Inovalon Results Presentation Deck

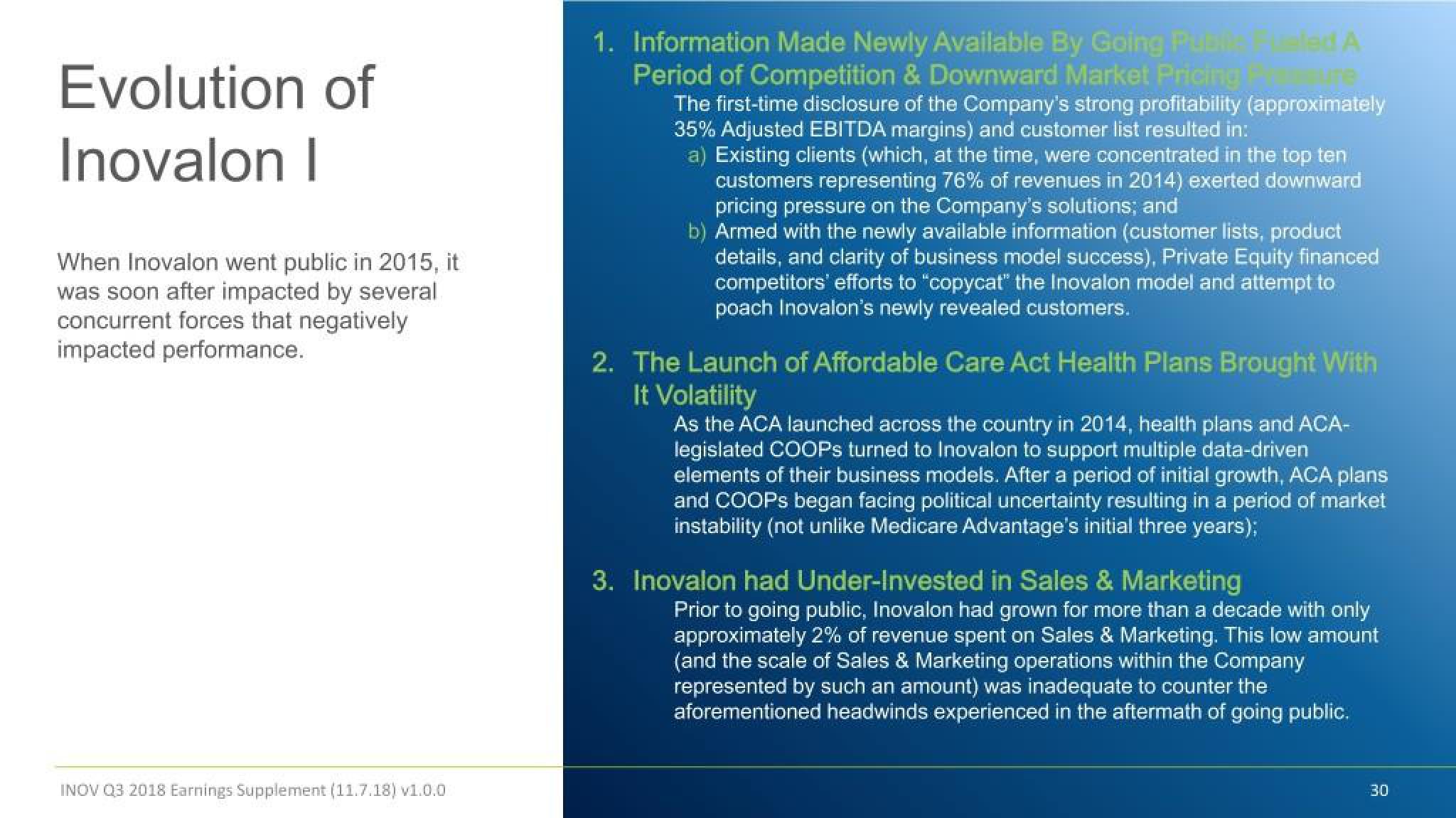

Evolution of

Inovalon I

When Inovalon went public in 2015, it

was soon after impacted by several

concurrent forces that negatively

impacted performance.

INOV Q3 2018 Earnings Supplement (11.7.18) v1.0.0

1. Information Made Newly Available By Going Publieled A

Period of Competition & Downward Market Pricing Pro

The first-time disclosure of the Company's strong profitability (approximately

35% Adjusted EBITDA margins) and customer list resulted in:

a) Existing clients (which, at the time, were concentrated in the top ten

customers representing 76% of revenues in 2014) exerted downward

pricing pressure on the Company's solutions; and

b) Armed with the newly available information (customer lists, product

details, and clarity of business model success), Private Equity financed

competitors' efforts to "copycat" the Inovalon model and attempt to

poach Inovalon's newly revealed customers.

2. The Launch of Affordable Care Act Health Plans Brought With

It Volatility

As the ACA launched across the country in 2014, health plans and ACA-

legislated COOPS turned to Inovalon to support multiple data-driven

elements of their business models. After a period of initial growth, ACA plans

and COOPS began facing political uncertainty resulting in a period of market

instability (not unlike Medicare Advantage's initial three years);

3. Inovalon had Under-Invested in Sales & Marketing

Prior to going public, Inovalon had grown for more than a decade with only

approximately 2% of revenue spent on Sales & Marketing. This low amount

(and the scale of Sales & Marketing operations within the Company

represented by such an amount) was inadequate to counter the

aforementioned headwinds experienced in the aftermath of going public.

30View entire presentation