Nikola SPAC Presentation Deck

OVERVIEW OF NIKOLA'S

ADDRESSABLE MARKET

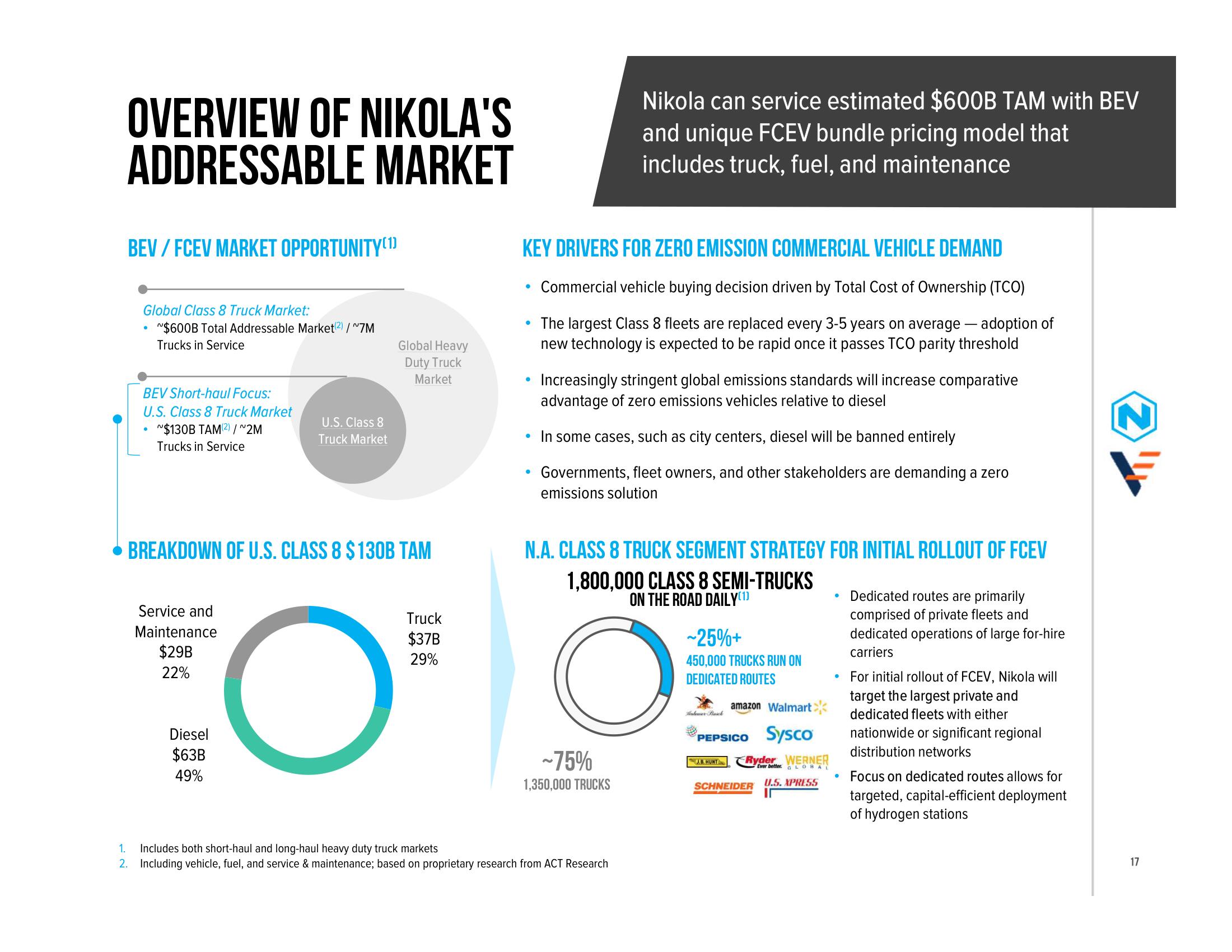

BEV/FCEV MARKET OPPORTUNITY(1)

Global Class 8 Truck Market:

~$600B Total Addressable Market (2)/~7M

Trucks in Service

•

BEV Short-haul Focus:

U.S. Class 8 Truck Market

~$130B TAM (2)/~2M

Trucks in Service

•

Service and

Maintenance

$29B

22%

U.S. Class 8

Truck Market

BREAKDOWN OF U.S. CLASS 8 $130B TAM

Diesel

$63B

49%

Global Heavy

Duty Truck

Market

O

Truck

$37B

29%

KEY DRIVERS FOR ZERO EMISSION COMMERCIAL VEHICLE DEMAND

Commercial vehicle buying decision driven by Total Cost of Ownership (TCO)

The largest Class 8 fleets are replaced every 3-5 years on average — adoption of

new technology is expected to be rapid once it passes TCO parity threshold

●

•

●

●

●

Nikola can service estimated $600B TAM with BEV

and unique FCEV bundle pricing model that

includes truck, fuel, and maintenance

Increasingly stringent global emissions standards will increase comparative

advantage of zero emissions vehicles relative to diesel

In some cases, such as city centers, diesel will be banned entirely

Governments, fleet owners, and other stakeholders are demanding a zero

emissions solution

N.A. CLASS 8 TRUCK SEGMENT STRATEGY FOR INITIAL ROLLOUT OF FCEV

1,800,000 CLASS 8 SEMI-TRUCKS

ON THE ROAD DAILY(1)

O

-75%

1,350,000 TRUCKS

1. Includes both short-haul and long-haul heavy duty truck markets

2. Including vehicle, fuel, and service & maintenance; based on proprietary research from ACT Research

~25%+

450,000 TRUCKS RUN ON

DEDICATED ROUTES

amazon Walmart

PEPSICO SYSCO

Anheuser Busch

B. HUNT Ryder WERNER

Ever better. GLOR

SCHNEIDER U.S. XPRESS

11

●

Dedicated routes are primarily

comprised of private fleets and

dedicated operations of large for-hire

carriers

For initial rollout of FCEV, Nikola will

target the largest private and

dedicated fleets with either

nationwide or significant regional

distribution networks

Focus on dedicated routes allows for

targeted, capital-efficient deployment

of hydrogen stations

N

17View entire presentation