Helbiz SPAC Presentation Deck

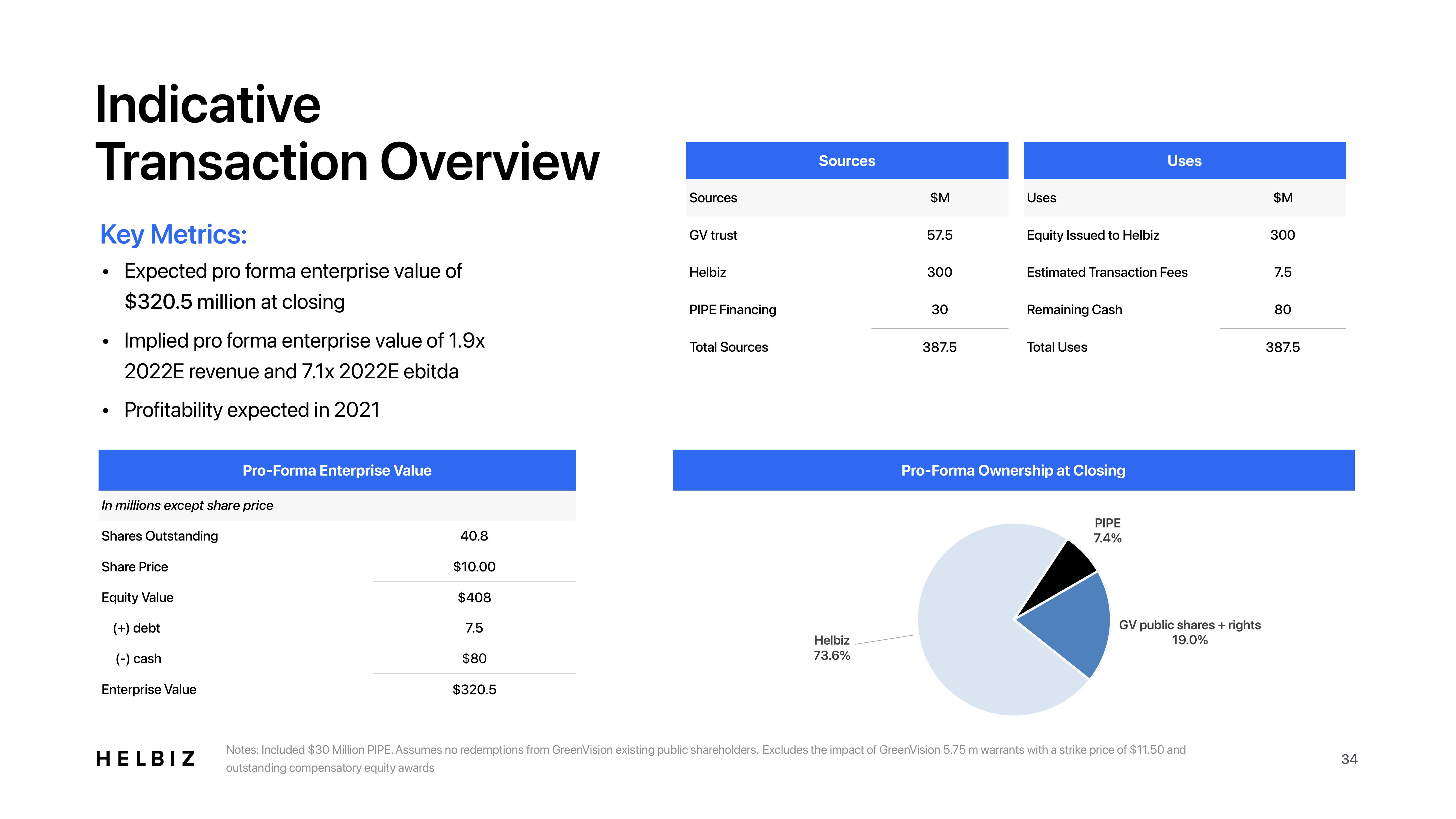

Indicative

Transaction Overview

Key Metrics:

Expected pro forma enterprise value of

$320.5 million at closing

●

Implied pro forma enterprise value of 1.9x

2022E revenue and 7.1x 2022E ebitda

Profitability expected in 2021

Pro-Forma Enterprise Value

In millions except share price

Shares Outstanding

Share Price

Equity Value

(+) debt

(-) cash

Enterprise Value

HELBIZ

40.8

$10.00

$408

7.5

$80

$320.5

Sources

GV trust

Helbiz

PIPE Financing

Total Sources

Sources

Helbiz

73.6%

$M

57.5

300

30

387.5

Uses

Equity Issued to Helbiz

Estimated Transaction Fees

Remaining Cash

Total Uses

Pro-Forma Ownership at Closing

Uses

PIPE

7.4%

GV public shares + rights

19.0%

Notes: Included $30 Million PIPE. Assumes no redemptions from GreenVision existing public shareholders. Excludes the impact of GreenVision 5.75 m warrants with a strike price of $11.50 and

outstanding compensatory equity awards

$M

300

7.5

80

387.5

34View entire presentation