LSE Results Presentation Deck

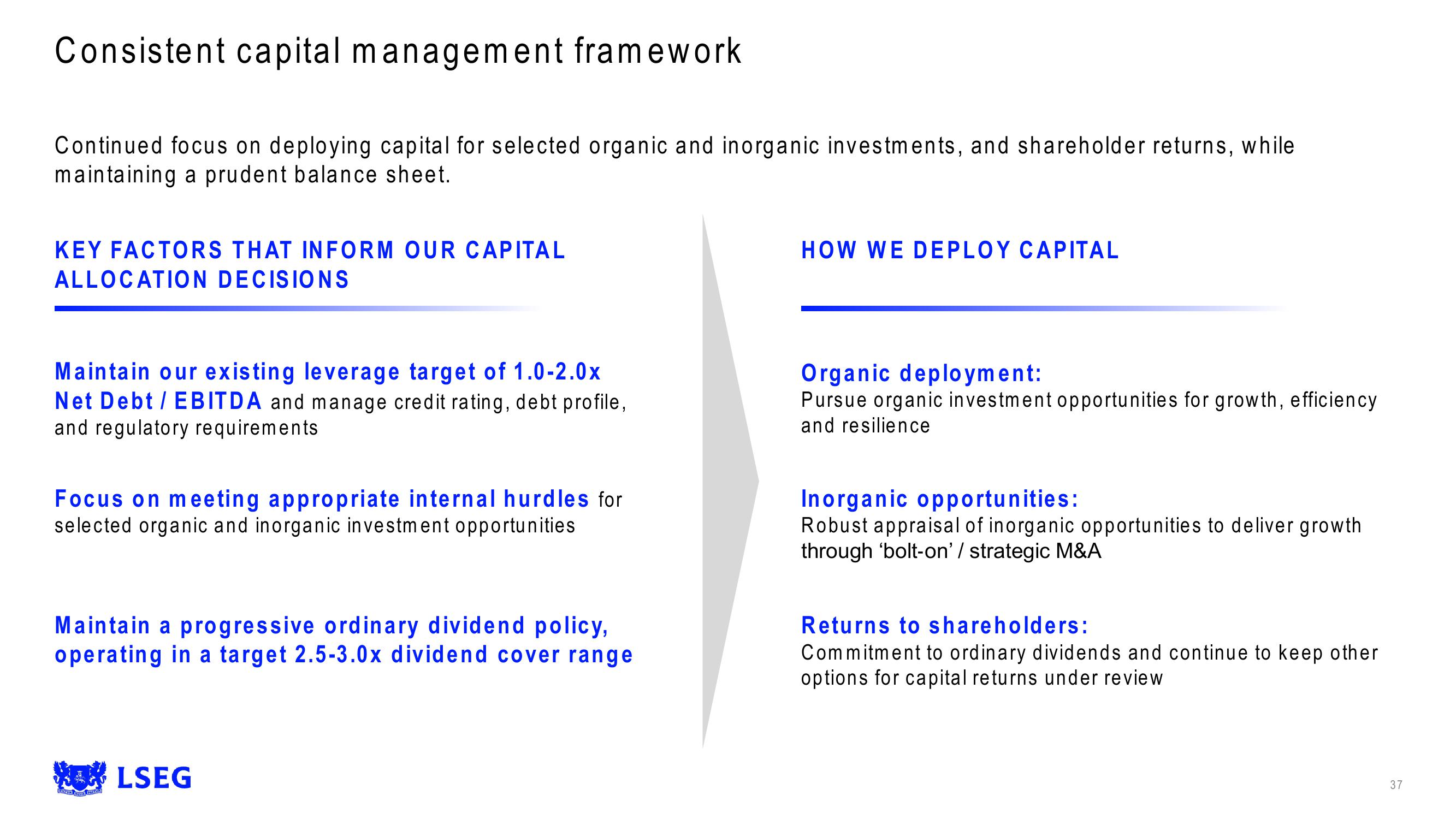

Consistent capital management framework

Continued focus on deploying capital for selected organic and inorganic investments, and shareholder returns, while

maintaining a prudent balance sheet.

KEY FACTORS THAT INFORM OUR CAPITAL

ALLOCATION DECISIONS

Maintain our existing leverage target of 1.0-2.0x

Net Debt / EBITDA and manage credit rating, debt profile,

and regulatory requirements

Focus on meeting appropriate internal hurdles for

selected organic and inorganic investment opportunities

Maintain a progressive ordinary dividend policy,

operating in a target 2.5-3.0x dividend cover range

LSEG

HOW WE DEPLOY CAPITAL

Organic deployment:

Pursue organic investment opportunities for growth, efficiency.

and resilience

Inorganic opportunities:

Robust appraisal of inorganic opportunities to deliver growth

through 'bolt-on' / strategic M&A

Returns to shareholders:

Commitment to ordinary dividends and continue to keep other

options for capital returns under review

37View entire presentation