> 6.9% revenue CAGR¹ delivered in 9M 2023 LTM vs. FY 2021

Significant progress executing investments in fee-generating

> businesses, including O&A and WM senior banker hires and the

Numis acquisition

>

Future revenue growth further supported by net inflows and

momentu in fees and commissions

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

Q3 2023 Fixed Income Investor Call

October 27, 2023

Efficiency measures

2.5bn

€

Operational efficiencies targeted

/

Adjusted costs kept essentially flat versus prior quarter despite

> absorbing inflationary pressures and investments into growth

and controls

>

Key initiatives delivering in line with or ahead of plan including

> optimization of retail branch network, streamlining of front-to-

back processes and headcount management

Additional measures further progressing, reaffirming € 2.5bn

operational efficiency target

3View entire presentation