Bank of America Investment Banking Pitch Book

Opportunity

Opportunity

Opportunity

2

Opportunity

3

Opportunity

Source: Pioneer Forecast.

Note: Dollars in millions.

B

■

2

■

7

S

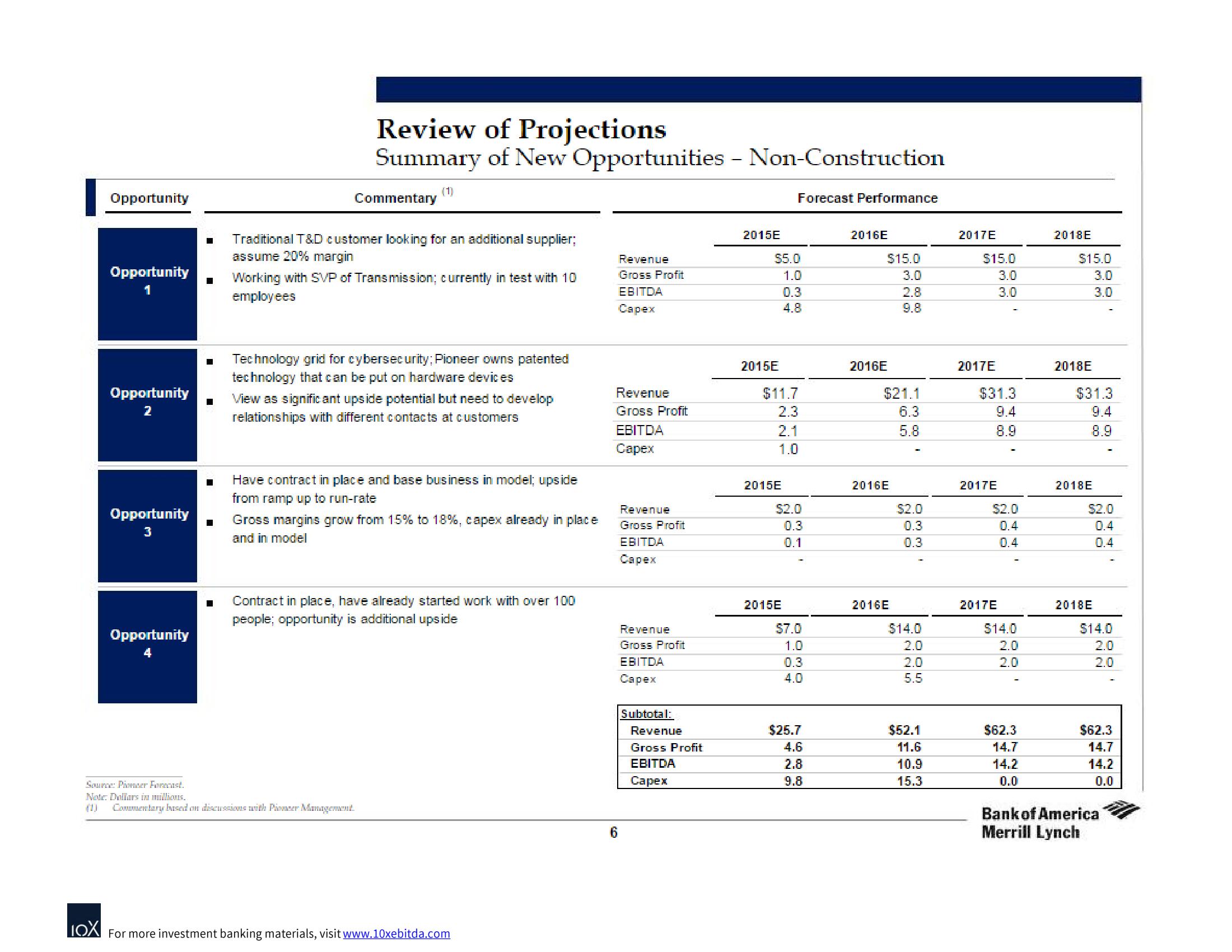

Review of Projections

Summary of New Opportunities - Non-Construction

Commentary

(1)

Traditional T&D customer looking for an additional supplier;

assume 20% margin

Working with SVP of Transmission; currently in test with 10

employees

Technology grid for cybersecurity; Pioneer owns patented

technology that can be put on hardware devices

View as significant upside potential but need to develop

relationships with different contacts at customers

Have contract in place and base business in model; upside

from ramp up to run-rate

Gross margins grow from 15% to 18%, capex already in place

and in model

Commentary based on discussions with Pioneer Management.

Contract in place, have already started work with over 100

people; opportunity is additional upside

LOX For more investment banking materials, visit www.10xebitda.com

Revenue

Gross Profit

EBITDA

Capex

Revenue

Gross Profit

EBITDA

Capex

6

Revenue

Gross Profit

EBITDA

Capex

Revenue

Gross Profit

EBITDA

Capex

Subtotal:

Revenue

Gross Profit

EBITDA

Capex

2015E

$5.0

1.0

0.3

4.8

2015E

$11.7

2.3

2.1

1.0

2015E

Forecast Performance

$2.0

0.3

0.1

2015E

70-4

WO

$7.0

GOMO

1.0

0.3

4.0

$25.7

4.6

2.8

9.8

2016E

2016E

$15.0

3.0

2.8

9.8

$21.1

6.3

5.8

2016E

2016E

$2.0

0.3

0.3

0331

4225

OOO5

$14.0

2.0

2.0

5.5

$52.1

11.6

10.9

15.3

2017E

$15.0

3.0

3.0

2017E

$31.3

9.4

8.9

2017E

$2.0

0.4

0.4

2017E

$14.0

2.0

2.0

$62.3

14.7

14.2

0.0

2018E

$15.0

3.0

2018E

2018E

$31.3

9.4

8.9

OO

3.0

2018E

$2.0

0.4

0.4

I

$14.0

2.0

2.0

Bank of America

Merrill Lynch

$62.3

14.7

14.2

0.0View entire presentation